Here’s a question: How willing would you be to give up, say, access to the internet for a month if it meant that afterwards you'd never suffer the indignity of a patchy connection ever again?

Good deal, right? It’s a challenge, sure, but it’s pretty standard as it goes. Not too taxing, and the reward is pretty tasty.

So how about a year? Now that’s more of a sacrifice. Would you go a year without Wi-Fi? It's still a pretty nice incentive, but what an awful year that would be. Making plans would be a nightmare!

"Sensible is the stuff you know you ought to do, but without your mum telling to do so, you never get round to it. A bit like going to the dentist."

A year is definitely tough. But what if we were talking about giving up something now for a reward in 40 years time?

Of course, we're talking about retirement. And yes, that's supposed to be the sensible thing to do. Savings, pensions, and rainy day funds are all very sensible. But the problem is sensible isn’t very practical. It's not fun. Sensible is the stuff you know you ought to do, but, without your mum telling to do so, you never get around to it. A bit like going to the dentist.

Now to be honest, I do consider myself pretty sensible with money (I had a spreadsheet at university, once). But a pension? I’ve genuinely never thought about it. It is pretty difficult to give up something now in return for a pay off in 40 years. I mean, I haven’t been alive for 30 years, let alone 40. What ever happened to the saying “you can’t take it with you”?

Besides, isn’t saving for a house supposed to be the big investment that will secure my future? Am I really that far behind already? Guess there’s one way to find out...

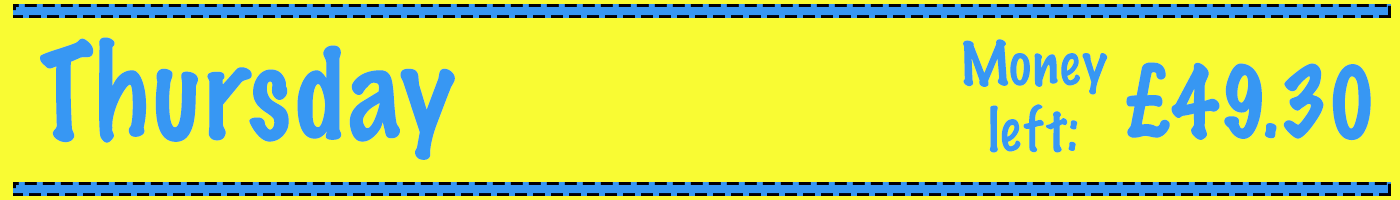

As it stands currently (in the tax year of 2016/17), you can receive as much as £155.65 a week when you hit 68. So:

- I’ll have exactly £155.65 to spend for the entire week.

- This budget needs to include all of my bills – phone, gas, electric – everything.

- However, rent is exempt (because hopefully I will own a house by the time I’m 68, fingers crossed).

- Travel is exempt too (because public transport is currently free in London if you’re retired!).

