Hollywood typically reserves the summer months to roll out its big-budget action films and earnest dramas. Between now and Labor Day, however, the most compelling theater can be found in Houston, not Hollywood.

Off-the-rack suit retailer Men's Wearhouse was founded in the decidedly unglamorous strip-mall and block-building city. And right now the custodians of the company are in a bitter divorce. On the one side is George Zimmer, the founder of Men's Wearhouse and face of the brand, who was unceremoniously fired as executive chairman last week. On the other side are the people who carried out the firing, namely the company's board of directors, including Doug Ewert, who Zimmer handpicked to succeed him as chief executive after roughly two decades of working together.

Though this particular corporate drama is only in Act I, not unlike Titanic, the fact that it isn't going to end well is obvious.

How could it not, when the board already took the unprecedented step of releasing a statement that essentially called Zimmer a baby and told him to screw off?

"Our actions were not taken to hurt George Zimmer," read a statement from the board explaining its rationale for ousting the Men's Wearhouse founder from his executive chairman role. A less diplomatic way to put that is that the board is saying it thinks Zimmer is being a whiny bitch because he can't accept not being in control of the company anymore.

Later, the statement goes on to say: "As we stated, we fully support Doug Ewert, our CEO, and senior management team who are unified and focused on the future of the company and the best interest of our shareholders, employees and customers."

Translation: You go away now, Mr. Zimmer — we don't really need your services anymore.

While that's a pretty powerful way to close Act I, in its zeal to justify firing Zimmer, the Men's Wearhouse board left open a huge door for the beloved founder to walk through to begin Act II, where the fade in is likely to start in a matter of weeks, if not days.

The board noted, somewhat foolishly, that Zimmer was "arguing for a sale of the Men's Wearhouse to an investment group," which it felt would threaten the company's culture, require taking on too much debt and was, therefore, not in the best interest of shareholders.

But even those with a rudimentary knowledge of Wall Street know that its first rule is that nothing is for sale until it is. With that one simple line, as Bloomberg noted in a report Thursday, the board basically put Men's Wearhouse in play. Put another way, the company may not have been for sale last week, but it almost certainly is now.

Zimmer is not only the Men's Wearhouse founder, but also a large individual shareholder with a personal stake of 3.5% in the company. He knows its finances, culture, and operations as well as if not better than anyone else. That makes Zimmer an ideal candidate to team up with private equity or hedge funds, who have billions of dollars under management that they need to put to work, and make an offer to buy the company.

Here's where things are bound to get messy. In his own statement on the situation, Zimmer readily admits that he wanted the board to "study" a range of possibilities, including taking it private through a buyout offer, but that they refused to even consider the idea.

"Such behavior by the Board does not strike me as consistent with sound principles of good corporate governance or the core values of The Men's Wearhouse, but instead suggests that the directors were more concerned with protecting their entrenched views and positions than considering the full range of possibilities that might benefit our shareholders and indeed all our stakeholders," Zimmer wrote.

Loosely translated, what Zimmer is saying is that should the board get a buyout offer, it is their fiduciary duty to not only consider it, but also accept it if it proves to be the best means of increasing shareholder value. Couple that with the fact that, as a public company, there is nothing to prevent a private equity or competing retailer from lobbing in a bid to acquire the company, and you have the makings of a buyout situation.

Indeed, the Bloomberg report quoted analysts from JP Morgan and Sentinel Investments estimating that Men's Wearhouse could get $50 per share in a deal, or about $12 more than its current roughly $38 per share stock price.

Just as Zimmer guarantees customers will like the way they look in Men's Wearhouse suits, it would be shocking if Act II in this drama does not end with him teaming up with a private equity firm and making an offer to buy the company.

Based on the unprecedented aggressiveness displayed by both sides already, logic would dictate that the Act III climax to this drama will be as bloody as the ending of a Quentin Tarantino film.

The Men's Wearhouse board says it has a strategic plan to maximize shareholder value and is opposed to a deal, so there's little chance they will attempt to negotiate one on a friendly basis. And while Zimmer said he hasn't yet decided if he plans to pursue taking the company private, that is just diplomatic lip service. He is not going to swap his beloved suits and the company he built for a velvet tracksuit and retirement.

