We hope you love the products and services we recommend! All of them were independently selected by our editors. Just so you know, BuzzFeed may collect a share of sales or other compensation from the links on this page. Oh, and FYI, prices and rates are accurate as of time of publication.

When it comes to money management, I like to use lots of different apps that make things a little easier for me. I've got budget apps, investing apps, rewards apps, saving apps, apps for banking and education...the list goes on and on. But there's a big trend that I've been noticing in all of my finance apps recently: They feel more and more like games.

Once I noticed the gamification in my finance apps, I started to pick up on it everywhere. And I had a lot of questions, like what happens in our brains when we're playing these kinds of games and whether games can actually help us build healthy money management habits.

For starters, "Gamification basically means using game-like features to achieve certain goals, such as creating challenges and competitions and giving rewards, bonuses, and things of that nature," says Jordan van Rijn, Senior Economist at the Credit Union National Association (CUNA) and Associate Lecturer at the University of Wisconsin-Madison.

And when we play games (or use finance apps with game-like features), some really interesting things happen in our brains that make us feel good and help us focus. "There are many mental biases working against us when we try to learn something new, especially if it's a potentially boring or intimidating topic," Jordan said.

But let's get back to the idea of flow, because this is a big part of why gamification can be helpful. If you have a hobby that you love, you've probably noticed that sometimes you get into "the zone" when you're doing this activity. You get super focused on the task at hand (but in a really fun way) and can easily lose track of time.

Being in "flow" feels really, really good, and the dopamine that we get from playing games helps to bring us into this state. So when we use apps that apply game-like features to our finances, they can actually help us overcome negative feelings like anxiety or being overwhelmed that we might normally associate with money management by nudging us into flow.

