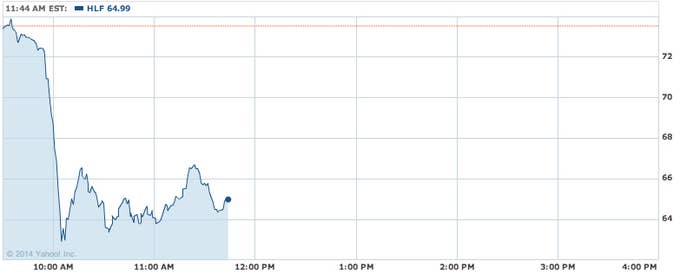

Herbalife, the nutritional supplements company whose multilevel marketing business model has been under attack for more than a year by hedge fund manager Bill Ackman, has seen its stock dip more 12% to around $65 this morning after Massachusetts senator Ed Markey wrote letters to the Securities and Exchange Commission the Federal Trade Commission requesting information on the company's business practices. He also wrote a letter to the company itself.

"There is nothing nutritional about possible pyramid schemes that promise financial benefit but result in economic ruin for vulnerable families," Markey said in a statement, "I have serious questions about the business practices of Herbalife and their impact on my constituents, and I look forward to receiving responses to my inquiries." A statement released by his office said that Herbalife's structure, where distributors sell products to customers through a network of other distributors they recruit shares a "common feature with pyramid schemes."

Herbalife spokesperson Barb Henderson said "We received the letter from Senator Markey this morning and look forward to an opportunity to introduce the company to him and address his concerns at his earliest convenience."

Ackman announced a $1 billion bet against Herbalife's stock in December 2012, describing it as a pyramid scheme that took advantage of its distributors who purchase products from the company but then rarely make any profit selling it to customers. Herbalife has aggressively defended itself from Ackman's accusations, saying its business structure is both legal and common in its industry. There are no known federal investigations of Herbalife.

The stock plunged to $26 after Ackman's presentation but has since gone up considerably, even getting above $80 two weeks ago. Ackman's short bet also attracted Carl Icahn to buy a significant stake in the company, leading to a public feud between the two.

This isn't the first large dip for Herbalife this year — its stock price fell 10% a week ago when the Chinese government said it would investigate Nu Skin, another multilevel marketing company, which along with Herbalife is active in China.

Ackman altered the composition of his bet in October after taking about $500 million in losses to make it less risky.

Both Herbalife and Ackman's firm, Pershing Square, have brought their fight over the legitimacy of the company's business model to Washington.

Herbalife hired former Los Angeles mayor and Democratic National Convention Chair Antonio Villaraigosa as an advisor and appointed former Surgeon General Dennis Carmona to its board of directors.

Pershing Square has signed up three firms to lobby the Senate on consumer protection issues: Ibarra Strategy Group, Wexler & Walker Public Policy Associates, and Moffett Group. Herbalife has two Democratic-aligned firms registered with the Senate — Podesta Group and the Glover Park Group, along with Ogilvy Government Relations.

Herbalife disclosed in October when it announced its third quarter earnings that it had spent over $20 million "mostly on legal and advisory services relating to the Company's response to information put into the marketplace by a short seller which information the Company believes to be inaccurate and misleading." Herbalife will next announce quarterly earnings on February 18.