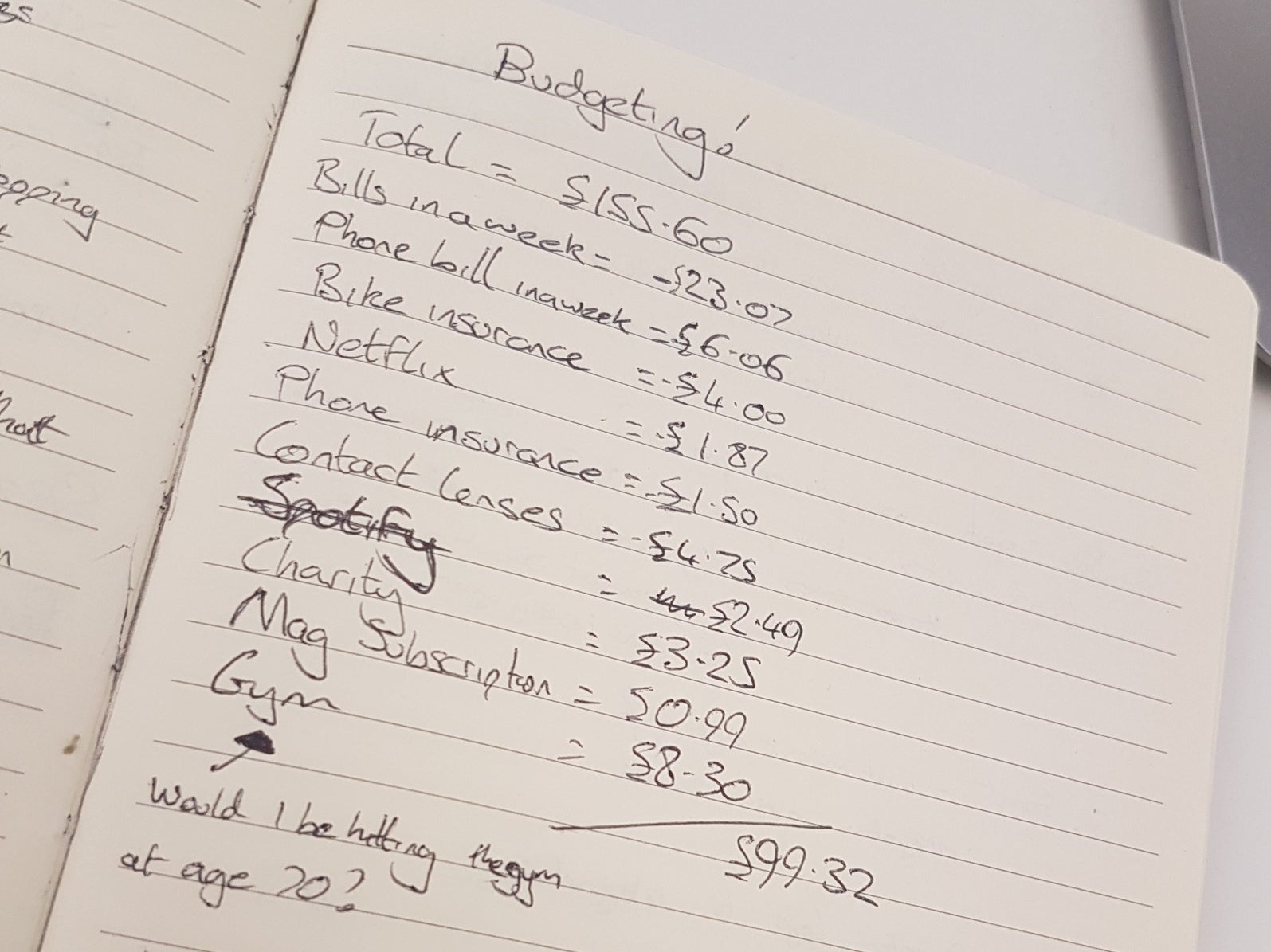

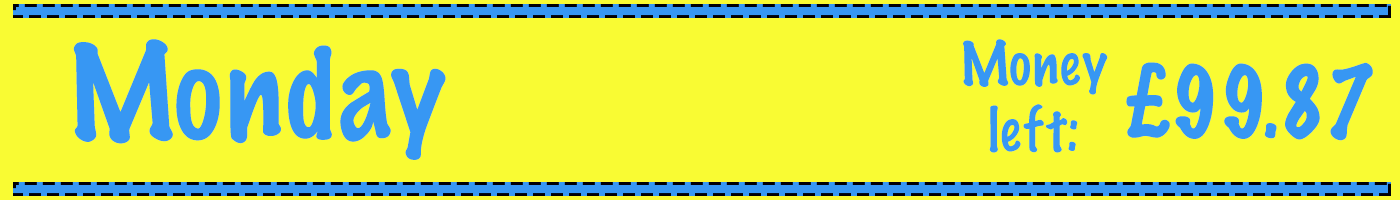

First things first, I needed to have a look at my usual outgoings. Which meant firing up the old online banking for the first time in two months. Pro tip: Don’t do this a week before pay day, like I did. :/

This was my Sunday evening. It was all looking fine until I remembered the membership fee for the gym I never go to. So much for being a savvy spender. Still, that's just under £100 for a week. Doesn’t sound too bad, right?

