The Strange But True Tale Of Argentina's Debt Mess

It's all here — everything from how the crisis could affect global poverty to why a New York hedge fund manager seized a three-mast sailing ship.

On Wednesday, Argentina made international news by defaulting on its debt. The nation of 41 million people failed to make a $539 million payment to bondholders before a deadline, triggering a ratings downgrade, a slump in Argentine stocks, and not a little bit of panic and confusion.

Argentina has defaulted on its debt on more than a half-dozen occasions over its history. But this time it's different, because nobody knows exactly what to do or how to resolve the situation, and lots of people are concerned that this could harm not only Argentina but the whole world economy.

How did Argentina get to this place?

A century ago, Argentina was one of the wealthiest nations on the planet, and considered a serious rival to the U.S. for economic dominance of the new world. The country had a fast-growing economy, agricultural abundance, and lots of natural resources. That didn't work out too well, however. Lots of reasons for it, but the end result is that while Argentina's GDP per capita in 1990 approached that of the U.S., by 2000 it was less than a third as much.

In the 1990s, Argentina borrowed heavily, issuing tens of billions of dollars in international bonds. By 2001, amid a recession, it became clear that the country couldn't keep up with payments and, in December of that year, the government defaulted on north of $80 billion in debt. It was — and still is — history's largest default by a national government.

This had many political and economic implications, but the main one is that the country was largely cut off from international capital markets, meaning it couldn't borrow any more money — or, if it did, it had to pay very high interest rates.

Argentina's president, Cristina Fernández de Kirchner, was elected in 2007 and is currently serving her second and final term in office. Her husband, Nestor Kirchner, was her predecessor in the office, and he soon realized that it would be very helpful to all sorts of things if the country could have credit again. So in 2005, his government offered holders of the defaulted bonds a deal: If they'd agree to exchange their defaulted bonds for new ones worth significantly less — like as little as a 30% in some cases — Argentina would promise to pay this time. It might sound like a crappy deal, but something is better than nothing.

In 2010, President Fernández returned to the negotiating table and make a similar offer to bondholders who didn't accept the original offer. Nine years into not getting paid proved enough for a lot of them. By the time the bargaining was done, more than 92% of all the original bondholders had agreed to the exchange. And since then, Argentina has faithfully been making interest payments on the debt.

The other 8%, known as holdouts, have received nothing. And the Argentine legislature passed a "lock law" making it illegal for the country to make subsequent offers to other bondholders. Basically, the 8% who didn't take the offer were frozen out.

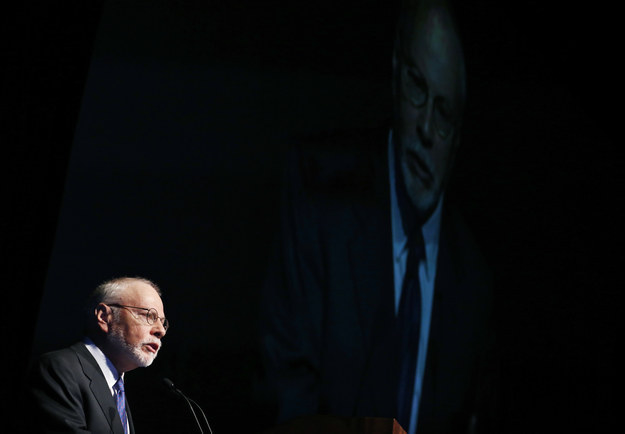

Paul Singer is a billionaire from New York and is the founder and CEO of Elliott Management Corp, a hedge fund managing over $21 billion in assets. Singer is a big-time backer of the Republican Party, helping George W. Bush get elected and putting up $1 million to fund a PAC that tried to get Mitt Romney elected. Notably, he's also a vocal advocate of gay rights and helped New York state pass a same-sex marriage law.

He buys debt from countries, such as Peru and Congo-Brazzaville, that have defaulted. He gets this "distressed debt" for pennies on the dollar. Then he tries to force those countries to pay up through international courts. It's a take-no-prisoners approach to debt negotiations. It's time-consuming, it's costly and it can get ugly. But the profits can be huge. In Peru's case, for example, Singer paid a reported $11 million but won court judgments for $58 million, which the South American republic eventually paid because it had no choice. These tactics have won Singer and other such firms the nickname "Vulture Funds."

