Budgeting. That life skill you don’t learn in school but are supposed to just do as a responsible adult. “Know your fixed expenses versus your flexible expenses,” they say. “Don’t you want to save for a house someday?” they say. Well, easier SAID than done, amirite?

I recently asked my highly organized mom when she first started budgeting, and she replied, “When I was in my late twenties, living in New York City, recently married, and starting to think about what the next stage of my life had in store.” I know she was being honest, but she was also totally giving me a big ol’ hint. Because that life sitch she described is, Hi! Me rn! And, beyond keeping an eye on my checking account and credit cards to make sure I’m not in a financial danger zone, I’ve never taken the time to really track what I’m spending on a day-to-day, week-to-week, or month-to-month basis.

I’m beyond thankful I’ve been in a financial situation where I haven’t had to track every penny. My parents paid for my college education, and my steady paychecks in publishing and media have allowed me to pay rent, eat, and even have some fun in the Big Apple. Now that I’m married, my salary combined with my husband, Mike’s, has us doing pretty well for ourselves, and I am very, very grateful for that.

That said, I’m not a frivolous spender. I love to cook, and I DON’T love to shop. By NYC standards, my rent is cheap. I’ve been lucky to be able to take some really cool trips, but I’m not constantly jet-setting. I buy my loved ones birthday gifts and wedding gifts, all within reason. Oh, and baby gifts. So many babies poppin’ out of my friends and into my life.

Well, in due time, I also want to start a family. And buy a house. And send my kids to college. All while also saving for my retirement. You get the picture. I decided it was time to get a better sense of my spending and figure out this whole budget thing.

Keep a detailed, hand-written journal of every single expense for a week to figure out what exactly I’m spending my money on, so I can create a budget to make sure I'm saving enough for my future.

Game on! I bought a blank journal for $8 (no templates — I wanted complete organizational freedom), dug up some colored pens (because if it’s going to be hand-written and categorized, it’s clearly GOTTA be color-coded), and thought of all the lifestyle buckets that could possibly encompass my expenditures.

I set up a page for every day of the week (if I needed to go over a page, I had bigger problems on my hands…) and figured I would keep receipts throughout the day and then journal everything together at night before bed. Pretty simple! So off I went into my week of financial discovery.

