The political world looked on in bemusement last weekend as Rafalca, a horse co-owned by the Romney family, qualified to compete in the dressage event at the upcoming London Summer Olympics.

Dressage is an obscure equestrian discipline whose participants spend painstaking years training their horses to perform balletic routines with little noticeable encouragement from the rider. As the New York Times reported, that sort of thing costs a pretty penny:

The Romneys declared a loss of $77,000 on their 2010 tax returns for the share in the care and feeding of Rafalca, which Mrs. Romney owns with Mr. Ebeling’s wife, Amy, and a family friend, Beth Meyers.

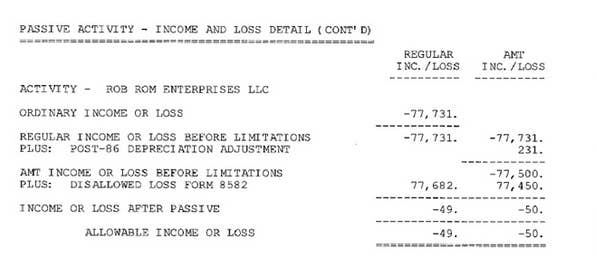

That's actually a rounded down number; in fact, the passive investment loss that the Romneys reported on "Rob Rom Enterprises LLC," the limited liability company that owns Rafalca and pays for the horse's expenses, was closer to $78,000.

The New York Times report led Matt Yglesias and some others to conclude, mistakenly, that the Romneys had taken a tax deduction for the full amount of their loss. That's not actually true.

When taxpayers report a loss, they aren't always able to take a deduction for it. The Romney's 2010 tax return (above) shows that the lion's share of the $77,731 "Rob Rom Enterprises" loss was, in the parlance of the tax code, "disallowed." That is, it wasn't eligible for a deduction in the 2010 tax year. The Romneys' actual "allowable loss"--the part that could be used for a deduction that year--was $50 (only 0.06% of the total declared loss).

The Romneys' return doesn't spell out exactly why their Rafalca loss was disallowed, but there is one likely explanation: The tax code doesn't typically allow the taxpayer to take general deductions for expenses on activities that the taxpayer doesn't undertake for a profit; these are called "hobby losses" and they can usually only be used to offset any incidental income the taxpayer gets from the same activity.

For example, if your sister--who, say, pilots fighter jets for a living--sells one of the watercolors she paints in her spare time, she could then deduct the cost of the paper and the pigments, but only up to the amount that she sold the artwork for. If the Romneys are treating their Rafalca expenses as hobby losses, their tax return is indicating that they lost nearly $78,000 caring for the horse and got only about $50 back as income.

But there's a twist: the tax code lets you carry disallowed hobby losses forward to offset hobby income in future years. Now that the Romneys' horse is an Olympian, her owners could presumably be paid quite handsomely for her foals. Consequently, Mitt and Ann may soon have some income that they actually can use that nearly $78,000 loss to offset--i.e. finally getting the tax deduction that they're taking the heat for today.

A tax deduction, much like a dressage horse, often takes years of careful cultivation.

CORRECTION: An earlier version of this piece incorrectly referred to Rafalca as a stallion; she is a mare.