Through one of his companies, Singer acquired a bunch of Argentina's defaulted bonds, as did some other hedge funds. There has been speculation about how much the hedge funds paid for the debt, or what its face value is, but whatever it was, they wanted more. Certainly, they wanted more than the 30 cents on the dollar Argentina was offering.

So they sued.

Sailing at upwards of 13 knots, with a crew of 357 sailors and officers, this 340-foot long beauty is a marvel to behold, the sixth-largest tall ship in the world. She is the ARA Libertad, a beloved training ship and one of the the crown jewels of the Argentine navy. But to Singer, the Libertad looked like an asset.

Despite years of litigation and numerous judgments in its favor, the holdouts had been unable to collect any money from Argentina. But in October 2012, Singer used a court ruling to convince a court in Ghana to seize the Libertad, which was docked temporarily in that West African country, and Singer demanded that Argentina pay him $20 million to release the boat. Eventually Argentina prevailed and the ship returned home, but the incident underscored the bare-knuckle nature of the dispute.

Unlike Peru and Congo-Brazzaville, Argentina was proved a formidable rival. It was wealthier and did not quickly cave to legal challenges; instead, it seemed to hunger for a fight. It hired expensive lawyers to counter the holdouts, and employed aggressive public relations to match those practiced by Singer and other holdouts.

Litigation dragged on for years, and no end seemed to be in sight. But one U.S. judge would change that.

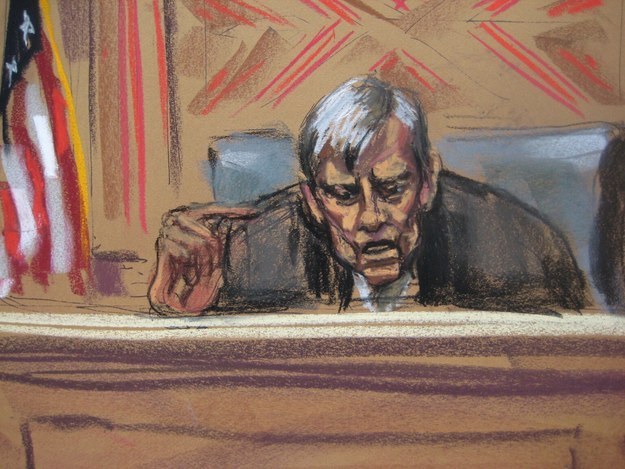

Appointed by President Nixon in 1972 to the federal bench in the Southern District of New York, Thomas Griesa oversaw some of the most important litigation in the long-running case. In February 2012, Griesa interpreted a clause in the debt contracts (known as Pari Passu) to mean that Argentina could not make further payments to the bondholders who agreed to the debt exchange unless it also paid the holdouts. In full.

What's more, the court told banks and other financial institutions that did business for Argentina that if they attempted to make payments to bondholders that had accepted the earlier deal without also paying the holdouts, the banks would be held in contempt.

It was a stunning decision and led to some serious questions about global poverty. In effect, Griesa seemed to be rewarding the holdouts, while punishing the exchange bondholders. If the prize for holding out on distressed debt is 100 cents on the dollar, then why would anyone negotiate?

By extension, would poorer countries be forced to repay all their debts in full, regardless of their economic woes, without a chance at negotiation? Many impoverished countries can barely afford health care or education, in part because interest on debt takes up such a large share of their treasury. (Some debt investors, such as Singer, have argued that rampant corruption in these countries is a bigger problem.) To help those countries develop, rich nations have helped negotiate terms with creditors in which only part of the debt needs to be repaid. But Griesa's ruling made many wonder if such negotiations were now moot, because bondholders might refuse to negotiate altogether.

Argentina appealed Griesa's ruling and lost. Then it appealed several related rulings and lost again. Finally, it appealed all the way to the Supreme Court. And lost yet again. On June 16, the highest court in the land refused to hear the South American republic's appeal once and for all, effectively affirming the lower court's ruling. After years of brutal fighting, it appears Singer and the other holdouts had won. With no more court stays in hand, the clock started ticking: Argentina's next regularly scheduled interest payment to the exchange bondholders was June 30. Would it pay everyone as the court required?

