The British government is going to sell its stake in Royal Bank of Scotland (RBS). It's being reported that the taxpayer will lose £7 billion on the deal.

But how did the government come to own a such a huge stake in the bank? And what does that £7 billion figure actually represent?

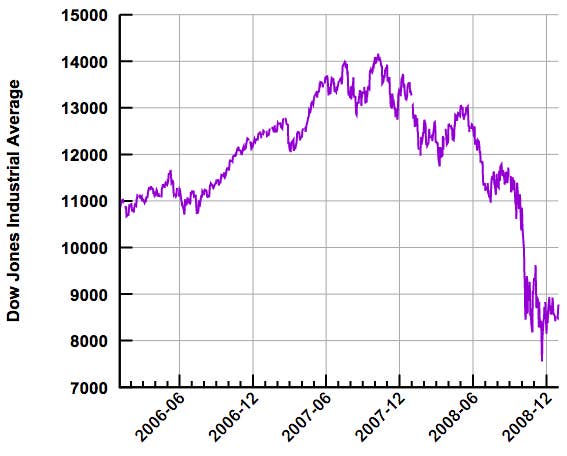

In 2007, the global banking system ground to a halt. There's some argument over the exact causes, but essentially, it's because banks in the US lent billions of dollars in mortgages to people who couldn't pay it back.

What this meant was that several banks became unable to lend money, or even to allow customers to get their own money out.

And it was going to get worse. Around the world, banks were refusing to lend to each other, and it looked as though ordinary people were going to lose all their money.

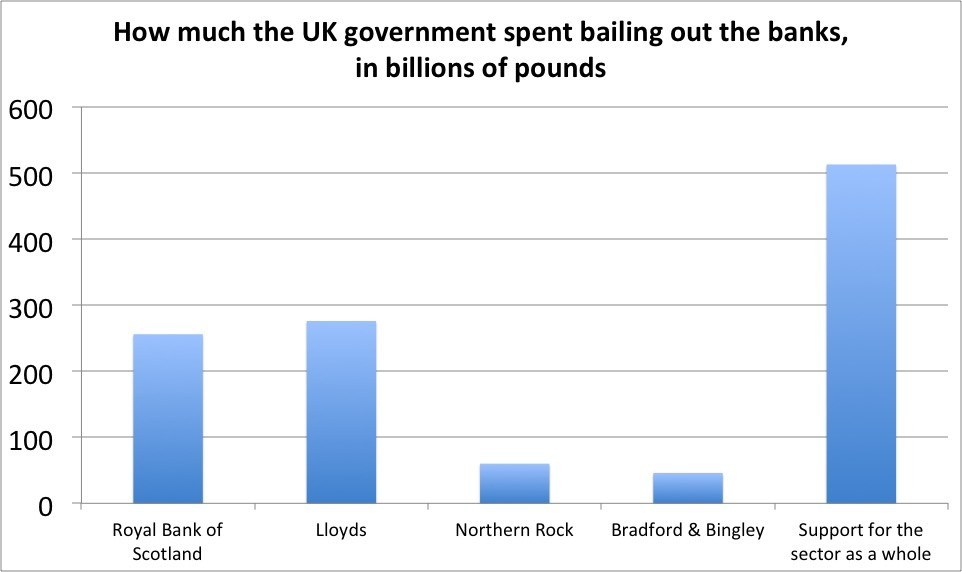

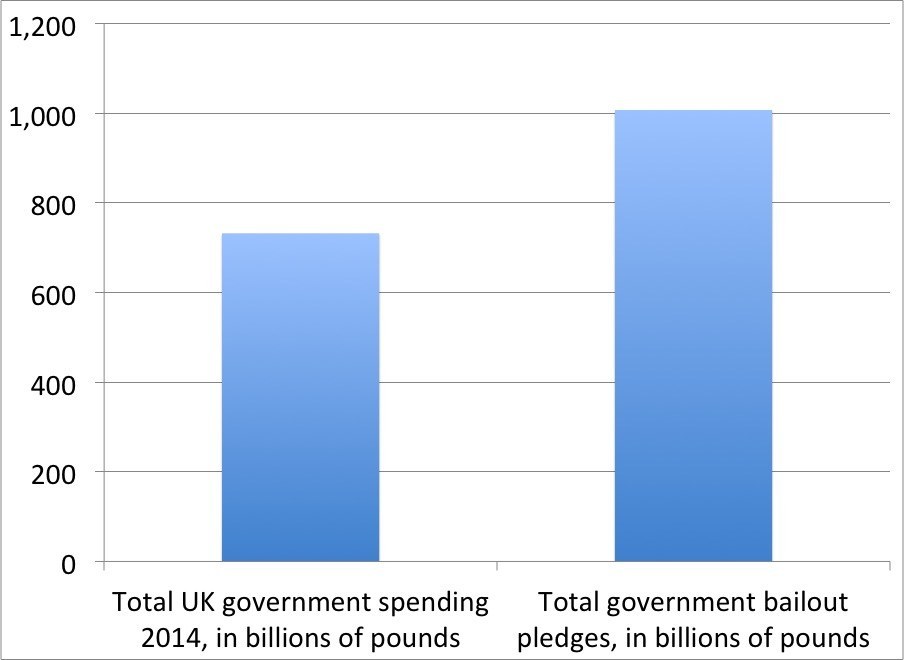

So governments in Britain, America, and Europe decided to put money into the banks so that the money would start moving around again. In total, Britain pledged to put £1.16 trillion into the financial sector.

This was, obviously, a huge amount of money. For context, it's about a third more than the government spent in total last year.

