A Wells Fargo district manager from Washington state allegedly outlined in a 2010 speech the three types of customers that sales employees should target for opening new, and often unneeded, accounts: "young, less educated, and Mexican," a former sales employee who was at the event told BuzzFeed News.

The district manager came from a high-performing branch to the employee's Washington branch to deliver a training address that the employee, who worked as a personal banker, compared to the one “Alec Baldwin gave in Glengarry Glen Ross.”

The employee left the bank in 2011 and wished to remain anonymous because he still works in the industry, which he described as "very sensitive to the press."

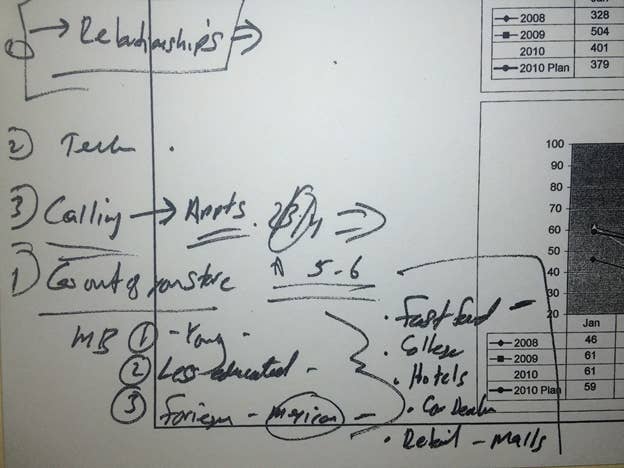

During the event, the employee asked if he could keep a sales sheet on which the manager allegedly wrote "Mexican" and other notes during the training session. The employee then provided the notes to BuzzFeed News:

“Young people who didn’t know better, and we could convince them without much pushback,” the employee said in an email. “Less educated people were an easy target for selling additional checking/savings accounts.”

But, the employee said, the “truly insulting” target was foreigners. The manager “went on to explain that foreigners, especially Mexicans, didn’t understand English very well, so they would say ‘yes’ or agree to what we were selling more often than not."

“The things he outlined in the path to success; that’s when I knew this cannot be right,” the employee said. His coworkers at the meeting were also shocked, he said. “You could have heard a pin drop.”

Anyone with English as a second language was "supposedly an easy target to sell additional unnecessary accounts AND to open brand new accounts — with new customers we could 'easily’ open lots of extra accounts when starting the relationship,” the employee said in text messages.

“The manager suggested that all we needed to open accounts was a verbal 'yes,'" he said. Because people who didn't speak English as a primary language "didn’t really understand what we were telling/selling, they would more easily say 'yes.' With that 'yes' we could open lots of accounts and 'justify' it."

When asked if employees were taught to profile customers based on their ethnicity, Mary Eshet, a Wells Fargo spokesperson, said, "Absolutely not. If this type behavior occurred, it was and is totally counter to our policies, practices and values."

The employee's claim also comes after a Wells Fargo banker who was fired told Bloomberg he secretly opened accounts for Latinos and recent immigrants. “There would be times the client would sit down and leave without even knowing they had these new accounts,” Matthew Castro told the financial news outlet in an article published Wednesday.

In emails and phone conversations, the former employee who spoke to BuzzFeed News — who left Wells Fargo in 2011 — described a “toxic” and “aggressive” sales culture. This year it was revealed that 1.5 million unauthorized credit and debit accounts being opened for unsuspecting customers, leading to more than 5,000 employees being fired since the bank began investigating its sales practices in 2011.

Wells Fargo paid a record fine of $185 million for its “widespread illegal practice.” Its CEO, John Stumpf, was grilled at a congressional hearing and then abruptly stepped down in October. The bank is also facing a $2.6 billion class action lawsuit filed in September by two former employees who claimed Wells Fargo fired or demoted employees who did not meet “unrealistic” sales quotas, while promoting those who met the quotas by opening fraudulent accounts.

The company said it first received reports of unethical sales practices in 2011, and began firing its low-level employees. However, according to documents obtained by VICE, misconduct was reported to management as early as 2006, when a former branch manager in the state of Washington sent a letter to the then-head of regional banking detailing the opening of fraudulent accounts — nothing was reportedly done.

Other former employees have recently revealed the intense pressure they faced to open more accounts. One such employee told NPR Money that she vomited at her desk from the stress, and was not only fired, but blacklisted by Wells Fargo after she refused to meet her sales quotas and attempted to report her concerns to the bank’s ethics hotline.

"Actively profiling people based on that stereotypical/ racist criteria was truly demoralizing."

The employee told BuzzFeed News that after the district manager’s training session, the sales pressure at his branch increased. In addition to helping walk-ins in or calling existing customers to open more accounts, Wells Fargo sent its sales employees out to local malls, restaurants and hotels, he said.

“Essentially, they would send us to try and sell out of the branch to employees of those hotels/restaurants/stores that fit the descriptions of the ‘ideal’ sale: Young, uneducated and foreign — preferably Mexican — in the words of the district manager,” the ex-employee said.

“Going out and actively profiling people based on that stereotypical/racist criteria was truly demoralizing," the former employee said.

He also described other practices employees were forced to adopt to meet sales goals. During “Jump into January” managers instructed employees to convince their family and friends to open accounts during the December holidays and “bring an account to work day” in January.

“We were expected to have a list of names, social security numbers, other personal information by the time Jan. 2 came, so that we could open as many accounts as possible,” he said. “Often times, the accounts were left open for just enough time — usually an entire quarter — so that the banker got sales credit and then the family or friend would close the account.”

The employee said that during his time at the branch, it was common practice for the employees — including the tellers — to keep a stack of blank account applications at their desk. This was done to “try to convince a bank customer very quickly that they need a new account, have them sign the bank application, and then the banker could fill it out later. With the client’s signature, it was deemed okay,” he said.

The employee said that by the time he left Wells Fargo in 2011, “the sales pressure was overwhelming.” (The employee provided BuzzFeed News with documentation proving he worked there.)

Eshet, the bank spokesperson, said, "We have made fundamental changes to help ensure team members are not being pressured to sell products, customers are receiving the right solutions for their financial needs, our customer-focused culture is upheld at all times and that customer satisfaction is high." She added, "this includes our recent announcement that we are ending all product sales goals for the retail bank, effective October 1st."

The employee said that he never complained to the bank’s ethics department about any of the questionable sales practices, nor did he know anyone who did.

He said bankers were written up for not making sales numbers and were fired if it happened two quarters in a row.

“It was unheard of to make complaints about sales practices,” he said. “Not only would it probably cost you your job at Wells Fargo, you would unofficially get ‘blacklisted’ from working at any other bank.”

Eshet said "Wells Fargo does not tolerate retaliation against team members who report their concerns and will take measures to protect team members from retaliation," and that their "non-retaliation policy makes clear that no team member may be retaliated against for providing information about suspected unethical or illegal activities or possible violations of any Wells Fargo policies."