David Cameron has made a pretty startling promise: If they win the election, the Tories will not raise taxes.

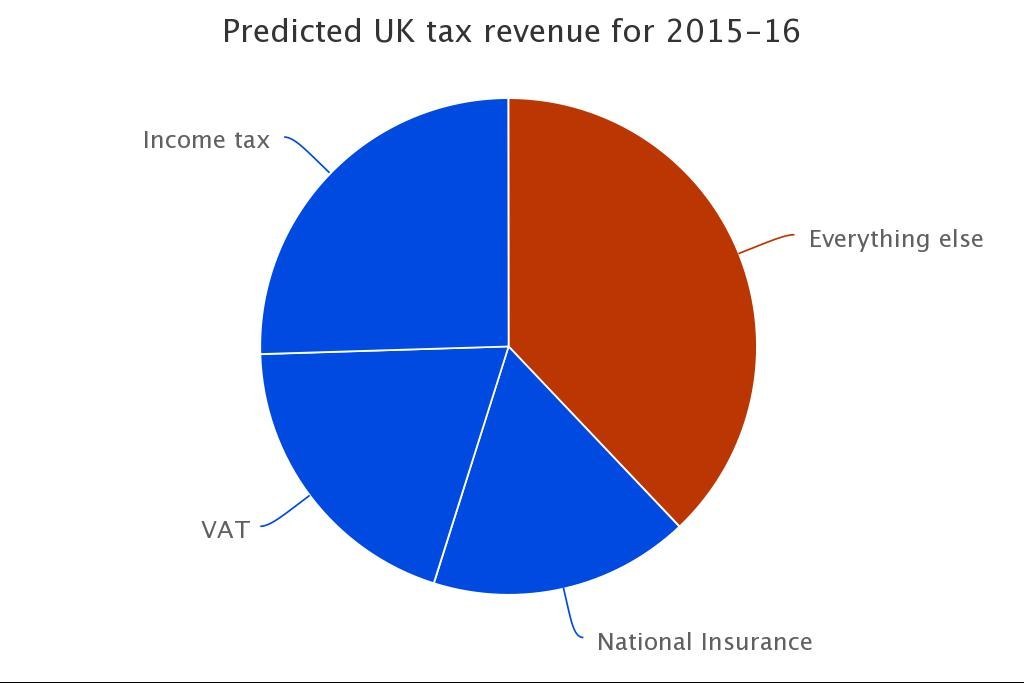

More precisely, they will introduce a law preventing themselves from raising income tax, National Insurance, or VAT.

At the same time, they will still keep their earlier promises to take everyone on the minimum wage out of income tax, by raising the personal allowance (the amount you earn before you have to pay tax) to £12,500 by 2020; increasing the threshold for paying the 40p rate of tax to £50,000; and lifting the threshold for inheritance tax to £1 million in line with inflation, to make sure you don't have to pay to inherit your family home (unless you live somewhere like this).

We're all used to politicians making promises, but this is a pretty big statement. Here's why:

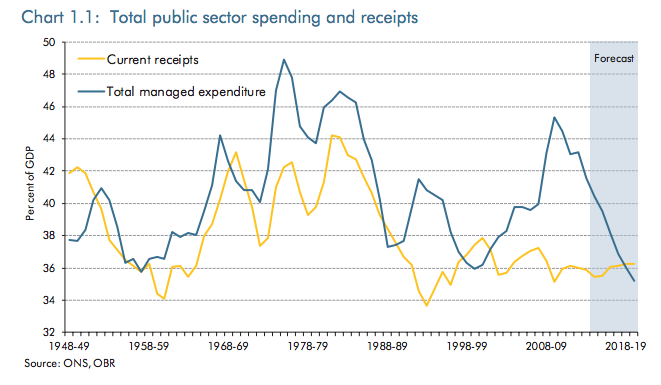

There's still a vast gap between what the government is spending (blue line) and what it's receiving in tax (yellow line).

In fact, that gap – the deficit – is so large (at £90.2 billion) that it's equivalent to the budgets of the Ministry of Justice, the Ministry of Defence, Department for Education, MI5, MI6 and GCHQ combined.

Just to clarify, this is departmental budgets only – because spending is spread around a bit, this isn't the same as the bill for the entire defence or education system. Though on that score, the deficit is still as large as everything we're spending on defence plus transport plus half of what we spend on public order – or, more simply, to two thirds of the NHS budget.

There are two basic ways to close the deficit: by raising taxes, or cutting spending.

The Tories have promised to eliminate the deficit by 2017–18. But they've also now promised to freeze the three taxes that make up the bulk of the government's revenues.

