1.

Signing up for a free trial but being too lazy to cancel when they start to charge.

2.

Making $20 stretch at the beginning of the month but immediately blowing through your second paycheck.

3.

Wasting money on ATM fees instead of cashing in on credit card reward points.

4.

Planning a week of meals to save money but ordering takeout because you're too lazy to get out of bed.

5.

Splurging on the latest smartphone you don't need but still somehow "too broke to hang out."

6.

Offering to pay for everyone's dinner for the points but then collecting interest from the large balance.

7.

Using only a third of the groceries you bought.

8.

Buying the cheapest thing on the menu but also getting a $14 cocktail.

9.

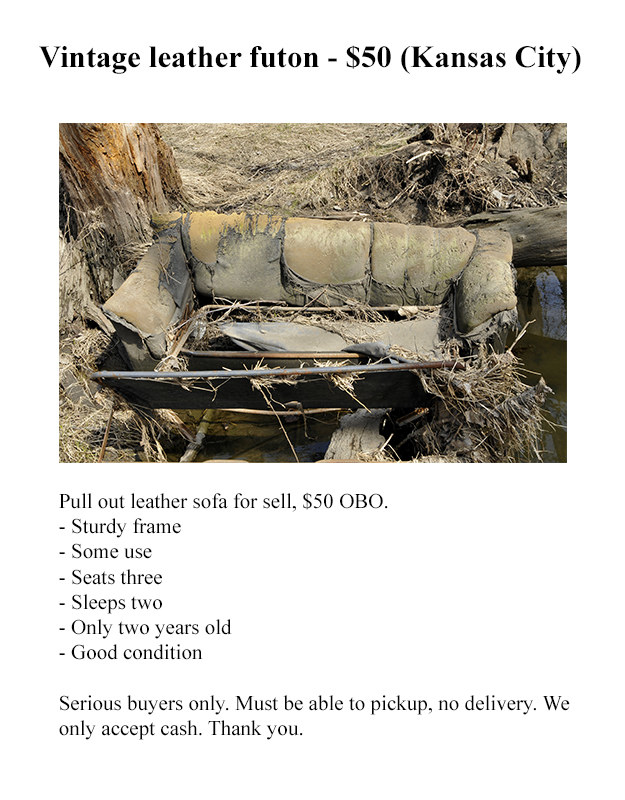

Justifying upgrading to a better apartment but keeping the same ratty furniture.

10.

Not paying extra for guac but spending $4 to get your own money out of an ATM.

11.

Paying just as much on shipping as you did on the item.

There's a smarter way to spend. With Affirm, financing big purchases like an insanely comfy Casper mattress is easier than ever.