Javier Martin-Artajo and Julien Grout, two former JPMorgan derivatives traders who worked out of the firm's London office, were charged today with four counts of wire fraud, falsifying SEC and bank records, and conspiracy. The SEC brought parallel civil charges against Martin-Artajo and Grout.

The charges in the unsealed complaint are largely consistent with a massive Senate report into the trades, which were known in the press and in the markets as the "London Whale," which ended up losing JPMorgan about $6.2 billion and leading to the firing or resignations of a large swathe of the bank's senior leadership.

The Feds say that Martin-Artajo, who was a managing director at JPMorgan and in charge of credit and equity trading for the Chief Investment Office, and Grout, a more junior trader who specifically worked on derivatives trades, "manipulated and inflated" the value of derivatives "in order to achieve specific daily and month-end profit and loss objectives." Ina Drew led the bank's Chief Investment Office and was in charge of managing and investing the company's $350 billion worth of "excess deposits."

The trades examined in the charges were part of its "Synthetic Credit Portfolio," which traded credit derivatives, like credit default swaps and collections of credit default swaps known as indices. Credit default swaps are insurance like contracts that let traders bet on the likelihood that a company will default on its debt.

The charges also detail the behavior of Bruno Iksil, an unnamed co-conspirator who has a nonprosecution agreement with federal prosecutors in the Southern District of New York and whose testimony is the basis for some of the complaint. Preet Bharara, the U.S. Attorney for the Southern District of New York, said in a press conference that "nonprosecution agreements are rare" for his office and that Iksil got one because there were "numerous examples" of Iksil "sound[ing] the alarm more than once." The complaint says that Iksil's information was "accurate and reliable" and corroborated by other documents. Iksil worked under Martin-Artajo as the head trader for the Synthetic Credit Portfolio. In the original press reports, he was initially referred to as the "London Whale."

Bharara said that the maximum penalties if convicted are five years on the conspiracy counts and 20 years on the fraud and falsifying records charges. Bharara noted that neither Grout nor Martin-Artajo had been arrested but that his office was in contact with their respective attorneys.

An FBI official at a press conference today said that Martin-Artajo instructed Grout to begin mismarking the trades because he was "buckling from pressure from JPMorgan's Chief Investment Officer." When asked if any more current or former JPMorgan employees would be charged, Bharara said "our investigation is continuing" and "if the investigation remains open, it's fair to say there are other people who remain under investigation."

1. "We need to discuss the synthetic book"

According to the charges, Martin-Artajo's boss, identified in the Senate report as Achilles Macris, sent him an email on Jan. 31 saying that the "financial performance" of the massive derivatives trades was "worrisome." Grout had reported $120 million in losses for January in the Synthetic Credit Portfolio.

2. "Defend the positions"

As losses continued to mount, Martin-Artajo was under increasing pressure to turn it around. The charges allege that Artajo "began pressuring" Grout and Iksil to record the positions "in such a way as to show smaller losses." He specifically told the two, according to the charges filed today, to "Defend the positions" near the end of February. This was because the bank would be examine the trades more closely at the end of the month, and so Grout "began to set some of the marks farther from the crude mid, at a price more favorable to the CIO's profits." The rough JPMorgan guideline for pricing these derivatives internally, which don't always have a precisely determinable price on the open market, was to price at the "mid," which means the middle point between the average price they got quoted for bids and offers on those derivatives.

The Feds say that at the end of February, thanks to Grout's marks, the traders reported a $88 million loss on the derivative portfolio.

3. "[f]ocus on the metrics and the P+L of the synthetic book"

This is a quote in the complaint from Martin-Artajo's supervisor, identified elsewhere as Achilles Macris, expressing more concern from higher up in the bank about the derivative portfolio getting out of control. He also said in the email, according to the charges released today, that "we will not be able to defend our positions" if the derivative portfolio shrunk. So, the traders continued to add to the portfolio, trying to overwhelm the hedge funds that had entered on the other side of the trade. This would result in the losses growing even more.

4. "what Javier would like is that if you start to see some gains we have to report it....what they don't want is for us to be down."

This is from an email from Iksil, the trader, to Grout, the more junior member of the team responsible for making the positions. The feds say that Martin-Artajo, starting in March, told the traders working under him not to record losses due to the market prices of the securities fluctuating. He claimed, the charges allege, that senior bank leadership didn't want to see volatility in the portfolio. So, the pricing of the derivatives worked in only one direction in response to market data: up.