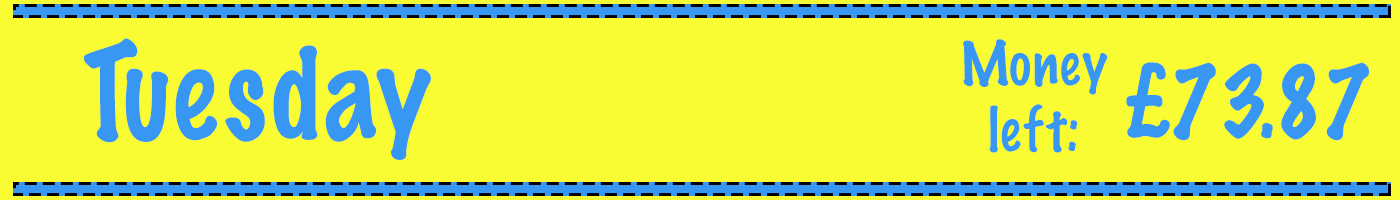

I have to say the most draining thing about this was the planning. The idea of planning. Just thinking about it makes me want to go lie down and groan for an hour. And it’s this precise lack of planning that resulted in a last-minute, overpriced sushi for lunch. Now, I admit, it was fairly decent sushi, but £5.70 is bloody punchy. Especially on my pension.

Resolving to do better, I made plans to stop and do a big shop on the way home, the way Mum used to.

Still, even at this early stage I felt an overconfidence setting in. Is £100 really that paltry?

Admittedly, this shouldn’t have taken an hour, but I was determined that budget wouldn’t stop me from eating well. Fresh fruit and veg are pretty important to me, while I’d hope that non-”basics” meat is important to everyone. Eventually, I came away with a surprisingly decent haul for just over £20.

Generally, I’m much more of a top-up shopper, so reverting back to the old “weekly shop” was a bit of a novelty. But choosing the entire week’s meals in one go definitely takes the fun and spontaneity out of things. (I know, I know. It’s tough being such a free spirit.)

Still, even at this early stage I felt an overconfidence setting in. Is £100 really that paltry? At university, I used to pride myself on being able to go out with a tenner and come back with change. Going a week should be a doddle.

Today, I thought I’d try to do something I wouldn’t normally do that wouldn’t put me out of pocket. Despite the price of a pint pushing the boundaries of taste (metaphorically speaking at least), there’s actually loads to do in London that doesn’t break the bank.

Where usually we might have headed out for dinner or seen a show, my girlfriend and I opted to head to Natural History Museum instead. Well, I say “we”, I opted to go the Natural History Museum because I hadn’t been there since primary school and I’d take dinosaurs over abstract art any day.

All in all, this evening was pretty awesome. After a couple of hours of gawking, we caught the end of a free comedy show at a local pub too, which was equally great and had me feeling all warm and fuzzy about living in London.

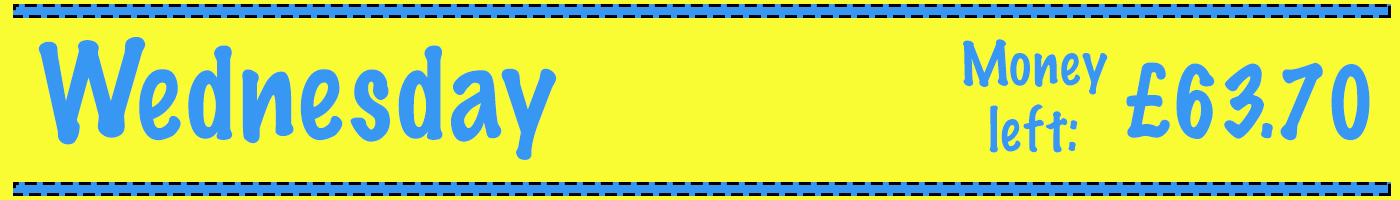

Wednesday turned out to be a pretty chill day. Work kept me pretty busy, while coffee and the odd snack kept me away from any sort of hunger-related grief. (Not to mention I had enough shepherd’s pie to feed a small social media team.)

