We recently asked members of the BuzzFeed Community to share their budgeting and money-saving tips. Here are some of the best responses.

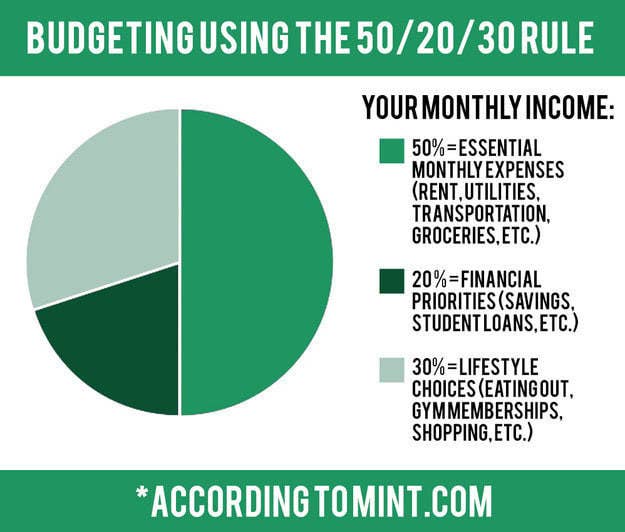

1. Use the 50/20/30 method to break down your budget, so you know exactly where your money should be going every month.

2. Plan a weekend once a month during which you can't spend any money.

3. Make your big purchases at thrift or consignment stores so you can buy quality stuff for cheap.

4. Set up a budget in the Mint app so you get an alert if you're getting close to or have exceeded your budget.

5. Think about what you want to buy in terms of the hours it took you to earn that money.

6. Meal prep so you aren't blowing all of your cash on lunch or getting take-out because you're too tired to cook.

7. And cook broth, black beans, and pasta sauce in bulk so you can pull it out of the freezer whenever you need it.

8. Set up a separate checking account for spending money so you don't accidentally eat into the cash you need for bills.

9. Schedule your reoccurring charges to hit the day after you receive your direct deposit so you don't spend it on anything else.

10. Break down how much you actually have to spend in the Daily Budget app.

11. Keep the amount you budget for discretionary spending in cash — it'll be way harder to spend actual physical money when you're not just swiping a card.

12. Move whatever you haven't spent during the pay period into your savings account.

13. Use a prepaid grocery card if you're always overestimating how much money you have to spend on food.

14. Or grocery shop online so you know how much is in your cart and there are no surprises at the register.

15. Set a different budget "challenge" every month so you're more aware of your impulse buying.

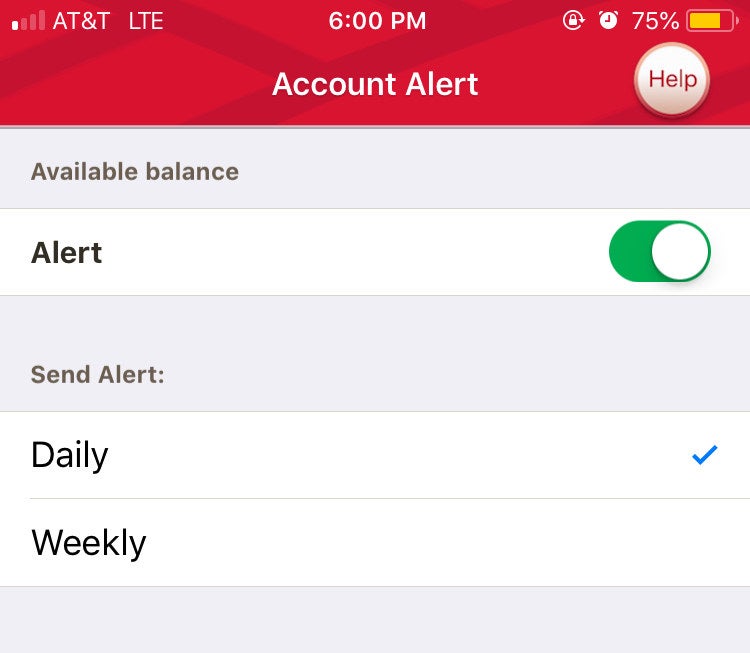

16. Set up daily balance alerts from your bank so you're never in danger of overdrafts.

17. Get help from a financial planner if you're really struggling to budget.

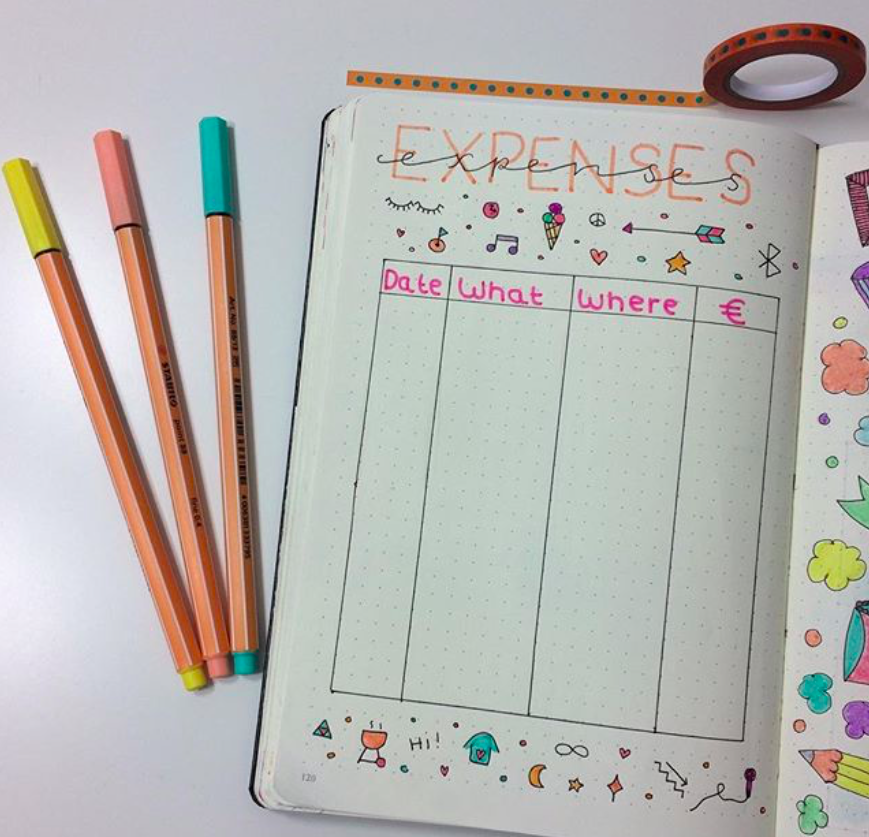

18. Commit to writing down every dollar you spend in a notebook for a month or two to see where your money goes.

19. And shop in bulk whenever you can.

20. Use your credit card as often as possible to get rewards, but make sure to pay your bill IN FULL every month so you're building good credit.

21. Bring a reusable water bottle everywhere you go so you don't have to buy one on impulse.

22. Learn how to make minor clothing alterations yourself so you don't have to throw things out as quickly as you otherwise would.

23. And make DIY gifts as an affordable alternative to buying new things for friends and family.