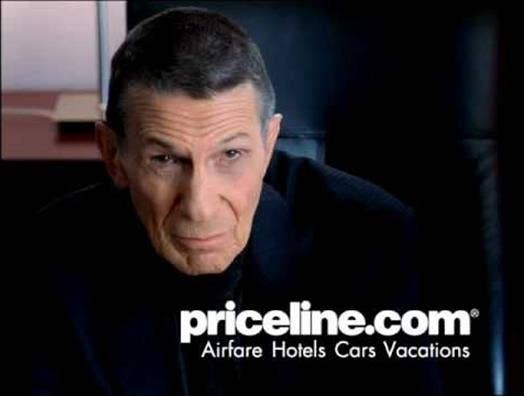

When most people think of Priceline.com, cheap fares spring to mind. Analysts at Morgan Stanley think of something else entirely: three of the world's largest and most influential companies.

In a research note today upping Priceline's per-share price target to $1,010 each, the analysts, Scott Devitt and Nishant Verma, said it's "the unique combination of part Amazon.com, part Apple and part Berkshire Hathaway all in one company."

"Priceline is a low-cost operator like Amazon, yet it is a company that focuses on large industry profit pools over market share like Apple, and it has a non-promotional management team with an acquisition strategy focused on talent retention like Berkshire Hathaway," the analysts explained.

While Priceline is indeed benefitting from the success of Booking.com and growth in Europe and the Asia-Pacific region, its $5.3 billion in annual revenue compares with more than $20 billion at Amazon and more than $100 billion each at Warren Buffett's Berkshire Hathaway and Apple. But on a share price basis, Priceline has all but Berkshire Hathaway beat — Apple ($414.28), Amazon ($289.67), and Berkshire Hathaway ($173,000 for class A shares). Priceline traded at $877.32 earlier today.