I'd like to think that what I see on my social media feeds doesn't really have that much influence over the way I live my life. But I have to admit, sometimes a casual scroll through Instagram or TikTok can be a slippery slope to an impulse-shopping spending spree — especially when I'm not feeling my best.

Recently, spending coach and host of The Money Love podcast Paige Pritchard (@overcoming_overspending) shared a TikTok highlighting the four themes she sees on TikTok and other social platforms that encourage us to spend, spend, spend, and she really nailed it.

Paige starts the video, saying, "Let's talk about the way that TikTok has skewed our view of what normal and average consumption habits look like." Then, she gets into four major themes on TikTok and other platforms that can make viewers feel the need to overspend:

1. First, Paige talks about how social media often emphasizes finding the best, newest, biggest, and shiniest version of the thing you want — but chasing after "holy grail" products can lead to overspending, clutter, and not really using or enjoying what you already have.

2. Next, she calls out how social media tends to place more importance on instant gratification than on thinking about the longterm.

3. Another big theme she's noticed is the idea of completeness being the best way to buy. Think: when influencers buy an entire skincare line, a whole new wardrobe for spring, or completely decorate their new place immediately after moving in.

4. Finally, she says that one of social media's most dangerous messages around shopping is the idea that more is more, and having more will always make us happier.

In the comments, people are calling out some of the specific ways they see these themes in action, such as people buying a whole book series before even reading the first volume.

Or, getting the same item in every color just to have the whole set.

People also shared some strategies that have helped them stop overspending, like unfollowing accounts that make them feel like they need to buy, buy, buy.

Or, adding the things they want to lists that allow them to prioritize and budget for their purchases.

According to Lindsay Bryan-Podvin, certified financial therapist (CFT-I) and partner to MetLife’s financial wellness app, Upwise, social media has been having a growing influence on the way we spend. And its bright and shiny world of influencers and filtered images often leads us to engage in something called "aspirational spending."

Lindsay explains, "Aspirational spending is buying something, hoping that the item purchased will lead to a behavior change. Think, 'If I buy that Stanley tumbler, I’ll be a person who stays hydrated all day,' or 'if I get a knitting kit, I’ll be the type of person who knits my own winter gear.' Instead, try doing that thing — e.g., drinking water or knitting — for a period, and then if you still have the financial means and desire to purchase the item, go for it!"

