Twitter is expected to close the books on its initial public offering this afternoon, bringing to an end a particularly tame IPO compared to that of Facebook's last year.

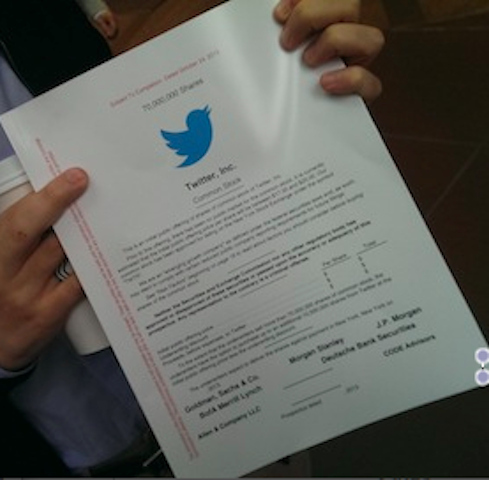

Twitter is expected to finalize the price for its shares on Wednesday and begin trading on Thursday. From the smaller number of shares floated to the conservative share price range of between $23 and $25 to a spate of positive analyst ratings, the road Twitter has traveled to its public market debut has been decidedly smooth, which is, of course, a good thing. Facebook's IPO, by contrast, was full of bumps and bombast.

Here's a tale of the tape comparing the run-up to both companies' respective IPOs that underscores just how different Twitter's looks from Facebook's:

Twitter filed financial documents for its initial public offering confidentially with the SEC, only offering a lone tweet to inform the public about its plans.

We’ve confidentially submitted an S-1 to the SEC for a planned IPO. This Tweet does not constitute an offer of any securities for sale.

We’ve confidentially submitted an S-1 to the SEC for a planned IPO. This Tweet does not constitute an offer of any securities for sale.

When Facebook filed for its IPO, the option of doing so confidentially didn't exist, so it had to make its financial documents publicly available immediately.

Facebook's road show was a bit of a circus, with massive crowds surrounding CEO Mark Zuckerberg, who donned his trademark hoodie — leaving some investors struggling to take him seriously.

Security at Twitter's road show was tight. In fact, we were thrown out of the road show!

Facebook's road show presentation, as much as it was about business, tried to transcend the traditional pitch to investors and feel more human.

Twitter, however, was strictly business on its investor tour.

Facebook priced its stock at $38, which investors viewed at the time as a bit pricey. (Facebook shares now trade at just below $50 per share.)

Twitter's current $23-$25 per share price range is viewed by the investor community as conservative, and perhaps even cheap.

While Facebook also raised its price heading into its IPO, Twitter has done so with a small share float, leading to an oversubscribed IPO even as it raises its price.

Facebook listed on NASDAQ, and the first day of trading was marred with massive technical glitches that left a sour taste in traders' mouths.

Twitter is listing on the New York Stock Exchange, which is doing plenty of work ahead of time to ensure it's ready for the first day of trading.

Facebook's stock cratered during its first few months of trading, with investors raising serious questions about the company's business.

So, what about Twitter's IPO debut?

Already, Twitter has a number of "buy" ratings and price targets well above its expected pricing — with some as high as $40 or $50.

Still, the company hasn't turned a profit in recent quarters and, like Facebook, a majority of its business comes from advertisements on mobile devices. Twitter's user growth has stalled on a quarter-over-quarter basis, which is a key way to drive revenue growth.

How investors react to that will determine if Twitter fares better in its first day of trading that Facebook.