The UK's generational wealth gap – caused by rising house prices over decades leaving wealth concentrated among pensioners and baby boomers – could lead to inequality among millennials through their inheritances, a leading think tank has warned.

The Institute for Fiscal Studies (IFS) has analysed the wealth of pensioners, and researched who receives inheritances and how big they are. The study finds that not only are people already on high incomes more likely to receive an inheritance, but those inheritances are also larger than those their poorer counterparts get – compounding existing inequality.

The result, the researchers warn, is that wealth for today's millennials will depend on their parents' fortunes.

"The wealth of younger generations looks set to depend more on who their parents are than was the case for older generations," said Andrew Hood, senior research economist at the IFS. "Today’s elderly have much more wealth to leave to their children than their predecessors did, primarily as the result of higher homeownership rates and rising house prices.

"At the same time, today’s young adults will find it harder to accumulate wealth of their own than previous generations did, due to the sharp fall in homeownership for that group, the dramatic decline of defined benefit pensions in the private sector, and the stagnation in their incomes."

Here's how the IFS sees the scenario.

Older households have a lot more wealth than they used to.

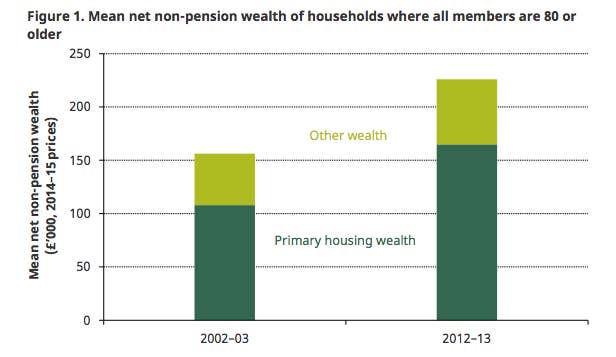

Excluding their pensions, the UK's oldest households have much more wealth than they did a decade ago, the IFS found – driven largely by the increase in house prices. The figure has increased 45% over a decade to an average of around £230,000 in wealth.

At the same time, more of those older households have said they expect to leave an inheritance – rather than spend all of their accumulated wealth – over the decade, meaning there is a marked increase in the size of expected inheritances over the next few decades.

This means today's adults are more likely to receive an inheritance than their parents' generation.

As more people expect an inheritance, that would tend to increase the importance of parental wealth to current adults and young adults – but it's the differing size of inheritances (as well as the have/have-not divide) that risks fuelling inequality.

Looking at people who have already received inheritances – largely older adults – gives some clues as to the patterns to expect.

High earners are more likely to get an inheritance.

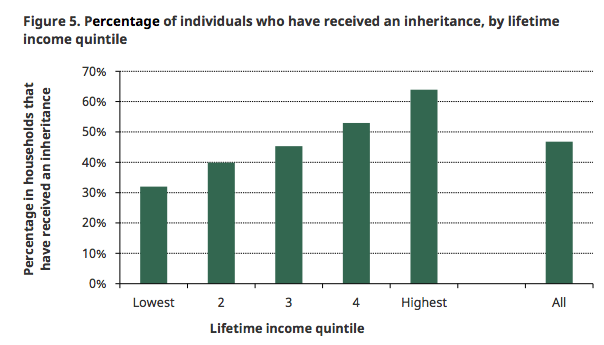

Firstly, people with the highest incomes are almost twice as likely to have received an inheritance than the lowest-income group. But that's not the only factor.

The size of inheritances also varies a lot by income group.

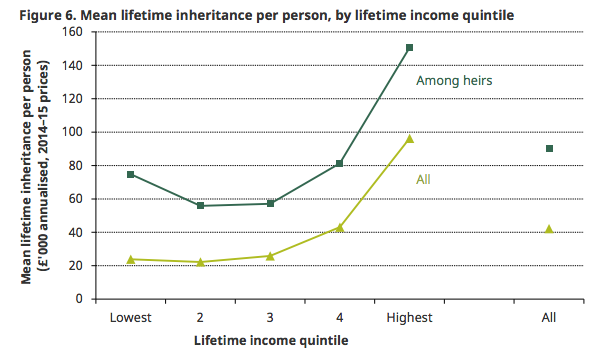

There is a particularly pronounced effect on inheritances for the highest 20% – while the lower four groups have roughly similarly sized inheritances, the top group of heirs are more than £60,000 ahead of the next-highest group.

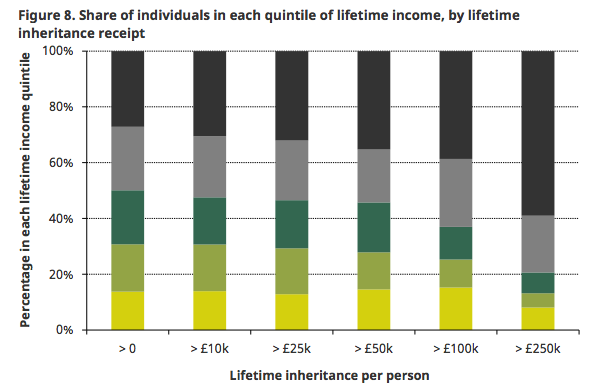

Another way of thinking about this is to look at the portion of people in each earning group who get inheritances of different sizes – and as the chart below shows, the biggest inheritances are much more likely to go to those who already have a high income than to those in other groups, compounding inequality.

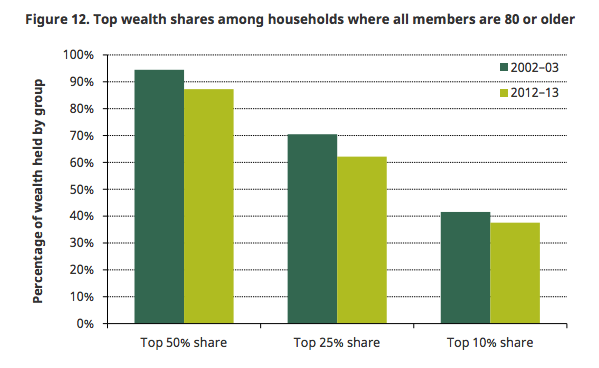

There are reasons to think this trend will continue: Wealth is concentrated among richer pensioners.

The richest 50% of the UK's oldest households have 90% of their total wealth – and the top 10% have almost 40% of the total. This means there are big disparities in the amount of wealth descendants of each group can expect to receive, suggesting trends in inheritance are unlikely to become more egalitarian, even though more people will eventually inherit something.

This trend seems set to carry on across multiple generations.

As the report concludes:

Looking at current pensioners, we find that those with the highest lifetime incomes are also those who have inherited the most across the course of their lives. High-lifetime income individuals are around twice as likely as low-income individuals to have inherited something, and many times more likely to have inherited hundreds of thousands of pounds. There is evidence that these patterns are likely to be maintained among younger generations: those with higher incomes are much more likely to either have received an inheritance or expect to receive one in future.