"The biggest stress came from preparing for the next day’s bake-off at work, which admittedly is a very British problem."

The biggest stress came from preparing for the next day’s bake-off at work, which admittedly is a very British problem. Unsurprisingly, I failed to learn any lessons from previous attempts (don’t rely on supermarket food colouring; stick to what you’ve done before), and the metaphorical pressure cooker I was experiencing resulted in me pinching a beer from the fridge. As this was something I bought earlier in the month, I docked myself £4.

Baking, man.

Despite the previous evening’s anxiety, the bake-off went pretty well. Brownies were enjoyed, and compliments were made. I’d like to think if it were the real thing, I’d probably be out around Week 6. So, an admirable effort, essentially. (And money well spent.)

As much as I enjoy (my own) shepherd’s pie, the prospect of a fourth straight portion wasn’t being met with great enthusiasm, so I ventured out for another overpriced lunch and began to contemplate just how many of these decisions seemed to be food-based.

My evening, on the other hand, was much more cost-efficient. Thankfully, sitting and watching football from the comfort of my sofa is only taxing on the soul, rather than my wallet.

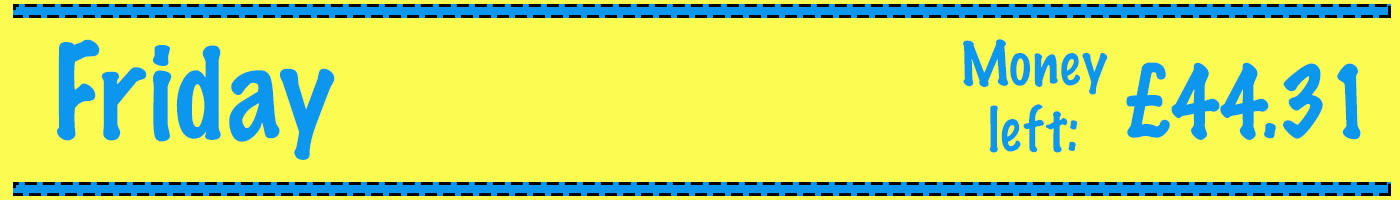

At the start of the week, I wasn’t really looking forward to Friday. It presented the first opportunity for an awkward social situation. I hate the idea of not paying my way, especially in those ambiguous social situations.

While my account was still looking healthy, I had pre-existing Saturday plans involving both food and drink, so I knew I couldn’t be too irresponsible here. Otherwise it could get a bit embarrassing tomorrow.

In the end, I went with a sensible option. I bought myself a quick token pint (skillfully avoiding any talk of rounds by announcing my intentions to stay for “just one”) and enjoyed an hour’s worth of chat before heading home for that pleasant evening in front of the TV.

I’m very much into jogging at the moment, which is an admirable endeavour but kind of counterproductive when I have a gym membership I rarely use. If anything, I’ve just lost money by jogging. Sigh.

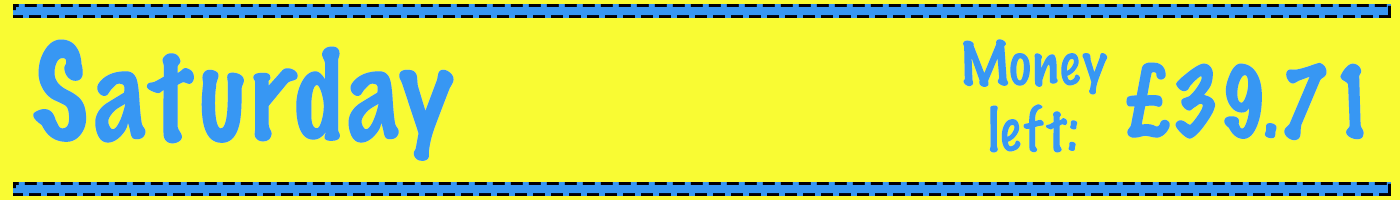

Anyway, the real social challenge of the week was an afternoon-and-evening out with a couple of friends – starting off with food in Brixton followed by a couple of bars.