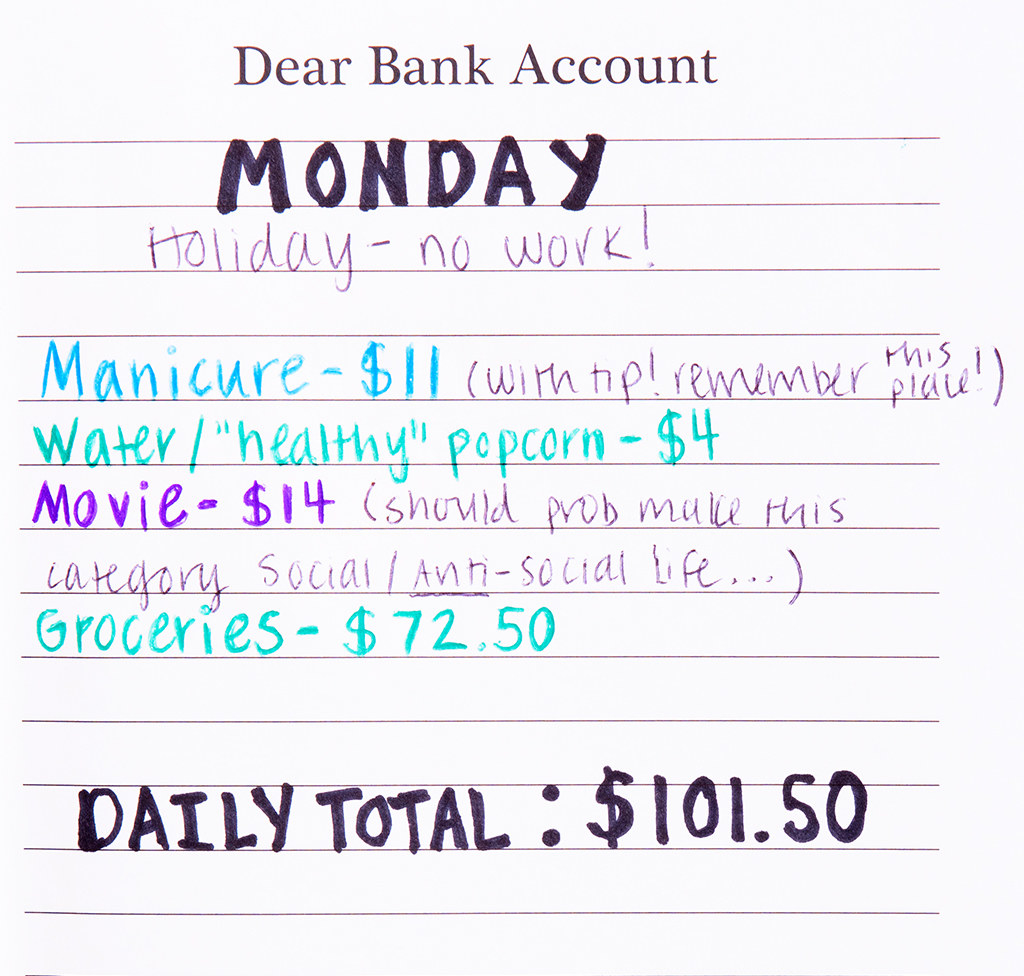

Monday

- Federal holiday, so no work, woot!

- Morning manicure.

- Afternoon movie. Bought a water and my own popcorn to sneak in (sorry ‘bout it!).

- Bought groceries for the week. Made a particularly delicious farro with roasted veggies for dinner, if I do say so myself.

