UPDATE

The Federal Reserve decided to hike the federal funds rate up by about 0.25 percentage points to between 1% and 1.25%. Read more here.

The Federal Reserve will in all likelihood decide to pump the brakes on economic activity by raising interest rates on Wednesday afternoon — irking some left wing activists and economists but not, surprisingly, President Trump.

Economists surveyed by Bloomberg News expected the Fed to hike interest rates at least twice more this year, including at this week's meeting and then in September. The Fed kicked off its rate hiking in December 2015 and didn't raise rates again before hiking them in December 2016 and March. Unemployment is now at 4.3%.

“If the economy performs about as expected, I would view it as appropriate to continue to gradually raise rates,” said James Powell, a member of the Fed's Board of Governors and a member of the committee that determines interest rates, in a speech earlier this month.

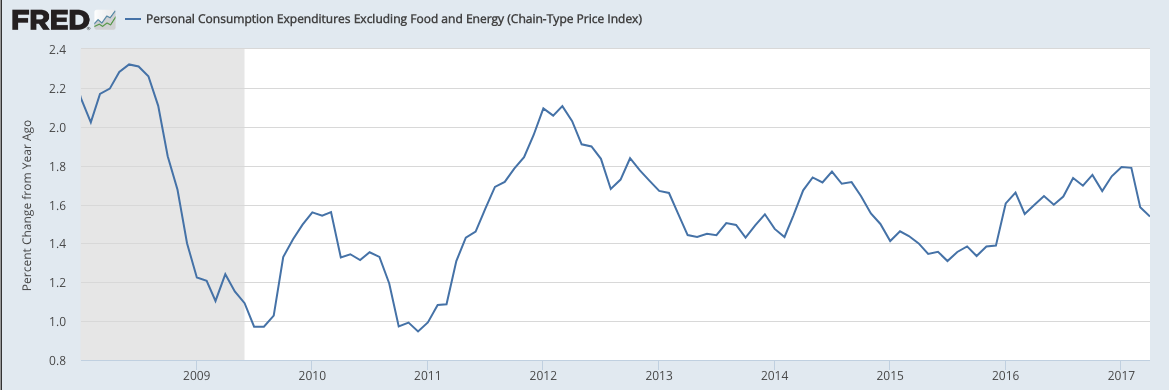

While inflation has remained low almost continually since 2008, Powell said, "there are good reasons to expect that inflation will resume its gradual rise... Incoming spending data have been relatively strong, and the labor market should continue to tighten, exerting some upward pressure on wages and prices."

Others disagree. "Now is not the time to raise rates," said Shawn Sebastian, the codirector of the Fed Up campaign, a coalition of community groups under the aegis of the Center for Popular Democracy, a progressive advocacy group. "The Fed feels the economy is good enough, that unemployment is low enough, and we have enough jobs, and our wages are good enough. We think that’s absolutely false."

The advocacy group is using a mix of political organizing tactics to attempt to influence the Fed, an institution that is typically the domain of financiers and academic economists. This has included protests in Philadelphia, New York, and DC; a plan to place op-eds in local newspapers; and a letter from a range of centrist, liberal, and more left-wing economists, including the chief White House economist Jason Fruman, the Nobel Prize-winning economist Joe Stiglitz, former Vice President Biden economic adviser Jared Bernstein, and former Minneapolis Federal Reserve President Narayana Kocherlakota, calling on the Fed to rethink its 2% inflation target.

"The Federal Reserve makes the most important decisions about our jobs and wages and our ability to make ends meet in the country," Sebastian told BuzzFeed News.

The Fed will likely justify another rate hike by expressing concern about inflation going over 2% with unemployment at its lowest level since before the financial crisis.

"The economy is now close to full employment and price stability," Powell said in his June speech. "We are making good progress toward reaching our full-employment objective," the Dallas Fed President Robert Kaplan said in a May speech. He also noted that continued low rates can impose "a cost ... in terms of limiting returns to savers, as well as creating distortions and imbalances in investing, hiring and other business decisions."

Inflation has mostly stayed below the Fed's 2% target.

There is evidence, however, that despite the low headline unemployment number, there is still a pool of people who were previously not even looking for work (and so were not counted as "unemployed") beginning to enter the labor force. Wage growth has been especially sluggish in what looks like, at least on the surface, like a very tight labor market.

Sebastian said there is also widely disparate labor markets for African-Americans and Latinos: The overall unemployment rate today is 4.3%, while it's 7.5% for African-Americans and 5.2% for Hispanic or Latino people. "Black and Latino communities face levels of employment that would be crisis levels if whites faced them," he said.

"Officials will portray the moves as necessary to 'normalize' monetary policy," former Minneapolis Federal Reserve President Kocherlakota wrote in Bloomberg View Tuesday. "[But] all Americans — especially black Americans — remain needlessly exposed to excessive economic risk." Kocherlakota signed the Fed Up letter on the 2% inflation target.

The Fed's agenda of hiking interest rates to curb inflation at low levels of unemployment has escaped critique or analysis from President Trump, who has been willing to expound publicly on many other topics that have generally been considered off-limits for presidents.

While staying mum on monetary policy decisions is in keeping with traditions of Federal Reserve independence, it is remarkable considering how frequently Trump trumpets job creation, the low unemployment rate, and growth in the stock market, all of which can be affected by Fed policy.

During his campaign, Trump was all over the place on the Fed, criticizing Chair Janet Yellen for keeping interest rates low to help out Hillary Clinton's campaign, while also calling himself a "low-interest rate person." Gary Cohn, the head of the National Economic Council, "has emphasized to colleagues in the administration the importance to markets of not publicly second-guessing monetary-policy decisions," the Wall Street Journal reported.

"There is no framework, no intellectual infrastructure" in the Trump White House, Peter Morici, a conservative University of Maryland economist, told BuzzFeed News. Its pick for chief economic adviser has yet to be confirmed by the president and its National Economic Council chief is the former president of Goldman Sachs. The president does have an opportunity to put his stamp on the Fed, which has two open spots on its Board of Governors.

"It's going to be telling to see whether or not Trump is committed to jobs," Sebastian said.