JPMorgan Chase, the largest bank in the country, this morning reported that it had a quarterly loss of $380 million, despite taking in $23.9 billion in revenue and making $6.5 billion last quarter and $5.7 billion in the third quarter of last year.

The difference: a huge legal expense. The bank disclosed this morning that it had a pre-tax legal expense of $9.15 billion, in addition to money it had set aside previously to pay for legal costs. Its pre-tax legal expenses a year ago were only $684 million.

This is the first time since the second quarter of 2004, before Jamie Dimon formally took over the bank in 2005, that JPMorgan has recorded a loss; even during the depths of the financial crisis, Dimon was still able to earn profits.

In a statement accompanying the bank's earnings, Chairman and CEO Dimon said "the quarter was marred by large legal expense. We continuously evaluate our legal reserves, but in this highly charged and unpredictable environment, with escalating demands and penalties from multiple government agencies, we thought it was prudent to significantly strengthen them."

The bank is currently negotiating with the Justice Department over a number of legal issues, mainly revolving around the bank's sale or mortgage-backed securities before the financial crisis, including litigation stemming from the actions of Bear Stearns and Washington Mutual, which JPMorgan acquired during the financial crisis. Late last month, Dimon even had a meeting with Attorney General Eric Holder to discuss the bank's legal issues. The reported cost of the settlement could be as high as $11 billion, which explains the massive amount JPMorgan added to its legal reserves, wiping out its earnings for the quarter.

JPMorgan's massive addition to its legal reserves is a surprise for analysts, who had expected the bank to earn $1.17 a share as opposed to the loss of 17 cents a share. The bank also said that excluding the huge legal cost, it earned $5.8 billion, or $1.42 a share.

In September, JPMorgan's Chief Financial Officer Marianne Lake said at a conference that the bank would likely increase its legal reserves by more than $1.5 billion, more than offsetting expected releases from money JPMorgan set aside for loan losses to consumers.

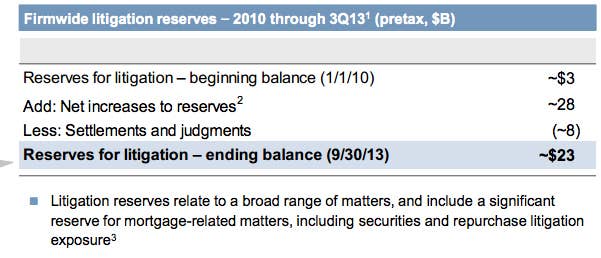

The bank's earnings were buoyed by $1.6 billion in reserve releases, which added to its earnings but couldn't offset its legal losses. Since 2010, the bank has added $20 billion to its litigation reserves.