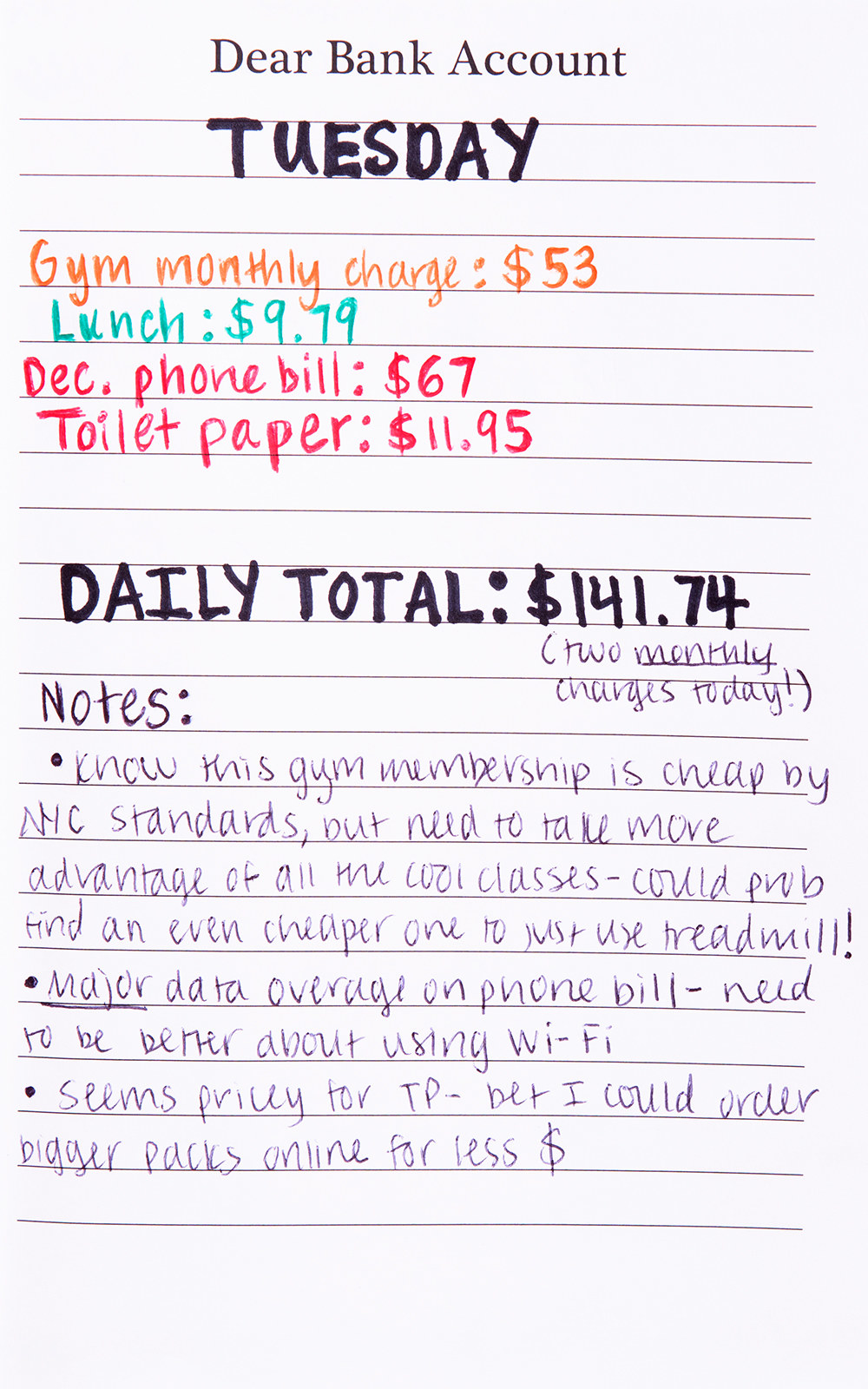

Tuesday

- Packed fruit and yogurt for breakfast (I do this basically every weekday).

- Automatic monthly gym payment.

- Bought lunch.

- Mom emailed asking for last month’s phone payment, so transferred that over online.*

- Bought a big bulk pack of toilet paper.

- Leftovers for dinner.

- Had some serious thoughts about the day’s expenditures, so created a separate Notes section below the Daily Total.

Only Day 2, and I was really getting into this journaling thing!

*Yes, I’m still on my parents’ phone plan — I just transfer them money every month.

Wednesday

- Packed breakfast and lunch.

- Randomly remembered nephew's birthday was on Saturday and had to pay a $10 rush fee on his Batman bathrobe, because you can’t give a 3-year-old a belated birthday gift. Ugh.

- Grabbed pizza and took an embroidery class with my friend Lily! May have found a new hobby.

- Quick cab home.

- Embroidery class must have gotten my creative juices flowing because I stayed up late journaling (lots more notes!) AND doodling.

Thursday

- Packed breakfast.

- Got lunch with co-worker (WAY overpriced and less satisfying than Tuesday's lunch).

- Bought groceries to make bean burritos with Mike.

Friday

- Packed breakfast.

Takeout coffee splurge! - Bagels at work, so ended up eating packed breakfast for lunch.

- Bought cleaning wipes and face lotion.

- Movies with Mike (yes, another movie — it's awards season, people!).

- Nice Italian dinner (we split the check), after which I promptly went into a food coma and fell asleep.

Saturday

- Cereal and coffee at home for breaky and random snacks for lunch.

- Ordered embroidery materials! This girl was going to get her DIY on. New year = more creative hobbies and less social media stalking!

- Bought wine for dinner party at friend's apartment (9-month-old baby did not partake in wine).

- Cab home.

Sunday

- Laundry day! Actually remembered detergent this time.

- Bought insanely overpriced bodega yogurt.

- Grocery run for lunch stuff and ingredients for our favorite winter Sunday cooking tradition: Sunday soup. (Yes, this is married life.)

- Closed my fabulous color-coded new friend on a successful week of expense tracking!

But I wasn't done. My week of journaling involved lots of writing and thoughts and colors and doodles — but up until this point, minimal math. Party time was over. I took a deep breath and whipped out my calculator (app) to accomplish four things:

1. Calculate my total spending for the week in each category to see how I'm currently allocating my money.

2. Multiply those numbers by four and add in other monthly expenses to calculate the general amount I spend in a given month.

