We hope you love the products and services we recommend! All of them were independently selected by our editors. Just so you know, BuzzFeed may collect a share of sales or other compensation from the links on this page. Oh, and FYI, prices and rates are accurate as of time of publication.

Life has a bad habit of sneaking up on us when we least expect it. Sometimes it's an annoying overdraft fee because our expenses got just a *little* out of control this month. Other times, it's a massive plumbing issue that's going to take some serious $$$ to fix.

But the good news is that we can sometimes take steps to prevent those expenses from feeling unmanageable (even if we can't always prevent them from happening all together). Here are some tips that'll help you do just that:

Just always remember that financial advice is not one-size-fits-all. You should consider your own personal circumstances before following advice and consult with a financial adviser when in doubt.

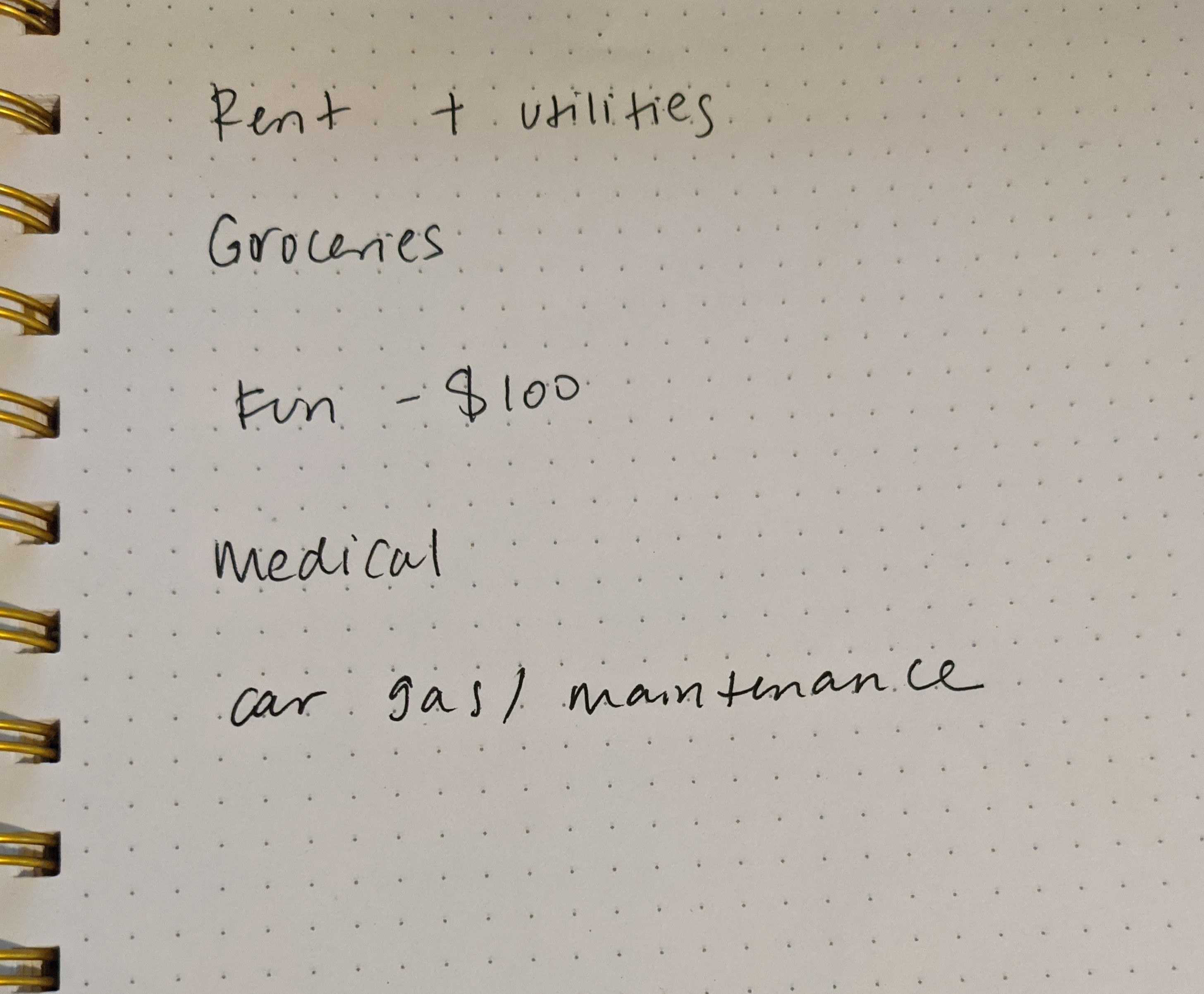

1. First off, create a budget so you know exactly what's coming in and exactly how much is going out.

2. And once you get that budget going, cut down on regular expenses that start to feel a little unnecessary — you'll have a little more room to save or spend on things that matter more to you.

3. Get into the habit of glancing at your checking account balance before you make purchases. This way, you won't accidentally spend more than you have.

4. Also try to keep a bit of a cushion in your checking account so that you don't have to worry about overdraft fees.

5. Comb through your credit card statements thoroughly. It'll help you catch unfamiliar charges sooner rather than later.

6. Start building an emergency fund, so you have cash to draw on when unexpected expenses pop up.

7. Also consider starting a family emergency fund. It'll give you a way to help your family (parents, siblings, cousin, etc.) cover a surprise expense without eating up your personal emergency fund.

8. Don't invest money you'll need in the next few years.

9. When you're hanging out with friends, be honest about what you can or can't afford.

10. Plan your meals before going grocery shopping — it'll help prevent over-shopping (and overspending) on things you don't actually need.

11. Save up some extra money for home renovations before you close on a house. Unexpected breaks do happen!!!

12. Exhaust all other options before you decide to withdraw money from your retirement account early.

13. Lastly, see if the college that accepted you has any scholarships and grants that you can apply for before you go all in on student loans.

What's a money tip that you really think more people should know about? Let us know in the comments below!

And while you're at it, check out some of our other personal finance posts.