In a statement on Thursday morning the prime minister and state premiers have confirmed an in principle agreement to apply the GST to overseas purchases which cost less than $1000.

Earlier: Online shoppers could soon be slugged with a 10% tax on products bought from overseas retailers.

Frydenberg has been keen to lower the GST Low Value Threshold for a while, accusing Australian consumers of going on a "GST-free buying spree."

This year's budget has already changed the rules so the GST also applies to digital "intangible" products like e-books, music and your Netflix subscription.

You might think that the GST on online shopping means that buying this attractive $89 fedora from ASOS will now just cost you $8.90 extra.

Or that you'll only be paying $6 more to get this mesh top. That's only $3 extra per moon boob.

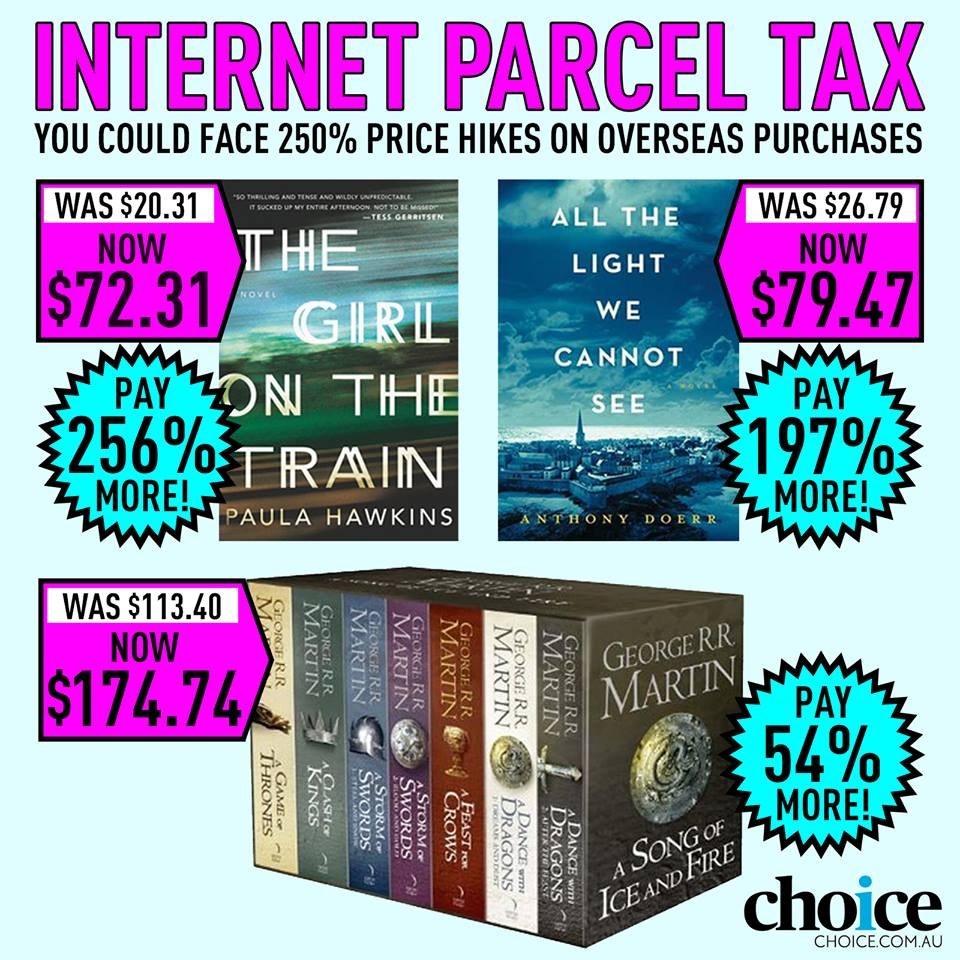

But consumer advocacy group Choice warns that online shopping costs will skyrocket, with price increases up to a whopping 256% for purchases under $100.

Josh Frydenberg and treasurer Joe Hockey say technological advances have made it much cheaper to enforce a threshold of $20.

The change to the GST on imported parcels looks set to have the support of the states when the treasurers meet next month.

At a pre-budget treasurers meeting, they were all in favour except for WA's Mike Nahan, who didn't want to agree to anything until the GST revenue distribution was changed.

And they probably won't get much opposition from Labor. In May, shadow treasury spokesperson Chris Bowen criticised the government for not including the lower threshold in the budget.

Choice says that it won't make much of a difference for local retailers because most people do online shopping because its convenient, more than anything else.

E-commerce analyst at Telsyte, Steven Noble, says there are other factors that influence the industry, such as shipping fees and the value of the Australian dollar.