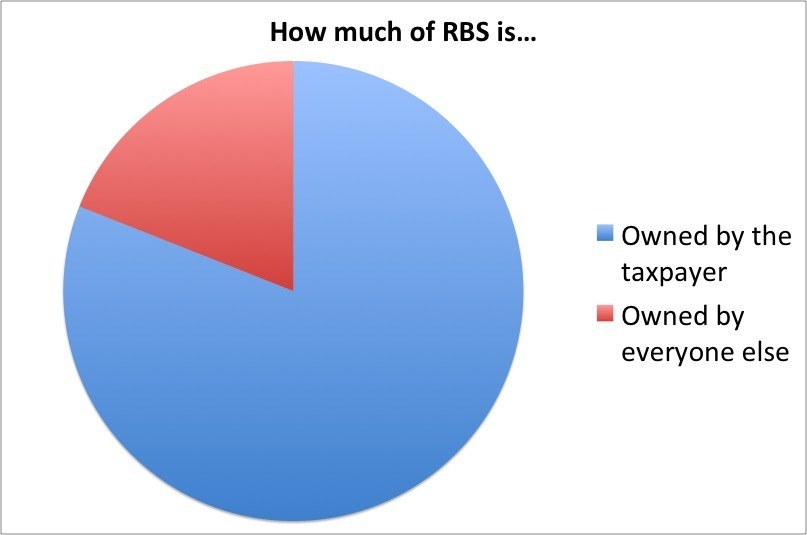

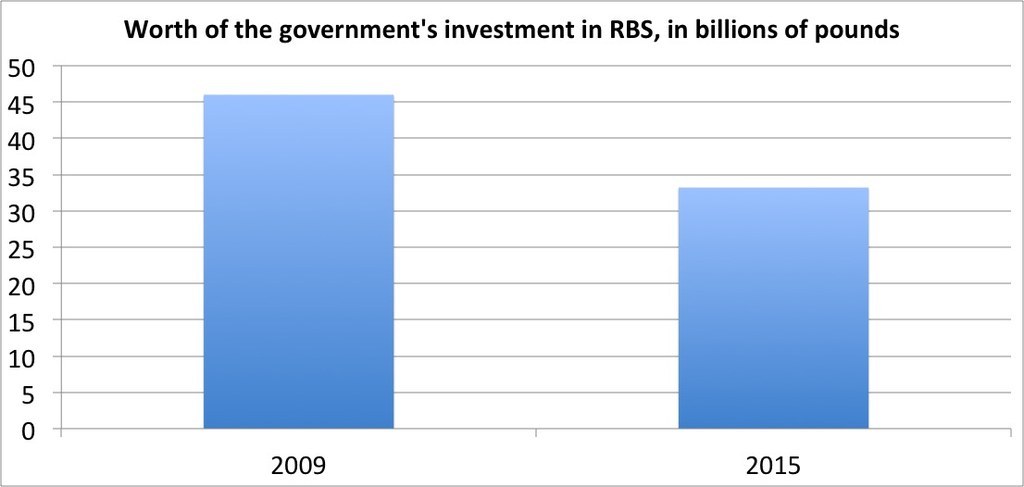

Of the money that was pledged to RBS, £46 billion was spent buying shares. It gave the government an 81% stake in the company.

The government hasn't got any of that £46 billion back yet. And the value of its shares has dropped by quite a lot.

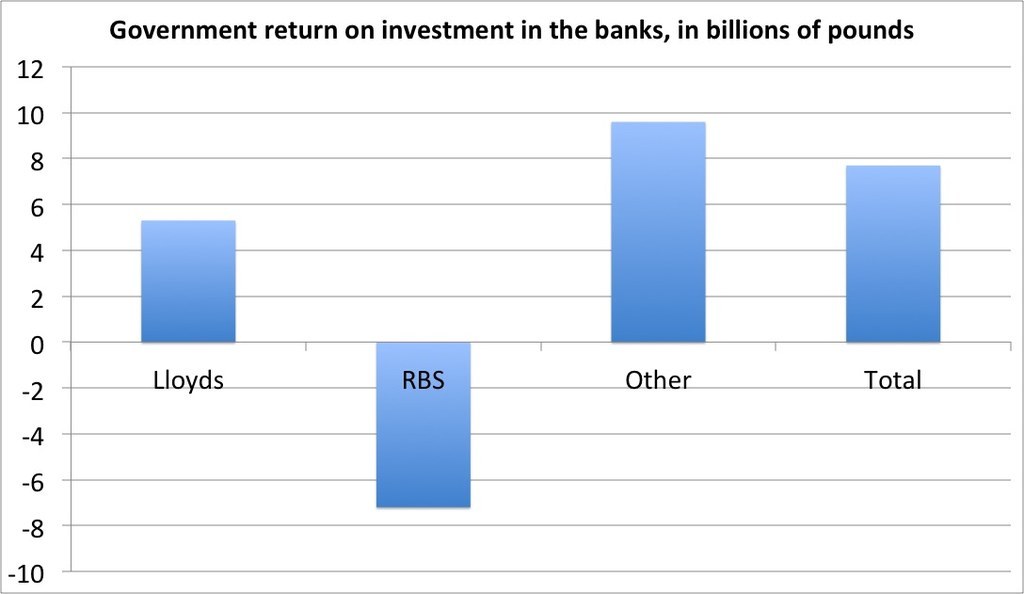

Ultimately, according to Rothschild, the investment bank managing the deal, the government can expect a loss of £7 billion.

Which is, obviously, a decent sum. A billion here, a billion there, pretty soon you're talking about real money.

But in the overall scheme of things, the government has actually made a profit.