That means that if they get back into power, George Osborne is going to have to cut like mad.

The Office for Budget Responsibility, the government's financial watchdog, estimates that he will need to take £51.2 billion out of the budget by 2018–19. The Financial Times has come up with this nifty game to show how hard that's going to be. (Also, if the government is legally banned from raising taxes, and the economy doesn't do well as it's hoping, its only option will be to cut even more deeply.)

But there's another problem. The Tories have already promised to protect certain budgets, or even increase them.

For example, the NHS is fine – in fact, it's getting £8 billion a year above inflation. (Although that may not be enough to keep pace with the increasing number of elderly patients...) The schools budget is protected, as are overseas aid and the state pension – the "triple lock" means the state pension goes up by the highest of inflation, earnings, or a base rate of 2.5%.

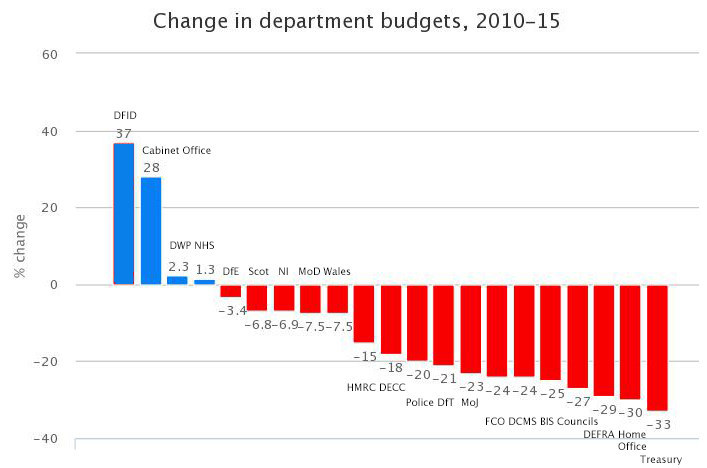

That means the cuts are going to have to come mostly from the budgets of the departments that aren't lucky enough to be protected – which have already been cut pretty heavily since 2010.

This chart shows what's happened over the past five years – a vast increase in spending on overseas aid and the Cabinet Office, benefits and the NHS holding steady, and the rest getting walloped to a greater or lesser extent.