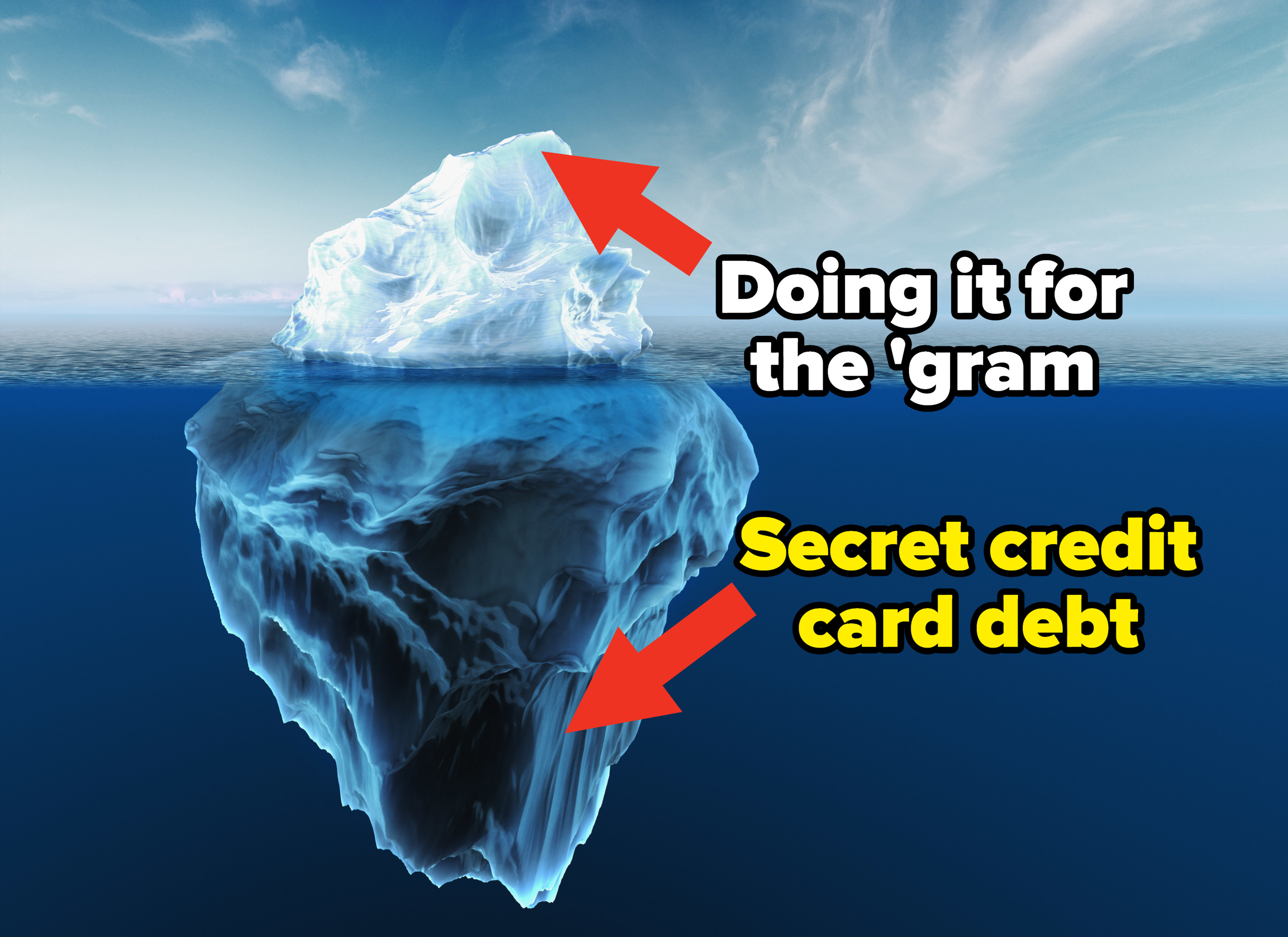

Lindsay also pointed out that the shopping haul videos we see on TikTok may not be telling us the whole story. "It can be helpful to remember that many TikTok users claiming to be able to furnish entire rooms are doing it for the app. They might buy everything, film, and head right back to the store to return those items. Or, they could be putting it on a high-interest credit card! We really don’t know!"

And she shared one way she helps her clients when they start comparing their lives to what they see on social media. "I like to use the phrase, 'curate your critics,' when this type of ‘comparisonitis’ kicks in. I encourage my clients to ask themselves whether the random TikToker deserves to be in their minds critiquing them about their wardrobe or apartment styling. The answer generally is 'no.'"

She also suggests looking for different ways to fulfill our needs besides spending. "If we take a pause to recognize what it is we’re spending for, nine times out of 10, we can find an option (other than spending) to address that objective or emotion." Like, for me, sometimes I get the urge to splurge and just go to the library instead. I get to take new books home and don't have to spend money, so it's a win/win.

As for Paige, she told BuzzFeed that her own experiences as a recovered overspender inspired her to become a spending coach. "In 2011, when I graduated from college, I started working my first corporate job making $60,000 a year. My intention that year was to save and pay off a big portion of my $40,000 of student loans, but I ended up impulse shopping my way through that salary."

"After barely being able to afford to move out of my parents’ house at the end of that year, I reached my breaking point and realized my spending habits were not healthy or sustainable. I started tracking my spending and living on a budget, and by being dedicated to developing a healthier relationship with money and forming healthier spending habits, I was able to pay off my student loans, cash flow an MBA, buy a home, and build a multiple six figure investment portfolio by age 29."

Paige also shared that overspending can hurt way more than just our wallets. It often has an unseen impact on our emotions as well. "Overspending and overconsumption have a tremendous impact on our emotional well-being. Ultimately, when we search for solutions to our internal problems with external products and services, we will always fall short. Consumer culture sells us the lie that 'more is better,' so many of us positively correlate how much we spend and accumulate to how happy we will be."

And she offered some tips for anyone who wants to curb their spending. First, she suggests taking note of the situations that spur you to shop and then making new rules for yourself, giving this as an example: "I used to do a lot of shopping on my phone after having some wine, so I put a boundary around my shopping that I don’t buy anything on my phone and no purchases if I’ve consumed any alcohol."

Paige also loves the idea of putting items you want to buy on a list. "This list is effective because A) it gives you a dopamine hit by adding the item to the list because dopamine gets released in the anticipation of a purchase. And B) it gives your brain time to 'cool off' and gives you time to evaluate if you really want something."

She also recommends using a timer to wait out those moments when you get hit with the urge to splurge. "When you get a strong urge to spend money and go shopping, that urge will last on average seven to 10 minutes. Set a 10-minute timer on your phone and breathe through the urge."