So that means the interaction between the Men's Wearhouse board and Zimmer is likely to become more hostile than it is already. According to a Reuters report, tensions between the two sides began as far back as six months ago over such things as strategy and executive compensation.

Here's how the end sequence will probably play out: Zimmer will most likely team up with a private equity firm and make an offer that the Men's Wearhouse board will almost certainly reject. He will then raise the offer slightly and the board will reject that overture. Then he will ask to engage in negotiations. That, too, will be rejected by the board. After having his best efforts rebuffed by the board, Zimmer will take his offer directly to Men's Wearhouse shareholders and wage a proxy battle. He will ask current shareholders to support his bid to take the company private by selling their stock to him, which would thus increase his ownership position and, by extension, power over the direction of the company.

The Men's Wearhouse board will counter that the stock price is up since Doug Ewert, the current chief executive, took over. They will say that going private will limit the company's options and saddle it with debt. They will paint Zimmer as a founder unable to recede from the spotlight and out of touch with the next generation of Men's Wearhouse customers. To be sure, as BuzzFeed first noted, even before Zimmer's firing, the company was evaluating the 64-year-old's effectiveness as a pitchman to millennials.

While this is going on, activist investors like Carl Icahn are likely to buy into Men's Wearhouse stock and start advocating for change. Not necessarily a deal, per se, but change. Maybe they will advocate for an increased quarterly dividend or larger share buyback. Or they might campaign for seats on the board. Or some other concession that will help make them a quick buck before they go away.

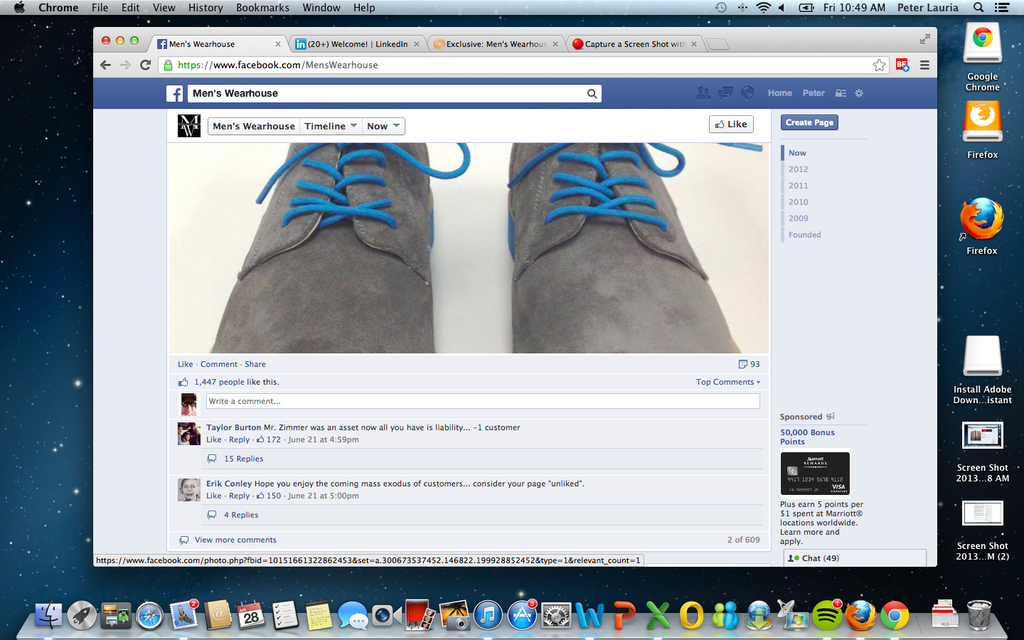

In terms of public perception, Zimmer has the advantage. As the founder and longtime face of the company, he is both recognized and beloved by customers and employees alike. Reuters quoted one Men's Wearhouse store manager as saying that Zimmer "made us feel like family" and that firing him "is ridiculous." The Men's Wearhouse Facebook page is lousy with comments supporting Zimmer as well. (See screenshot below.)

Optically, at least, the Men's Wearhouse board doesn't look nearly as good. While they may indeed have solid business and cultural arguments for ousting Zimmer, to the company's customers and the public, they look like a group of former friends — Reuters notes that he has known many of the board members for decades — who turned on their buddy.

This will, of course, all play out in the press. And in terms of corporate drama, it is going to be spectacular.