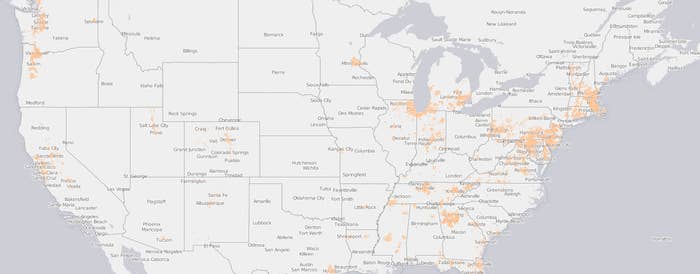

Comcast's Broadband Subscriber Locations:

Today's news that Comcast is seeking advice about what kind of regulatory obstacles it would have to climb should it pursue a bid for Time Warner Cable makes perfect sense — if you look at a map. Based on their geographic locations, Comcast has always been one of the two most logical deal partners for Time Warner Cable. (Cablevision being the other.)

Comcast and Time Warner Cable currently rank as the largest and second-largest cable operators in the country, with about 22 million and 12.2 million subscribers, respectively. Both satellite television distributors, DirecTV and DISH, have more subscribers than Time Warner Cable but fewer than Comcast.

In cable industry parlance, "clustering" refers to the grouping of geographically contiguous systems together. Having systems grouped close together provides for economies of scale, allowing owners to upgrade infrastructure, roll out new programming and services such as broadband and telephony, and deploy trucks to set up new connections and fix service outages and issues quicker. Back office functions such as human resources and payroll can also be consolidated to a regional office.

Comcast, based in Philadelphia, has its largest concentration of subscribers grouped together in a "supercluster" that stretches from New Jersey to Washington, D.C. Indeed, more than 50% of the company's subscriber base is located in this supercluster. However, the company has essentially been locked out of New York due to the control over cable in the state exerted by Time Warner Cable and Cablevision. By buying Time Warner Cable, Comcast can extend its supercluster not only into New York, but also all the way up into Maine.

Moreover, in addition to the economies of scale clustering provides, owning cable systems in the Northeast is particularly desirable since it ranks as one of the most affluent and densely populated parts of the country, thus allowing operators to charge higher prices and extract more profit from each subscriber.

While the charts in this post show broadband subscribers, it is safe to assume that they provide a reasonable and representative example of video subscribers to each company as well, since subscribers typically get both services — and sometimes even telephone service — from their cable provider.

Time Warner Cable's Broadband Subscriber Locations: