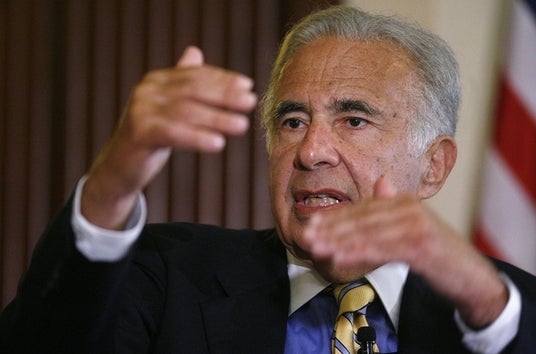

Heading into tomorrow's iPhone unveiling, Apple's future actually looks even brighter than it did a month ago — which might not be a good thing for billionaire hedge fund manager Carl Icahn.

Apple is set to unveil tomorrow an updated high-end iPhone, as well as a cheaper iPhone that will appeal to emerging markets and budget smartphone customers in China and other markets where Android has been eating up Apple's potential market. Apple is also reportedly preparing to ship the cheaper iPhone to China Mobile, the largest carrier in China with more than 700 million subscribers.

"Most customers in the U.S. are on [contracts]," said BTIG analyst Walter Piecyk. "In the rest of the world, it's the opposite, they're on pre-paid models. We'll see where the pricing ends up on the product, but to that extent to any market in the world, that's gonna be a positive."

Though cheaper devices place increasing pressure on the high margins that Apple generates and Wall Street investors love, the market opportunity they represent in the form of incremental growth is worth the margin compression. Moreover, according to Scott Kessler, head of technology research at S&P Capital IQ, investors have been willing to tolerate lower margins in pursuit of future growth opportunities (Exhibit A: Amazon). Assuming Apple is successful in capturing a lower-priced part of the market, it points to incremental profit growth and earnings-per-share growth, which would naturally benefit investors, Piecyk said.

"I think it's fair to say that a lot of the companies that have performed best in the tech sector are ones that have strong and maybe improving growth stories and there hasn't been as much of an emphasis on margins as you might think," Kessler said. "Part of that is because people see that these companies are investing for growth, so there's a greater level of patience if companies are delivering growth spurred by investment as opposed to decelerating or absent growth prospects."

For Icahn, who on Monday lost out on an ugly public takeover battle for ailing PC-manufacturer Dell, the developments over the last month for Apple makes the chances of him succeeding in his campaign for an expansion of its stock repurchase program even more difficult. A representative for Icahn did not return a call for comment.

In a pair of tweets last month, Icahn disclosed that he had a $1 billion stake in Apple and said he was encouraging the company to increase its buyback program and return more of its cash to investors. Icahn's position to instigate when he bought into Apple stock already looked weaker compared to earlier in the year when the company faced a somewhat similar situation with activist investor David Einhorn. Apple agreed to increase its share buyback program at the time, in part because it had just reported a softer-than-expected holiday sales quarter and didn't have a product release until the back half of the year when Einhorn bought into the stock.

Icahn said on CNBC Monday that he will still be meeting with Apple CEO Tim Cook over dinner this month to discuss the possibility of greater buybacks. "I don't want to put words into his mouth, he agrees buybacks are good and he mentioned he's doing one," Icahn said on CNBC. "We're gonna discuss it. I believe Apple is a very undervalued situation just on the numbers."

On that Icahn has a point: Apple, for all its R&D spending and buyback programs, is still sitting on an enormous cash pile that has often prompted the phrase "burning a hole in the company's pocket." Cook has denied this is the case, but even for all the company's increased activity, a $146.6 billion cash pile is hard to ignore — even if a lot of it is remaining overseas.

"We've seen decelerating growth, increased spending on R&D, the company committing capital to buybacks and dividends over the last year plus — with that really, you could argue just in terms of how they've gone from nothing to really substantial programs," Kessler said. "Still you're talking about a company with all that being said still has close to $150 billion. Given all those circumstances, it still seems to many that the company is overcapitalized."

But even if Icahn can't convince Cook to increase Apple's dividend and share buyback program, that doesn't necessarily mean he placed a losing bet. Already, Apple stock has enjoyed a nice run up following Icahn's disclosure, gaining about $15 billion in market capitalization — which is enough to make any investor happy. A strong, new product line would both grow earnings-per-share for Apple and Icahn's return-on-investment as well.

So, it may be that Icahn ends up winning with Apple either way.