Apple was widely expected to release a cheaper smartphone targeted at low-end consumers in a bid to retake market share in emerging markets like China. But that's not exactly what happened.

While Apple did unveil a new iPhone that costs less than the traditional $199 on contract, many smartphone owners outside the U.S. have pre-paid plans rather than contract-based plans that are common in the U.S. And for those people, it appears that the new mid-tier iPhone 5C — which is basically an iPhone 5 with a plastic shell — will still cost roughly the same $550 (at least in the U.S.) unsubsidized and without a contract as it typically has, according to the Apple Store listing.

Not surprisingly, Apple executives like Phil Schiller basically skipped mentioning the unsubsidized pricing in the presentation unveiling the new iPhones.

"Most customers in the U.S. are on [contracts]," said BTIG analyst Walter Piecyk told BuzzFeed prior to the iPhone event. "In the rest of the world, it's the opposite, they're on prepaid models. We'll see where the pricing ends up on the product."

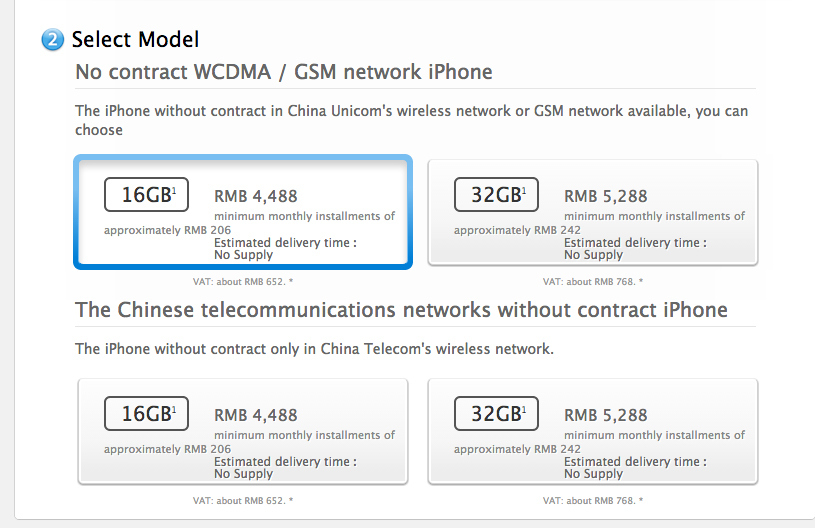

In China, which is one of Apple's most important emerging markets, the device will also still remain on the high end of pricing, coming in around 4,488 RMB (or around $730), per its listing on the Chinese Apple Store. The rather stringent adherence to past pricing models caught many Apple observers flat-footed. The conventional wisdom going into Tuesday's event was that Apple would make introduce a cheaper smartphone in a bid at grabbing share in emerging markets.

As a result, investors sent Apple shares down as much as 2% immediately following the event.

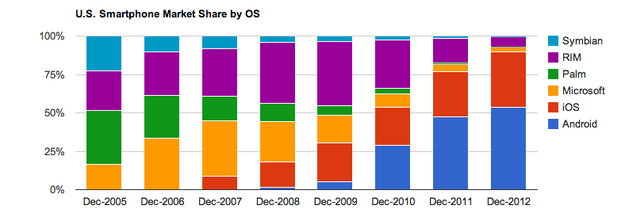

Apple's reliance on higher-priced devices has caused it to face pressure from competitors with cheaper devices powered by Android in markets that don't support subsidized contracts or rely on cheaper devices, such as many emerging markets. Many had expected that Apple would choose to sacrifice some margin in order to retake share from Android, and Wall Street seemed primed to forgive Apple for that.

"I think it's fair to say that a lot of the companies that have performed best in the tech sector are ones that have strong and maybe improving growth stories, and there hasn't been as much of an emphasis on margins as you might think," Scott Kessler, head of technology research at S&P Capital IQ, said in an interview prior to the iPhone event. "Part of that is because people see that these companies are investing for growth, so there's a greater level of patience if companies are delivering growth spurred by investment as opposed to decelerating or absent growth prospects."

While there was much talk about Apple ending up with compressed margins — basically making less money per device in order to sell more devices — it appears that Apple will actually come out in better shape since the 5C will come with a cheaper plastic case rather than the iPhone's standard-issue aluminum.

So, what this basically means is Apple could be facing a future where it is, essentially, the same old Apple and not the company with the enormous growth potential that it seemed to have when its stock was rocketing toward $700. Instead, Apple may have to do what it has basically always done — create a category-defining product.

And Apple, while investing in R&D, has also showed a willingness to sit on a massive pile of cash — which has attracted interest from activist investors like billionaire hedge fund manager Carl Icahn. Questions about its ability to innovate and willingness to go after market share have already brought the stock price down substantially from its highs.

There are plenty of rumors about Apple testing the waters in product categories ranging from larger smartphones to wearable iOS devices and services like iCloud, but the near term does not look anywhere as bright as it did only a day ago.