1. Property or Real Estate Taxes

Property tax deductions are among the many perks of being a homeowner, but you don’t necessarily need to own a home to benefit from this tax break. Under the Tax Cuts and Jobs Act, you may be able to deduct up to $10,000 ($5,000 if you're married but filing separately) for a mixture of sales taxes, state and local income taxes, or property taxes. This could include being able to deduct property and real estate taxes for items like your primary home, a co-op apartment, your vacation home, land, property outside the US, cars, RVs, and even boats. Be extra careful, though. You can’t just go ahead and write off your fancy new speedboat. There’s specific rules to these deductions, so please consult your tax advisor.

2. Declaring Part of Your Home a Home Office

Since the surge of the pandemic, a lot of us were forced to work from home and still do to this day. The good thing about that is that the IRS offers a home office deduction, so you can claim business-related expenses, but they must fall under certain guidelines. To determine how much you can deduct, you calculate the percentage of your home office space as it relates to your home’s total square footage. It also should only be used exclusively for business purposes and be your principal place of business. Expenses that may be deducted could include your desk, a computer, chairs, your printer, etc. Sorry, but your 60-inch big screen might not make the cut.

3. Claiming Your Cellphone as a Small Business Deduction

Can you imagine life without a cellphone? Like, seriously. It kinda gives you a bit of anxiety to think about that, doesn’t it? We’ve grown so accustomed to and reliant on our phones that it may be difficult to picture our lives without them. They’re so convenient and helpful that almost everyone needs one these days. As helpful and necessary as they may be, the downside is that our phone bills can be exceedingly expensive, especially when finances may be tight during a pandemic and soaring inflation. But there’s good news. If you’re self-employed and find that you’re using your cellphone for business purposes, a percentage of your phone bill can be deducted. You must calculate what percentage of the time you spend on your phone is related to your business, and then you can deduct that same percentage of your phone bill. The Small Business Jobs Act of 2010 also makes it easier for you to write off the depreciation of your phone if you use it to conduct business extensively. Another quick way to save is to switch to a lower-cost, no-contract unlimited wireless plan for as low as $25 per month with Visible.