On the one hand, being out for a prolonged period was pretty fun and reassuring at the same time. We had some great street food, and I bought a round of drinks, as I normally would, which is great. However, by the time we moved on to round two, my enthusiasm started to wane as I began to feel a bit uncomfortable about the night possibly spiralling out of control (from a cost perspective, at least).

In the end, it wasn’t too bad. I definitely didn’t pay my full share for drinks, but I did chip in, and it’s rare those things work out equally, so I didn’t feel like a complete leech. A good evening’s fun.

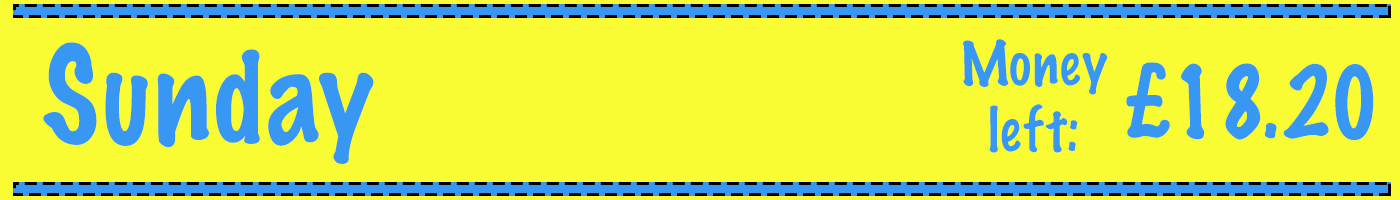

Entering the final day with some cash to spare (and hangover free!), I decided I should treat myself to an afternoon out at the cinema.

This was probably the most frivolous purchase of the week, considering a) the blockbuster film that shall go nameless was pretty underwhelming and b) £15 for a cinema ticket is LUNACY. Still, it was nice to know that I did have a bit of money left for a “treat”, even if it was poorly chosen.

Success! I think?

Setting out at the start of the week, I’m not sure what I expected. I thought the natural conclusion would be that this might be a big wake-up call. That I’d find out £155.65 isn’t enough for anyone to live on and we need to act immediately, or else face a horrific retirement.

In reality, £155.65 a week is enough to live on, at least without too much discomfort. I wasn’t eating ready meals or shopping in the reduced section. I didn’t have to sacrifice a huge amount from my social life. Come Sunday evening, I wasn’t cradling my credit card,

promising to never abandon it again. Rather, what I’ve really learnt from this experience is that this *shouldn’t* be a challenge. Because it’s unnecessary. Just reeeeeaaally unnecessary'

"Sure it hurts a little to give up a piece of my paycheck now, but I’ve worked hard enough to get where I am at 28, why go backwards?"

Living with this budget for a week was fine. But that's because I knew I could likely go back to my normal means straight after. Could I do a month? Yeah, probably. But I’m certain the novelty would quickly wear off rather quickly. What about the holidays I’d want to book? The new clothes I’d want to buy? What would I have to give up just to pay for a haircut?

And that’s kind of the point. For many people, this doesn’t get to be a week-long novelty. It’s reality. And it’s a reality I’ve lived through before. Sure it hurts a little to give up a piece of my pay cheque now, but I’ve worked hard enough to get where I am at 28, why go backwards?

In the end, this week did inspire me to go ahead and set up my workplace pension. Because planning for the future isn’t about sacrificing fun right now. It’s just about preserving what you’ve achieved so far. And that doesn’t have to be anything major.

Sometimes, it’s just about the little luxury of saying, “I can’t be bothered to cook tonight – let’s get a takeaway.”

And for me, that’s well worth preserving!

How much do you think you'll need to live on in retirement?

Aviva's Shape My Future tool lets you build your future life and help you discover what your retirement budget might be.

(Additional imagery courtesy of Getty Images/istock)