3. Compare that total monthly cost to my monthly income to see how much I'm currently saving.

4. Use the category totals, as well as the notes I jotted down, to create a budget with set dollar amounts for each category. Goal: to ensure I'm actively saving toward impending life expenses while maintaining a lifestyle I'm comfortable with and enjoy.

Steps 1–3: At first, the Food category total was higher than my rent, which made my jaw drop because I thought I was pretty frugal with food! But then I realized meals out/wine for parties should be in the Social Life category instead, not grouped with food essentials like groceries. So I shifted those numbers and got Home as my highest cost (including rent, utilities, internet, cell phone, laundry, and apartment necessities), followed by:

- Food and Social Life

- Transportation (including my monthly subway card and cabs)

- Gifts

- Clothing & Beauty

- Hobbies

That order seemed reasonable to me...but as I went to add 'em all up and compare to my monthly income, I prepared for the worst.

But, surprise, even with my current spending exactly as is, I was saving! Saving about 17% of my income! TOTALLY more than I expected. But...was it enough?

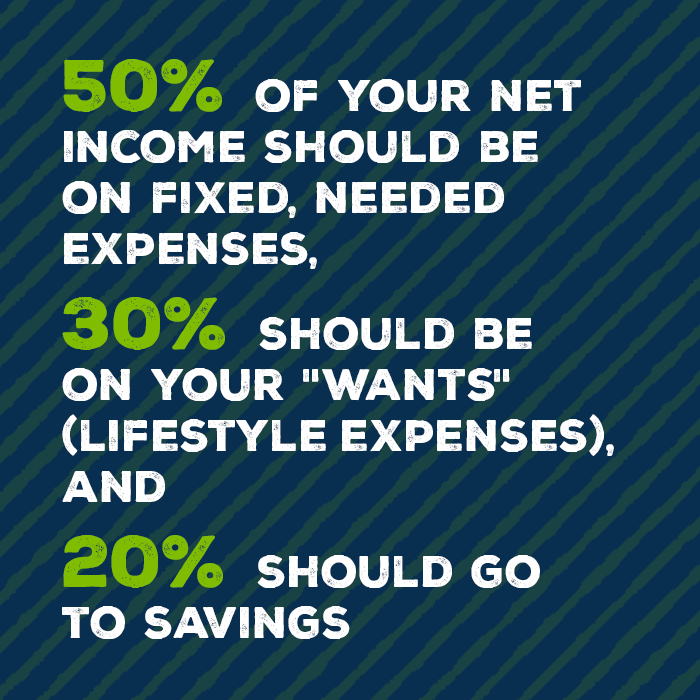

Step 4: For that answer, I turned to the interwebs and found a lot of resources citing the 50-20-30 rule. Fifty percent of your net income should be on fixed, essential expenses, 20% should go to financial goals like savings, and 30% should be on flexible "wants" (lifestyle expenses).

My fixed and flexible expenses were at pretty much the right ratio when I grouped them, so I decided to cut a bit from each to get my savings up to 20%. Looking back through my journal notes, I sliced some $ off the totals for Food (adios, insanely overpriced salads and bodega yogurts), Home (cheaper toilet paper and no more phone data overages), and Social Life (two movies in a week was an exception, and Mike and I don't do an expensive dinner every week). I made sure all my new totals had me saving 20%, and — voilà! — they became my new spending rules!

And that's it, folks. I tracked my expenses and made a sweet, sweet budget — and you can, too, with as much or as little color-coding, notes to self, or doodles as you want! (The math part is not optional though, sorry.)

I decided to share the news with my mom to show her that I took her not-so-subtle hint. In return, I got four baby-with-pacifier emojis.

What other response should I really have expected, tbh? Tracking and budgeting was the easy part; my work has just begun.

Getting a handle on your spending doesn’t have to be stressful, and neither does doing your taxes! File them online quickly, easily, and for free with H&R Block. See hrblock.com for details.

Design by Marjan Farsad / © BuzzFeed

Photos by Lauren Zaser / © BuzzFeed