Yesterday, we discussed how, five years after the failure of Lehman Brothers, the banking system has gotten more stable and has become less of a risk to taxpayers. Banks are borrowing less, banks are borrowing for longer periods of time, and investors are starting to lose the expectation that banks will be bailed out should they run into trouble. But that's not the entire story.

Here are three signs that the banking system is actually not that much safer or more stable than when its near collapse almost brought down the world economy five years ago.

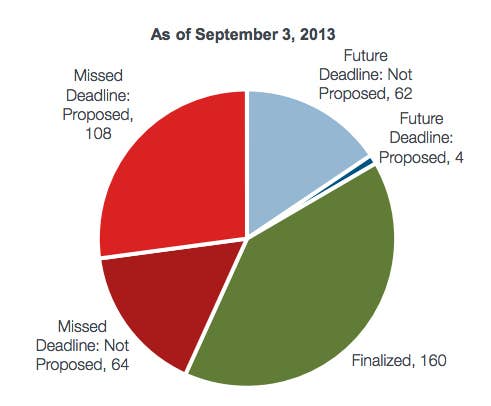

There is a lot of work to be done on Dodd-Frank.

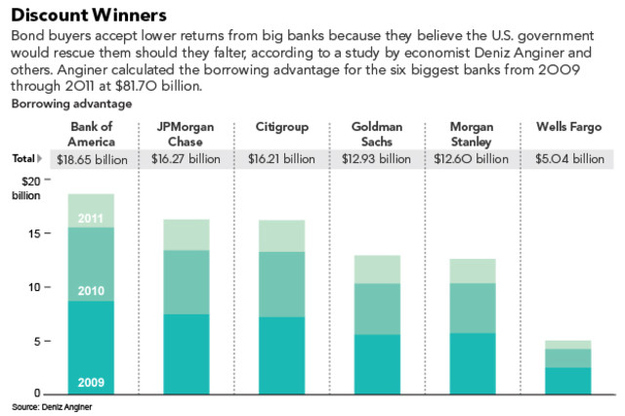

The biggest banks have getting about $27 billion a year from investors because they think the government would rescue them if they got in trouble.

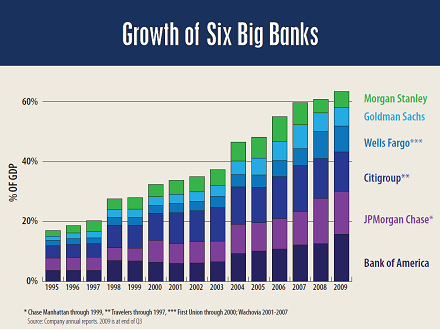

The biggest banks have only gotten bigger.