Ah, the majesty of the 99 cents store...

I love the 99 cents store. I love it like Tom Hanks in Big likes FAO Schwarz (RIP). I love to wander the aisles, browsing the perfect merchandise, marveling at the deals. But I live in New York City, where dollar stores bloom on every corner. For me, picking up wrapping paper, lightbulbs, or a new broom is easy. For non–city-dwelling people, it means driving, parking, schlepping.

So it seems like dollar-store shopping online would make sense, right? Well, sort of. Thus far, dollar stores haven't really worked as e-commerce, for a bunch of reasons, most notably the fact that costs are hard to balance — credit card processing, warehousing, and shipping costs can all gobble up the tiny profits on cheapie items. (Dollar Tree does have an e-commerce site, but a representative for the company told BuzzFeed New that while the site is profitable, it accounts for a very small part of the company's business.)

A new startup, Hollar.com, is trying to become the first dollar store to succeed exclusively online. And so far, it seems to be working — the company claims that, after launching six months ago, it is profitiable on each order, with more than $1 million in sales and $17.5 million in venture capital, raised over two rounds since last summer.

Hollar.com has a few ways of getting around the problems that have plagued other online dollar stores. It enforces a $10 order minimum in order to avoid losing money shipping a $1 item. It doesn’t carry any heavy or oversized items, which are expensive to ship (no full-size bottles of laundry detergent, for example), nor does it sell perishables.

It's also judiciously stocked. “We buy smart,” said David Yeom, one of the founders of Hollar. One of his co-founders came from the chain 99 Cents Only and had relationships with suppliers that could provide good deals on desirable products like Revlon nail polish for $2 a pop (normally around $6 at a drugstore, but probably overstock colors from last season). Despite the low prices, there’s still a profit to be made. “It’s amazing how healthy the margins are in this business.” That $2 nail polish has a 60% profit margin, and Hollar's average customer buys around $30, so it adds up.

Hollar doesn't see its competitors as sites like Amazon and Jet, but rather brick-and-mortar stores like TJ Maxx or Ross, which actually have a really significant business selling cheap toys and home goods, not just clothing. These stores thrive on the “un-Amazonable” parts of retail — people who go into a store not for the one thing they know they need, but to browse and find stuff they had no idea they wanted. The 2012 IPO filings for dollar chain Five Below boasted that the chain's brick-and-mortar stores, “create an element of discovery, driving repeat visits and customer engagement while insulating us against e-commerce cannibalization trends.”

I love my local dollar store exactly for this reason — I love browsing the aisles, looking at the weird stuff. New York City dollar stores tend to be heavy on weird and off-brand goods, which is an extra delight. Hollar doesn't truly provide this — you sort of just browse by category, and a lot of the stuff is name brand (Disney toys, etc.).

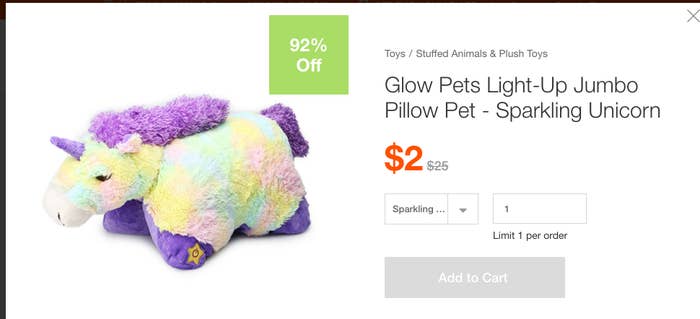

Hollar wants to emulate the impulse shopping experience that dollar stores have traditionally provided. Come for a cheap spatula you know you needed; leave with a toy for your nephew’s birthday, makeup brushes, or a beach bag. So far, Hollar's biggest-selling item by far is a plush light-up toy called a “Glow Pet.” It sells for $2 on Hollar, or around $10 on sale at Walmart.com.

If one of the big hurdles for online dollar stores is being able to re-create the experience of browsing the aisles and finding some weird shit you never knew you wanted, but at two bucks is worth a risk, perhaps Hollar hasn’t figured out exactly how to crack that — perhaps it’s that the customer base is finally tech-savvy enough to be willing to try it online. Yeom described Hollar's target customer as a millennial mom in a flyover state who is looking for a bargain and is used to shopping online. Eighty percent of Hollar's customers are on mobile, split between its app and the mobile site.

I asked Yeom how a company founded by five men was going to understand a female customer. “We all are married; we all have kids,” he said. “And we listen to our wives."

CORRECTION

Hollar is profitable only in the per-order sense (it makes more on each order than the costs of the merchandise and shipping). However, it is not yet actually profitable — the profits from its first six months in business have not yet covered the costs of running a business (marketing, payroll, website, etc.). An earlier version of this post did not make this distinction — which is huge! — clear. We're very sorry about this.

Also, one of Hollar's founders previously worked at 99 Cents Only, not Dollar Tree.