Fittingly for a country boasting the highest number of shrinks per capita in the world, Argentina's economy minister is the son of a psychoanalyst and a psychologist. Some also think he's a real looker.

For the past several years, Kicillof has been President Fernández's point man as the country tries to figure a way out of a seemingly intractable situation.

On the one hand, the Argentine leader has made it clear that she won't "submit to extortion" at the hands of the hedge funds, backing herself into a political corner at home. On the other hand, she literally cannot pay the exchange bondholders without violating a court order. Even if she wanted to negotiate, Kicillof and others have pointed out, the country's lock law prevents paying the holdouts. And if Argentina did pay the holdouts at face value, what would stop all the exchange bondholders — the ones who agreed to accept far less than what Argentina originally agreed to when they sold the bonds — from suing for full value? Some calculations put that amount at nearly $200 billion, more than 10 times all the money Argentina has at the moment.

In the wake of the Supreme Court decision, Argentina deposited the $539 million it was supposed to pay to the exchange bondholders at the Bank of New York Mellon, which is the bank that handles its distributions to creditors. But, of course, the bank is barred from passing those funds on . So the whole situation developed the feel of a nasty high-stakes game of international chicken. Who would blink first?

Outsiders and observers hoped for some radical solution. One proposal involved a group of Argentine banks buying the debt from Singer and the other holdouts and then agreeing to an exchange. Another, floated by Fernández herself, called for Argentina to offer yet another bond exchange, this time using specially written bonds issued and payable in Argentina — far beyond the reach of U.S. courts.

Although the June 30 deadline passed without incident, Argentina had a grace period of 30 days, until July 30, to make the payment without being considered in default under the rules of international finance. This week, Kicillof, who has a doctorate in economics, flew to New York to join in talks with a court appointed mediator. They went nowhere, and reports were that his offer was little different than the ones made to bondholders in 2005 and 2010. On Wednesday evening Kicillof left the meetings and headed to the Argentine consulate in Manhattan. There was no deal. Argentina had, once again, defaulted.

What comes next?

Kicillof, in a press conference Thursday, said that it was an "atomic absurdity" to claim that the country had entered into default. His argument, essentially, is that Argentina had deposited the money to pay the bondholders in the bank; what blame did it have?

The markets didn't see it quite that way. The Merval Index of Argentine stocks fell more than 8% on Thursday, and a 2% decline of the Dow Jones Industrial Average was blamed on collective worries about the Argentina situation.

In Argentina, some reacted with a shrug. After all, the country hasn't been able to get a loan for years, so what else is new, some asked.

But the truth is that being a credit pariah has had terrible effects on the country's citizens. Unable to borrow, Argentina has printed vast sums of money, driving staggering inflation. Prices on consumer goods rose 15% in the first six months of the year. And that inflation, combined with the Fernández and Kicillof's aggressive intervention into the economy, has scared off foreign investment. That, in turn, has hurt Argentina's economic growth by, among other things, reducing exploitation of its considerable petroleum and gas reserves. As a result, Argentina has become an energy importer, using its shrinking store of hard currency to buy oil and gas from other countries. Desperate to hold on to dollars, the government now severely limits access to foreign notes by residents, heavily taxes purchases made abroad, and forces citizens to apply for a permit to exchange pesos for other currencies. This has created a robust black market for dollars.

Though few would argue that Argentina wouldn't be far better off it could get past these debt problems once and for all, there's growing political pressure within Argentina to fight to the end. Many see the country's pride on the line. The sign depicted above, posted in Buenos Aires, refers to an effort by Spruille Braden, U.S. Ambassador to Argentina in 1945, who openly opposed the political ambitions of Juan Domingo Perón. The legendary Argentine leader used the slogan "Braden o Perón" (Braden or Perón) in his successful candidacy for president in 1946.

Like Ambassador Braden, the sign seems to say, Judge Griesa is an interloper in Argentine affairs.