JPMorgan did two things this morning that were unprecedented: it recored a quarterly loss for the first time in the Jamie Dimon era and fully disclosed the size of their litigation reserves.

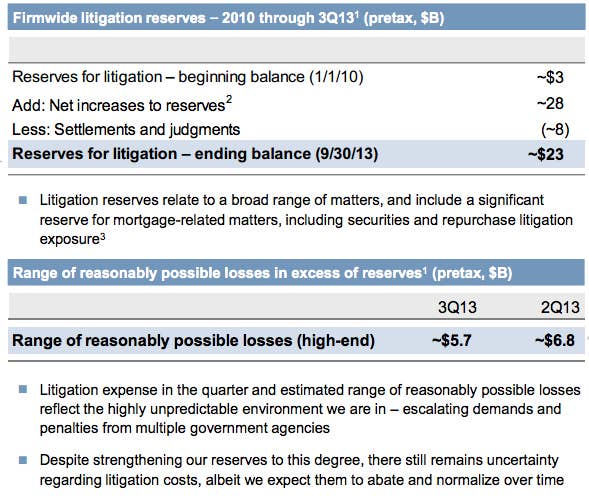

Thanks to a $9.2 billion pretax charge for legal costs, the bank ended up losing $380 million despite generating almost $30 billion in revenue. And the extra information they disclosed was uglier still: starting in the beginning of 2010, the bank had set aside $3 billion to pay for litigation and that total is now up to $23 billion

Since 2010, JPMorgan had paid out about $8 billion in settlements with private litigants and judgments with regulators and added an additional $20 billion to its reserves. This is money JPMorgan could have been spent shoring up its capital base to make the bank more resilient to large losses, paying employees, investing back in the business or distributing to shareholders.

And that's not the entire cost for legal issues. Every quarter, JPMorgan discloses how much its "resonably possible" litigation losses in excess of what it's already set aside. Last quarter it was $6.8 billion and this quarter its $5.7 billion. In a conference call with regulators, JPMorgan's chief financial officer Marianne Lake said the bank "didn't anticipate the environment being as volatile and escalating to the point that has now."

The bank paid more than $1 billion to settle with five different regulators on both its losses from the "London Whale" derivatives trades and abusive credit card practices just on September 19 alone. Right now, the bank is tied up in negotiations with the Justice Department over charges related to JPMorgan, Washington Mutual and Bear Stearns's sale of mortgage-backed securities before the financial crisis. JPMorgan acquired Washington Mutual and Bear Stearns in 2008.

Just this quarter, the $9.2 billion pretax charge, or $7.2 billion after-tax was more than JPMorgan spent on paying its employees this quarter ($7.3 billion), or equipment and technology ($1.4 billion), or rent ($950 million).

So who wins from JPMorgan spending all this time and money dealing with investigations into its mortgage-backed securities business, possibly obstructing regulators who investigated its energy trading practices, potential nepotism in China, its dealings with Bernie Madoff, alleged manipulation of a derivatives index, and role in the LIBOR price-fixing scandal? Lawyers, lawyers and compliance staff.

Internal compliance employees

In its earnings, JPMorgan described internal controls, basically ensuring the huge, sprawling bank is able to comply with the law and regulations, as its "number one priority." JPMorgan is reducing its overall headcount by over 15,000, but is adding around 5,000 internal compliance and control staff and has increased its spending on controls by about $1 billion just this year. The bank said that it has "significant resources committed to addressing control and regulatory agendas." In a conference call with analysts, Dimon said that this was a "permanent investment" and that "costs are not going away, I think it's important to get this exactly right."

Outside lawyers

That $20 billion JPMorgan has set aside — and the $9 billion it spent this quarter — wasn't just for paying fines, but for paying the legions of outside lawyers to deal with lawsuits, internal investigations, and negotiations with regulators. And the big winners there are the white-shoe law firms JPMorgan brings in to help out its massive internal legal team. This includes Wilmer Hale, who JPMorgan brought in to do an internal investigation into its massive derivatives trading losses — the "London Whale." The board also separately hired Shearman & Sterling partner Linda Rappaport to advise on the internal investigation.

One of the biggest beneficiaries from JPMorgan's legal difficulties is the omnipresent Wall Street firm Sullivan & Cromwell. The firm's senior chairman, H. Rodgin Cohen, accompanied Jamie Dimon during his meeting with Attorney General Eric Holder and another Sullivan & Cromwell partner, Daryl Libow, in an unsuccessful shareholder suit against the bank tied to the London Whale losses.

When the Federal Housing Finance Agency, the regulator that oversees Fannie Mae and Freddie Mac, sued JPMorgan and 17 other homelenders in 2009 for allegedly misrepresenting mortgage-backed securities it sold to Fannie and Freddie, 11 Sullivan & Cromwell attorneys from two different offices were listed on the docket.