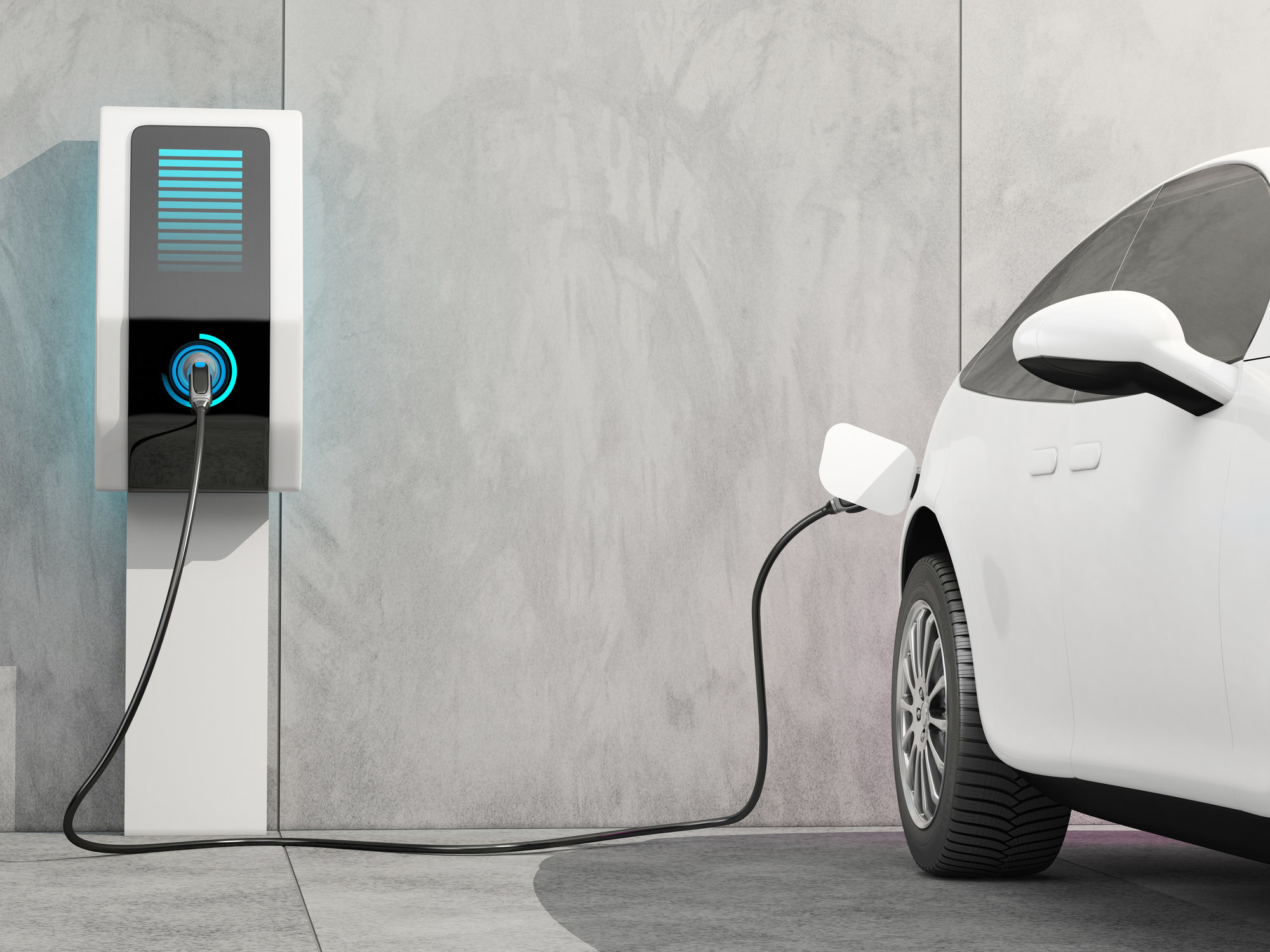

4. Getting a Federal Tax Credit on Your Electric Vehicle

If you purchased an electric vehicle recently, you may be able to qualify for a federal tax credit. Any new plug-in hybrid or electric vehicle purchased in or after 2010 may qualify for a federal income tax credit of up to $7,500. This is calculated based on the size of the battery in the vehicle you purchased and how much income tax you owe. Your state may have its own credits/rebates/grants that could be applied as well. For example, California drivers can get rebates up to $7,000 toward a purchase or lease of a new vehicle. With gas prices and inflation going through the roof, switching to electric might be the move, especially with these tax breaks. But since these numbers can get confusing pretty quickly, you may want to consult with your tax advisor for those specifics.

5. Getting Education Credits for Going Back to School

Taking college-level courses doesn’t necessarily mean you have to be consumed with student loan debt. The Lifetime Learning Credit and the American Opportunity Tax Education Credit give credits for expenses you paid for continuing your education. Expenses could include tuition, fee payments, required books, or supplies for post-secondary education for yourself, spouse, or dependent child. Each credit is slightly different and has its limitations, so consult with your tax advisor on which one might be best for your situation.

6. Deducting Student Loan Interest

While we’re on the topic of continuing education and paying for your college tuition, you may be able to save some cash by deducting paid student loan interest on your tax return. The downside is that the maximum student loan interest deduction is $2,500. But anything helps these days! However, if you make too much money, are single and your adjusted gross income is over $80,000, or are married filing together and your adjusted gross income is over $165,000, you can’t deduct your student loan interest. So, if you paid $600 or more of interest on a qualified student loan during the year, you'll receive Form 1098-E from the institution you paid and you should be able to deduct that amount on your return.