Facebook knows a lot about young people — information it gathers and analyzes to shape its product and to let advertisers know who they can reach. On Monday, the company is sharing a snapshot of that knowledge, focused on what people aged 21 to 34 think about money and finance.

Researchers at the social network have put together a white paper on the topic using survey data, the company's own Audience Insights tool, and analysis of conversations and content on Facebook itself.

The study was done to help "financial services marketers understand what millennials on Facebook talk and care about," Facebook's Financial Services Head of Industry Jerry Canning said. Young Facebook users tend to be "first-adopters of new technology and are driving the changes that are shaping the future of banking," Canning said.

From Venmo to Robinhood, Wealthfront, and Affirm, there are a bevy of fast-growing financial services apps that offer everything from investment advice to money transfers, with a tech-heavy spin. They're all marketed to young people, and some of them are big advertisers on Facebook.

Even Facebook Messenger offers person-to-person payments (all of Facebook's messaging products are run by David Marcus, who prior to joining the social network was the president of PayPal, the most successful financial company of the last tech boom).

Here's what Facebook's study had to say about young people and money:

There are lots of affluent young people on Facebook

Two-thirds of the 70 million Facebook users in the U.S. aged 21 to 34 are college graduates, more than half of them own a home, and 46% have a household income of over $75,000.

And they're very, very scared of debt.

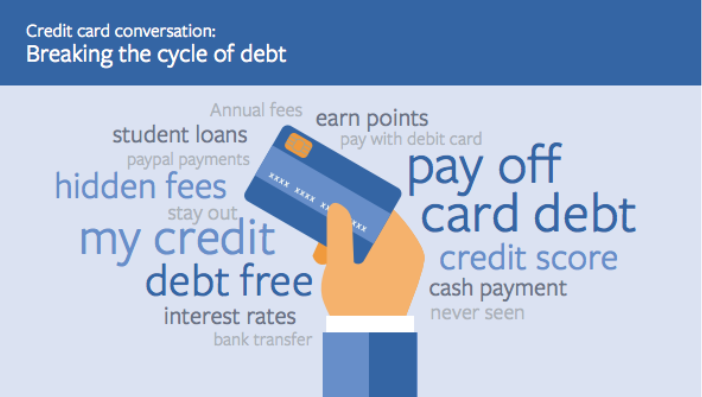

As seen in many other studies, Facebook found many of its young users are suspicious of taking on debt (in addition to their student loans, of course).

While the type of financial services you might see advertised during a football game promote the idea of using a company's financial prowess to build up assets and retire rich, Facebook found only 18% of young people agreed that "being able to retire is the #1 indicator of financial success." Meanwhile, 46% said "financial success means being debt free."

And young people — even the affluent ones — really don't like credit cards.

Fifty-seven percent of young people "prefer to pay primarily with cash," Facebook's survey says. And while some of this may be due to young people being scared of taking on debt or just not having access to credit, the data shows that even the more affluent are 1.7 times more likely to pay primarily with cash than affluent members of older generations.

A quarter of young people agreed that credit cards "worsen my financial standing," a feeling they are 1.3 times more likely to express than older people.

The young people who do think more positively about credit cards tend to do so in strategic terms. "Forty-six percent of millennials say the main reason they use credit cards is to help them build credit and 36% to increase their financial flexibility," the white paper says.

Lots of young people (on Facebook at least) save, but not necessarily towards a financial goal.

When people save, at least according to much of the sales pitch of the financial services industry, it's to build up to something: buying a home, paying for a college education, or retirement.

For young people, it's a bit different, Facebook's data shows. Eighty-five percent of young people save some money, the survey said, but only 17% say the main reason they are saving is to buy a home. Retirement feels like a far-off fantasy at this point, with only 8% citing it as the primary reason they are saving.

Fifty-four percent of young people say they are saving "because they want to 'be responsible,'" a motivation that's 2.7 times more common among young people than baby boomers.

But just because many young people are putting money away, it doesn't necessarily mean they're investing.

Getting people in their early-to-mid twenties to use alternative investment advice and brokerage companies is one of the most competitive areas in financial services, especially among the new, tech-driven financial companies. Services like Wealthfront and Betterment automatically manage investments over time, while the brokerage Robin Hood offers no-commission stock trading on iPhones.

Young people are 2.5 times more likely to trust automated investment strategies, Facebook's data shows.

But, for now, the young people these tech companies target are less likely to invest at all, according to Facebooks's data. They're 1.6 times more likely than older generations to have no investments at all. The reason being, for the majority (54%): "they don't feel they have the money" to be investing. About a quarter say they don't invest because "they don't know enough about investing."

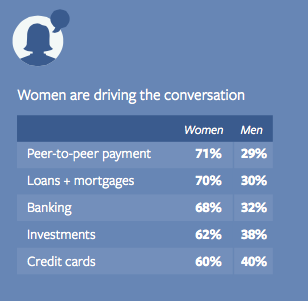

Young women talk more often about financial issues on Facebook.

"Millennials are actually 1.57x more likely to discuss finances online than Gen X/Boomers," Facebook wrote. The data also shows that women are far more likely than men to discuss financial issues, making up more than half the discussion of banking, investment, credit cards, and mortgages.

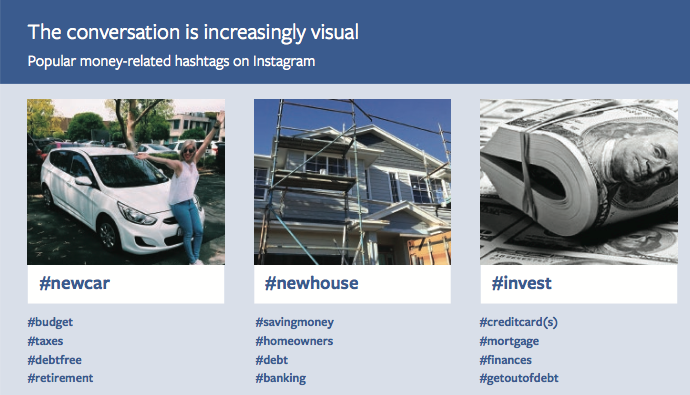

And hashtags, lots of hashtags.