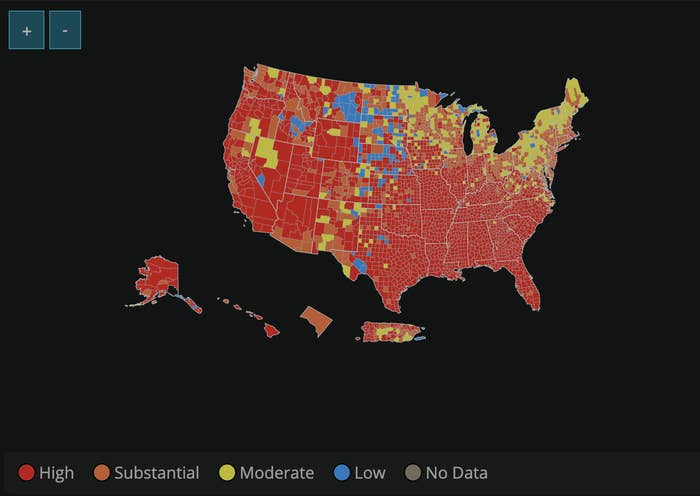

On Tuesday evening, the Centers for Disease Control and Prevention issued a new temporary ban on evictions in areas with "substantial" and "high" spread of COVID-19. According to CNN, the ban will cover 80% of US counties and 90% of the population.

To find answers to some big questions about what this new eviction moratorium means to renters, I reached out to Natalie Campisi, mortgage and housing analyst with Forbes Advisor. Here's what she had to say.

1. How can you tell if you're covered under the new moratorium?

2. If you're a renter who needs to take advantage of the new ban, what do you need to do?

Campisi says it's best to notify your landlord ASAP and make sure that you have a digital or paper trail for your records, just in case. "No proof of hardship is necessary; renters must simply write a letter to their landlord letting them know they have been affected financially by COVID, can’t pay rent, and need to use the eviction moratorium protection. Most housing advocates advise renters to send the letter electronically, so there’s proof that it was sent. Renters can check the CDC website for the list of requirements." Requirements include making your best efforts to get pandemic renter's assistance (more on that in a sec), and your income must be no more than $99,000 in 2020 if filing single.

3. Since the ban is based on COVID cases, could the area it covers expand if cases rise in places that are not currently covered?

4. There's still billions in pandemic renters' aid money available. Who's eligible to get it, and what should you do if you are?

You could be eligible for up to 18 months of current and back rent. "Emergency rental assistance has a short list of requirements, which you can check on the Treasury Department’s website or your local housing authority." Requirements include some income limits, but if you experienced job loss or financial hardship due to the pandemic, you may qualify. You can apply for aid through a program near you. "To find the local emergency rental assistance program in your area, check the US Department of Housing and Urban Development’s (HUD) website." Though local and state governments have been slow to distribute these funds, you should still apply for them ASAP if you qualify. Distribution did pick up in June, and as lawmakers put pressure on states, it's hoped that they'll speed up the process to avoid a mass eviction crisis.

5. Is there anything that renters who are covered by the new moratorium should keep in mind?

6. What about people who were evicted during the days between the end of the old moratorium and the start of this new one?

For several days, there was no eviction moratorium in place, and in many states evictions have sadly already taken place. "For people who feel they have been wrongfully evicted, they can sue their landlord — in this case, they can consult legal aid. But for their immediate housing needs, or for those who were evicted during the brief window of when the previous ban ended and the new ban started, their best course of action is to talk with a local housing counselor to determine the options available to them in their area. If they were given an eviction notice, but not yet evicted, they should talk to a lawyer (there are free legal services for those who qualify) about their rights."

7. And how will this new moratorium affect small landlords who rely on rent as income?

Finally, if traditional personal finance advice and suggestions feel inadequate for you in your current situation, they probably are. We're living with massive inequality, which has only widened during the pandemic, and many people are facing situations right now that no amount of budgeting will immediately alleviate.