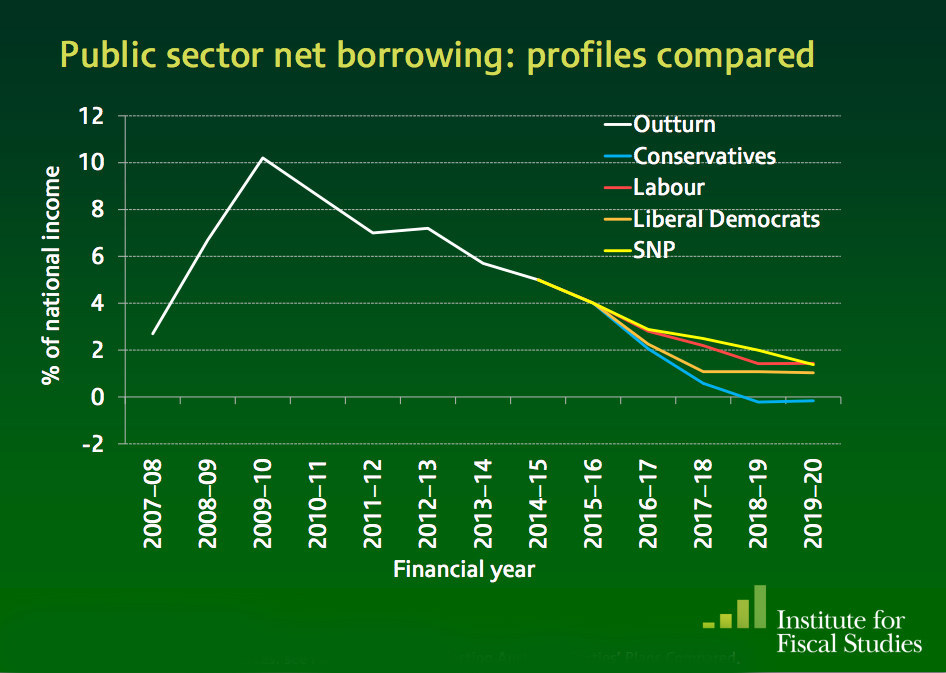

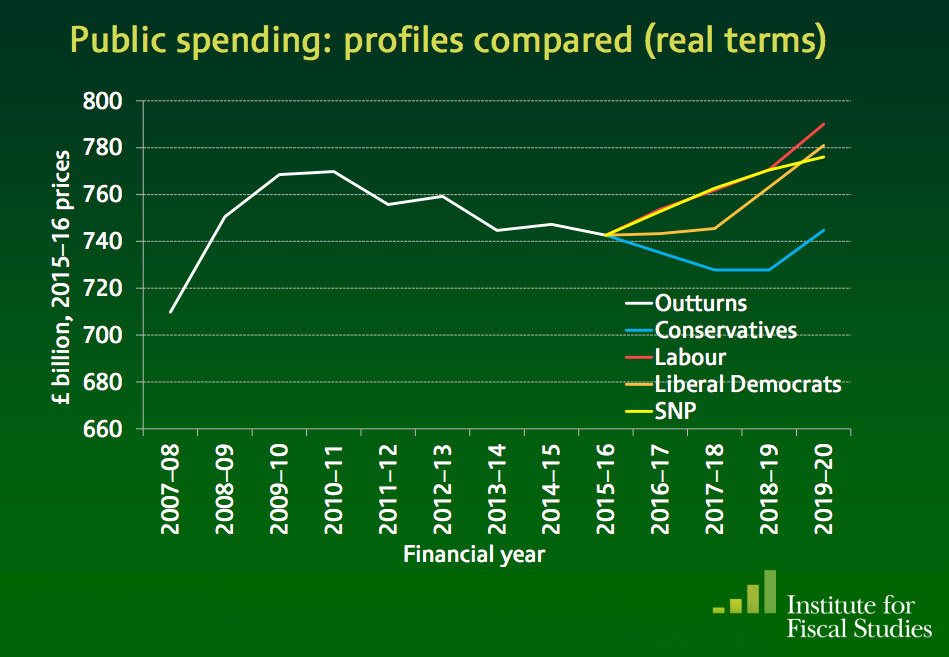

All this means that the election next week offers the country a pretty massive choice.

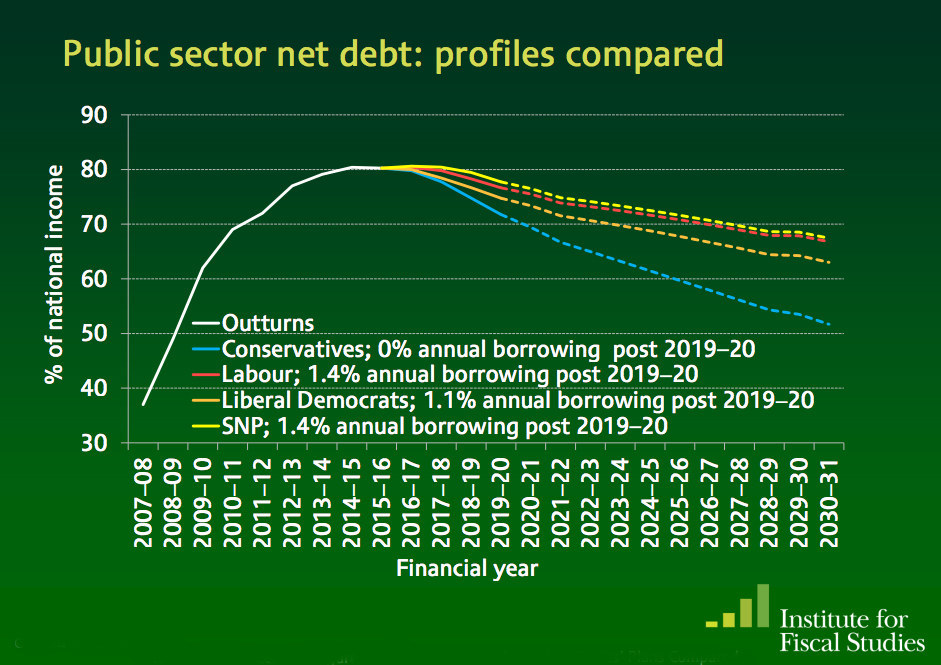

The Tories would borrow a hell of a lot less.

And Labour would spend a hell of a lot more.

As well as raising taxes by about £12.2 billion, mostly on the rich.

So after five years, the country would look fundamentally different.

For example, spending on benefits would be about £20 billion lower under the Tories.

As would spending on pretty much everything else apart from the stuff that's been ring-fenced.

But then, the national debt would be much, much lower as well.

Which is why anyone who tells you it isn't worth voting is, frankly, a bit of an idiot.

Because when we decide who we want to be prime minister, we're also choosing how much tax and spending we want – or need.

And if we don't like the answer, we'll have no one to blame but ourselves.

This post was updated to reflect the fact that the deficit figures related to departmental budgets rather than the entire cost of the various things being discussed.