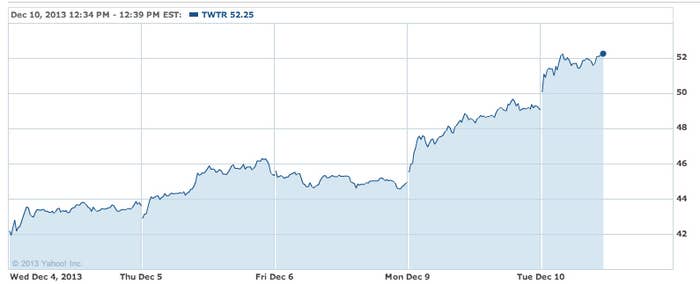

Twitter's stock is up about 6% Tuesday and is now worth double its initial public offering price of $26 after a surge of about 20% in the past week, following a relatively soft performance after its IPO.

Twitter is now worth nearly $28.4 billion — putting it well ahead of Facebook's IPO performance last year, where the company saw its share price decimated in the weeks following its IPO over concerns about its ability to grow its advertising business. Facebook, now trading at $50, has yet to double its initial public offering price of $38 and at one point traded as low as $17 following its IPO.

Last week, Twitter said it was rolling out a new product that would deliver more targeted ads, letting advertisers target promoted tweets to users that have visited relevant websites. The idea is that a better promoted tweets will lead to better ad conversions.

That, along with some optimism on the advertising side, sparked a big run-up in Twitter's price over the past several days. Twitter has to find new ways to better target ads in order to generate greater revenue, and recent announcements suggest the company is still finding some ways to improve its ad products.