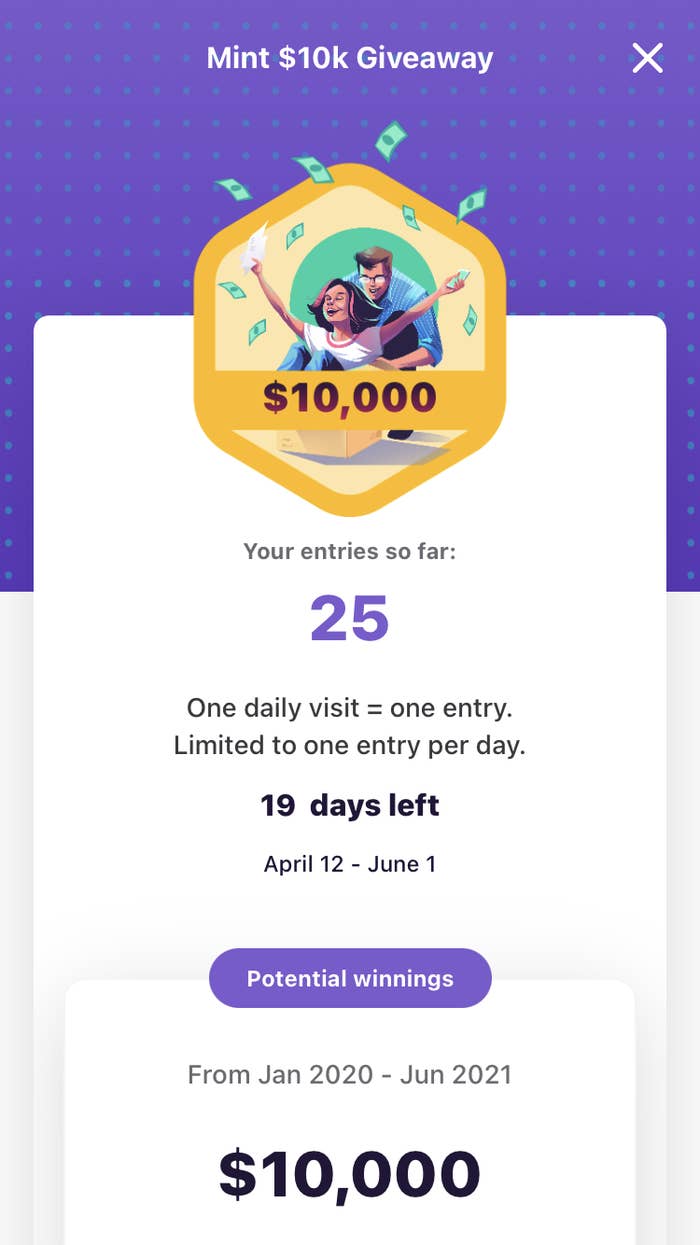

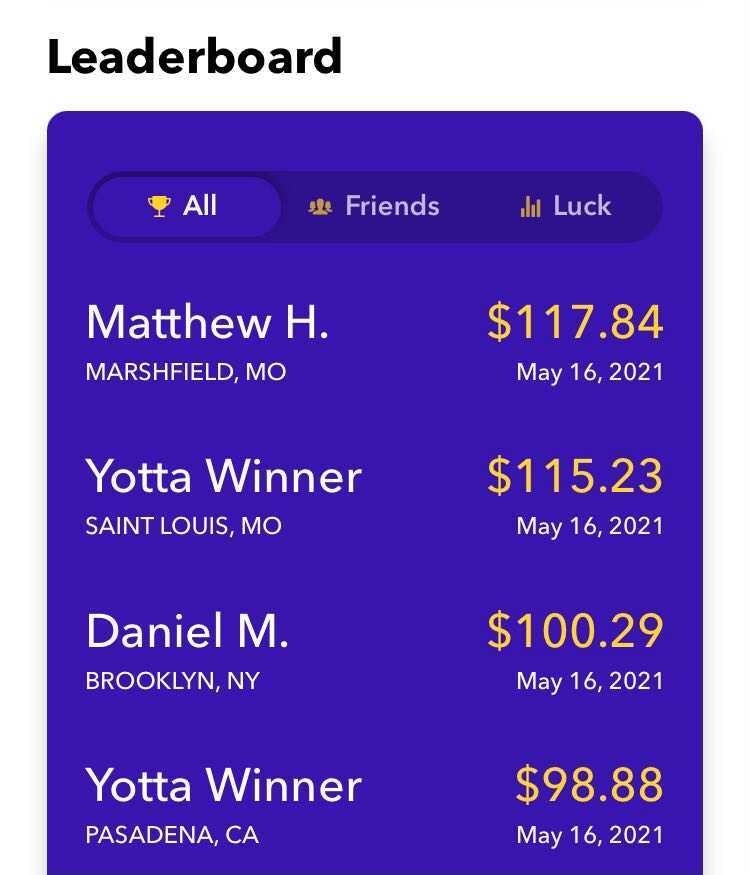

Prize-linked savings accounts, like Save to Win and Yotta, that enter users in weekly lottery drawings for cash prizes are a great example of a financial service using gamification to encourage healthy money habits. The more you save in these accounts, the more chances you have to win a big chunk of cash. And unlike playing the regular lottery, you still have the money you "paid" for your tickets in your savings account, so you can't really lose.

But gamification can be a double-edged sword. Because it's fun getting into flow, you could actually find yourself spending a bit too much time playing games and engaging with these apps.

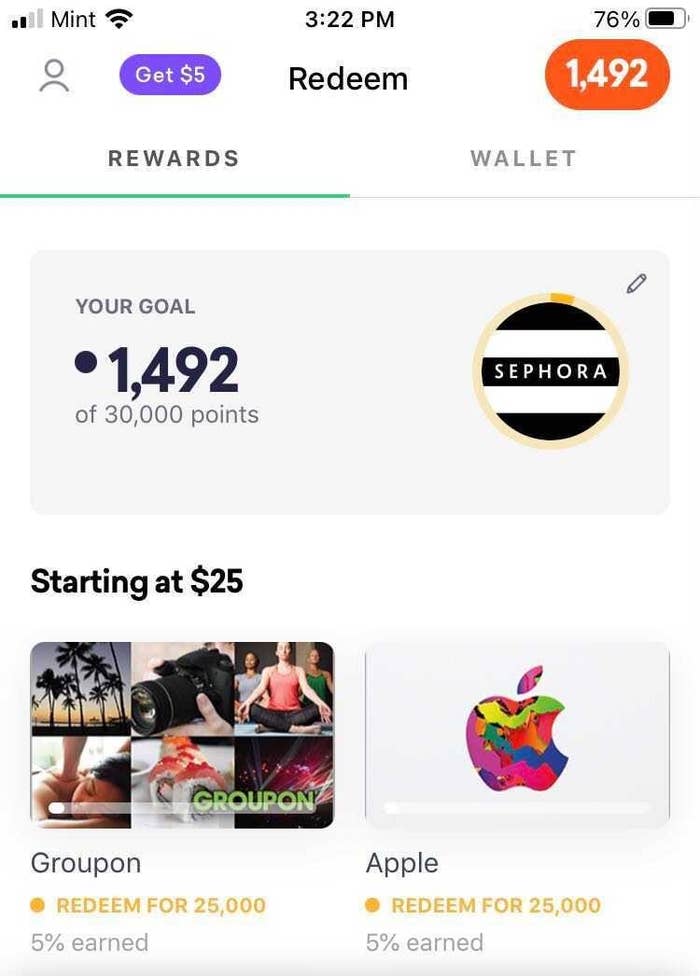

Another important thing to remember is that these apps can offer broad financial education or help you target a particular habit, but they aren't very personalized. So you might spend a lot of time earning points and getting rewards without really making progress on your individual goals.

Dan also cautions to be wary of apps that gamify investing. "The platforms that gamify investing are trying to make money for themselves, not you, so the rewards are not necessarily optimized around you growing your money."

You can also gamify your money IRL by setting goals, tracking them with family and friends, and treating yourself when you reach milestones along the way.

And if games appeal to you, there are other easy things you can do to help yourself stay on track with your money, like setting up automatic savings deposits and contributing to retirement accounts like an IRA or 401(k).

At the end of the day, games can be a great way to get motivated to tackle your finances, but you should probably make sure you're using other strategies too.

Do you use any game-like apps to manage your money or learn about personal finance? Tell us about them in the comments below.

And for more money tips and tricks, check out the rest of our personal finance posts.