Everyone needs money, but everyone has different strategies for saving it and spending it.

So we asked members of the BuzzFeed Community to share with us the best advice about money they'd ever gotten.

Here's what they shared:

1. Keep your three biggest expenses as low as you can.

2. If you want to pay off multiple debts fast, try the Snowball method.

3. Round up on each bill and pay that amount.

4. Figure out what your monthly bills are going to be and then put that amount in savings throughout the month.

5. Use direct deposit to put money directly into an account that's just for bills.

6. Every time you make a dollar, save a dime.

7. Impose a 24-hour wait limit on purchases to prevent impulse shopping.

8. Save all your pennies.

9. Think of a budget as you telling your money where to go, instead of wondering where it went.

10. Don't borrow from your 401K.

11. "If you are paid bi-weekly, saving $20 per pay period is $500 at the end of the year."

12. When you first enter the work force, save as much money as possible.

13. If you save a little each week for something big, it'll give you time to decide if you really still want the thing.

14. "I you can't buy two of it, you can't buy it at all."

15. "Put a dollar in a jar every day and never touch it."

16. Open a savings account at a totally different bank from all your other accounts to make it harder to transfer yourself money when you need it.

17. Plan in advance what you're going to spend on a night out and take out only that much cash.

18. Try the 50-20-30 budget method (50% on living expenses, 20% on financial goals, 30% on personal spending).

19. Maintain your financial independence in every possible way.

20. "Stash away every $5 bill you receive. You’ll have a lot saved after a few months."

21. "My mom told me to never buy a wallet that cost more than I carry in it, after I showed her my new Burberry wallet I just got."

22. Convert how much something costs into how long you'd have to work to earn it.

23. Become an expert bargain shopper.

24. "Save up to nine months or more worth of expenses in case of emergency."

25. Don't not talk about money.

26. Invest in a retirement account as soon as possible.

27. Never go to a grocery store when you’re hungry.

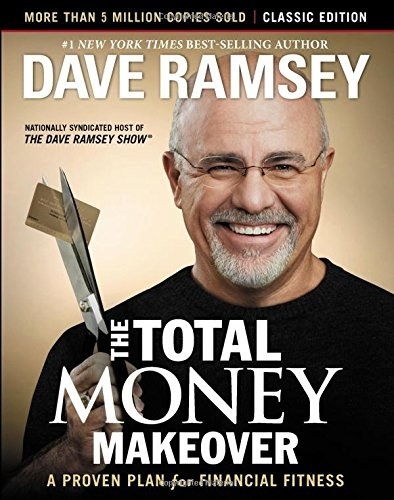

28. "Read Dave Ramsey's book, Total Money Makeover. His advice is solid."

29. Try to separate your feelings from your money.

30. Ask for raises regularly.

31. Map out your budget for the year and stagger bill payment.

Responses have been edited for length and clarity.

Follow along at BuzzFeed.com/NewYearsRevolution from Jan. 1 to Jan. 14, 2018.