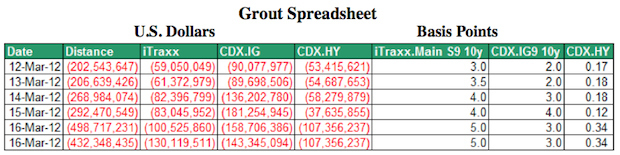

5. "Send to me and Javier the spreadsheet where u store the breakdown of the difference between our estimate and the crude mids."

6. "I don't know where he wants to stop, but it's getting idiotic"

The charges allege that, by mid March, Grout and Iksil had disagreements about how to interpret Martin-Artajo's order to not report market losses. The feds allege that Grout was marking on security they held $300 million away from the mid. Iksil, according to the charges, said this wasn't "realistic" and Grout responded that "I'm trying to keep a relatively realistic picture here," with the exception of the one marked $300 million away from its market value. That one security was CXD.NA.IG9-10Y, a section of an index of credit default swaps on the debt of large corporations, the trade at the heart of the eventual losses. By March 16, the feds say that Iksil had become frustrated with Grout's agressive marking of the trades and instructed him "not to make the additional effort to disguise the loss." That's when he called Martin-Artajo's instruction "idiotic." Iksil has a nonprosecution agreement.

7. "I reckon we get to 400 [million] difference very soon."

This is from an email from Iksil to Martin-Artajo saying that the difference between the market prices and the reported value of the trades was only growing. Also, on that day, Grout allegedly continued to mark the derivatives in a favorable way, against Iksil's instructions.

8. "You're losing your mind here, man, you're sending an email that would get, what is this 800 [million] bucks"

When Iksil sent Martin-Artajo and senior management in the Chief Investment Office a document saying losses could go as high as $800 million, Martin-Artajo called Iksil asking him, "Why did you do that?" Martin Artajo also said that he understood that Iksil wanted "to be at peace with yourself." and that "we're just going to have to explain that this is getting worse, that's it." Martin-Artajo, however, told Iksil, "You're losing your mind." Martin-Artajo, prosecutors allege, was worried that the potential losses Iksil and Grout reported got too high, the Chief Investment Office would take away the derivatives portfolio and force them to unwind it.

9. "We will lose more today...this is going to happen across the book...I reckon we have today a loss of 300m USING THE BEST BID ASKS...and approx 600m from the mids"

By the end of March, the losses were mounting and any reasonable method of counting them would reflect that, according to the charges. Iksil allegedly told Martin-Artajo that even using the highest prices quoted by buyers of the derivatives in the portfolio, they were down $300 million just on March 23 and down $600 million using the standard mid prices. The charges say that Grout said the losses were "more than 500 [million] anyway."

10. "[w]e are going to close the books in one hour and still around -$150MM"

Prosecutors allege that Iksil made a PowerPoint presentation for Grout on the losses in the derivatives portfolio that listed the losses for the year at $750 million and the total losses at $800 million. The charges say, however, that Grout's profit and loss statement for the next day, March 30, the last business day of the first quarter, showed a $583 million loss despite initial estimates that the portfolio had lost $250 million on March 30. Allegedly Martin-Artajo asked that the loss be adjusted down to $200 million and then $150 million. By 8:15 London time, Martin-Artajo told the New York office where he was going to close the books — at a $150 million loss. The final submission by Grout, at 8:41 p.m., was $138 million. Martin-Artajo's response as recorded in the court documents: "Excellent tks."

JPMorgan said in a later investigation that there was a $767 million discrepancy in the CIO's marking of the values and the consensus prices. JPMorgan would eventually restate their first quarter earnings for 2012 by $660 million and total losses ended up above $6 billion.

On April 6, Bloomberg and The Wall Street Journal ran the first articles on the derivatives trades. By July, Achilles Macris, Martin-Artajo, and Iksil were all fired by JPMorgan. Ina Drew, the head of the Chief Investment Office, which housed the derivatives traders behind the trades, resigned in May and Grout resigned in December. Grout is reportedly now in the South of France and his lawyers told Reuters that "We're confident he will eventually be cleared of all wrongdoing."

Martin-Artajo's lawyers told The New York Times that he "is confident that when a complete and fair reconstruction of these complex events is completed, he will be cleared of any wrongdoing."