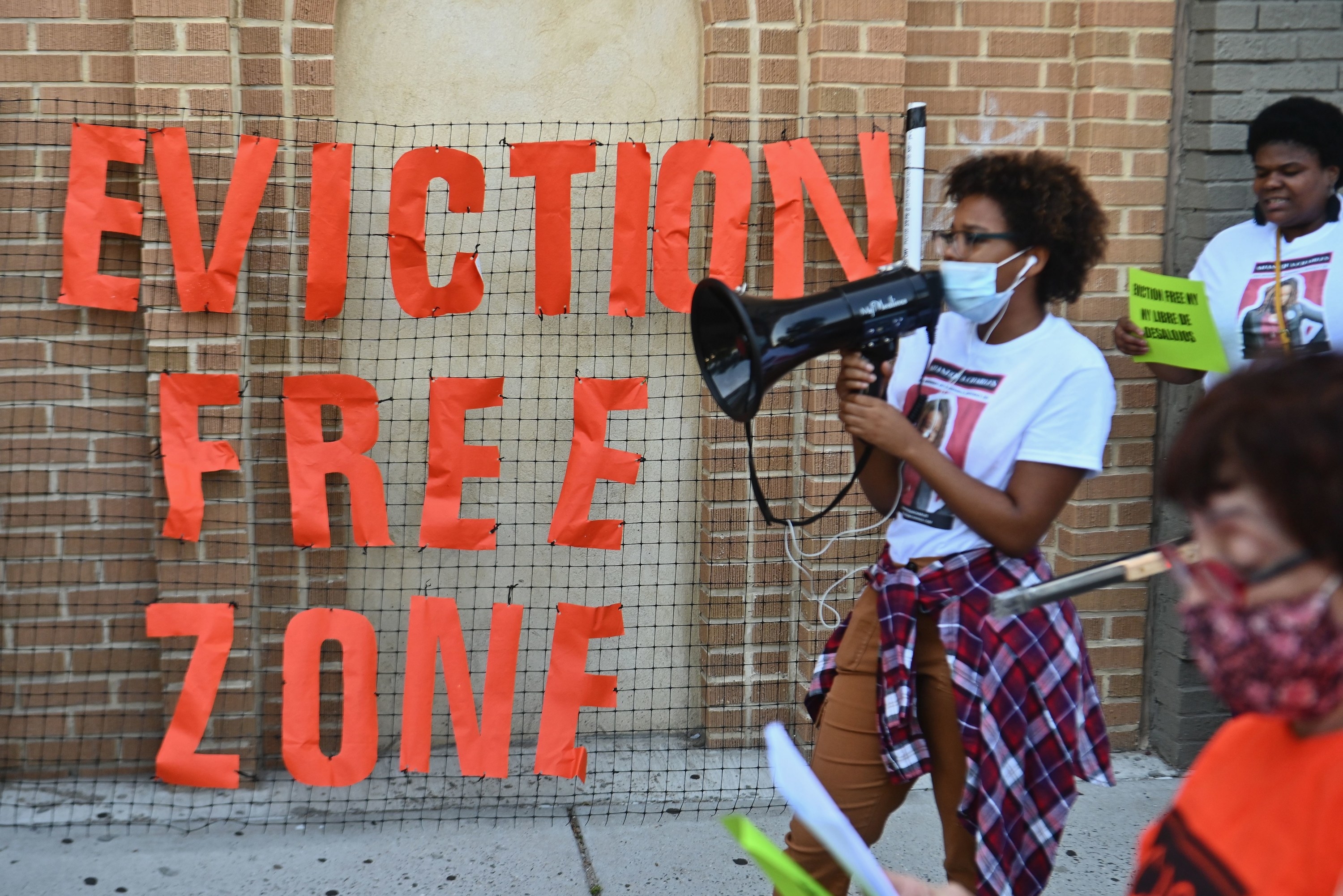

Personal finance advice is focused on individual choices, but there are systemic issues with housing in the US that need to be addressed on a broad level. Even if these issues aren't affecting you directly, it's helpful to learn more about them and make your voice heard in any way that's accessible to you, whether that's through your vote, contacting your representatives, or a nonviolent demonstration about the right to safe and affordable housing. In the US, we are dealing with affordable housing shortages and the pandemic-related rent crisis on an individual level, but it's not really an individual problem. It affects all of us.