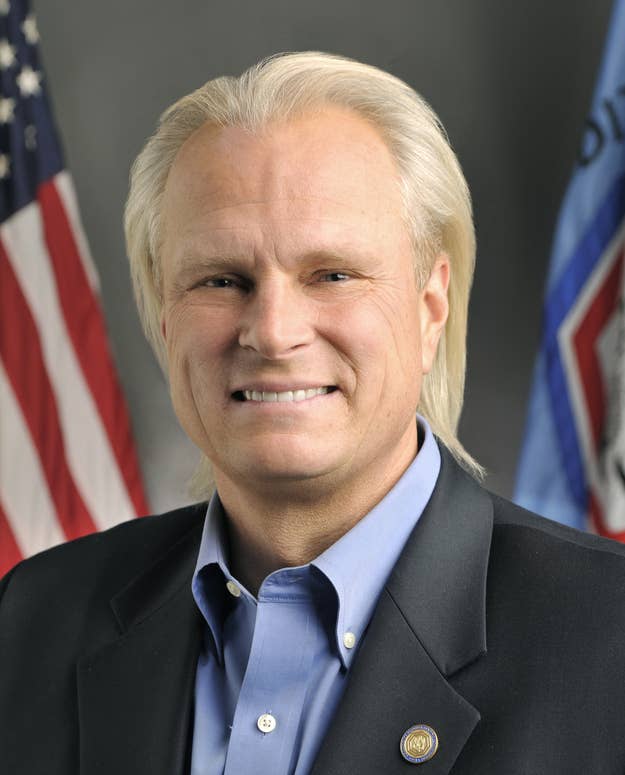

This is Bart Chilton. He has amazing hair.

Bart Chilton has been a commissioner on the Commodities Futures Trading Commission since 2007 and is easily the coolest financial regulator of all time. Look at his hair! Look. At. His. Hair.

Anyway, Bart Chilton gives speeches that are almost as amazing as his splendiferous blond locks. He gave one this February that was several riffs on the color red. But the one he gave today at the Yale Club in New York City, titled "Cinema of Uncertainty," may take the cake. It's a call for writing strong rules in Dodd-Frank, the 2010 financial reform and regulation bill, as explained through a ton of movie references. Here are almost all of them:

Belly of the Beast

Planes, Trains, And Automobiles

Analyze This

It's A Wonderful Life

Network

E.T. the Extra-Terrestrial

Wall Street

Rambo

Gone With The Wind

Clash of the Titans