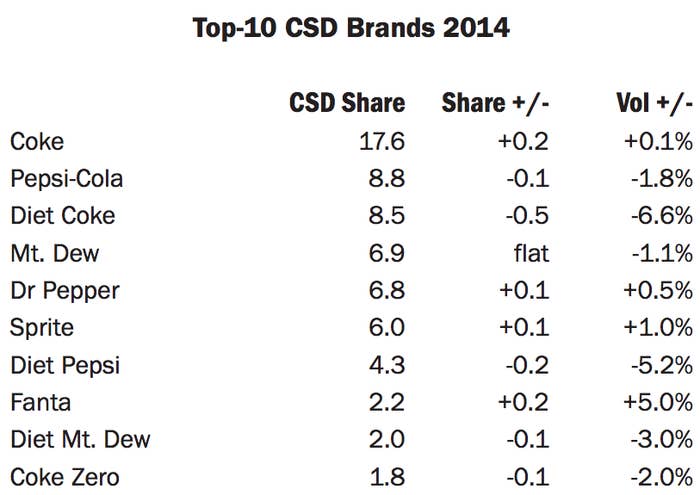

Soda consumption has fallen every year for the last decade, and lately it has been diet sodas falling even faster than full-sugar ones. New numbers released today by Beverage Digest, an industry publication, show the carnage continued in 2014, with one notable change: Diet Coke has fallen so far that it is no longer the country's second most popular soda.

The No. 2 spot, which Diet Coke claimed in 2010, was taken by Pepsi-Cola. Coke held on to its long-running top spot, while among the top 10 carbonated soft drink (CSD) brands, only Fanta pulled off significant growth for the year.

Here are the numbers from Beverage Digest — note in particular the big drops for the two diet colas.

Across the whole carbonated soft drink business, volumes sold are now back to levels from the mid-1990s, Beverage Digest said, down by about 14% since their peak in 2004. Per capita soft drink consumption is at its lowest since around 1986.

But thanks to higher pricing, the industry managed to pull in more dollars than it did in 2013, and squeezing more money out of a declining market looks like the strategy going forward. "Multiple senior executives at the big beverage companies have recently indicated that they are focusing strongly on dollar growth, using such tactics as package downsizing with higher per/ounce pricing," Beverage Digest said.

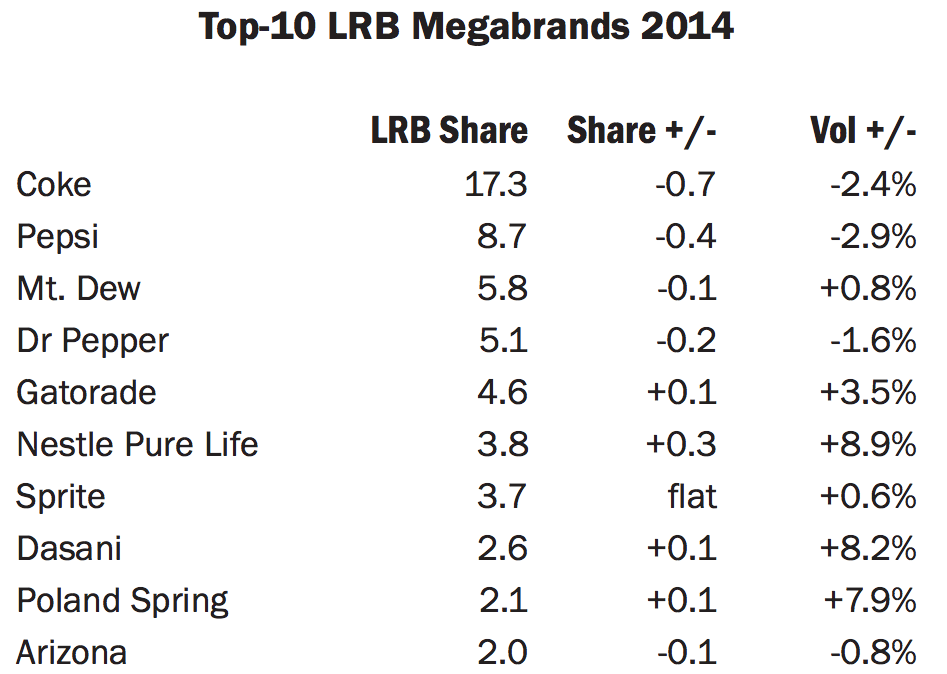

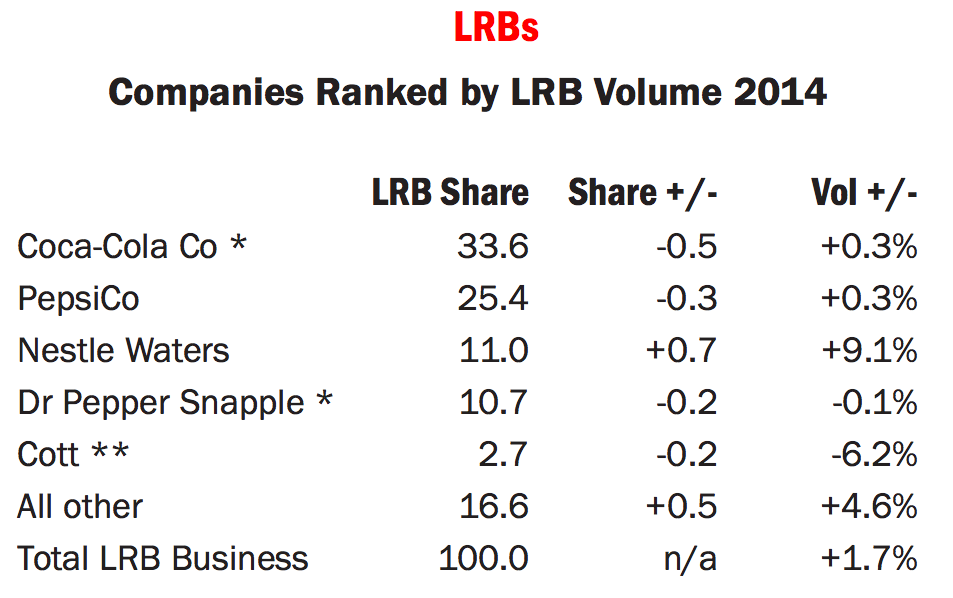

But the real action in the industry is away from sodas altogether. While Pepsi-Cola took the No. 2 spot in carbonated soft drinks, the bigger trend played out in the broader market for liquid refreshment beverages (LRBs), as the industry calls them. Encompassing water, iced teas, juices, and sodas, the LRB market has a new No. 3 company chasing after Coca Cola and PepsiCo: Nestlé Waters, which overtook Dr Pepper Snapple.

Nestlé's rise, driven by bottled water, isn't the exception. "A look at

the top megabrands tells the story, in a nutshell, of where the growth is coming from: bottled water," Beverage Digest said.

The three fastest-growing "megabrands" in the industry, defined as drink brands selling more 100 million cases per year, are all waters. (A case is equivalent to 192 fluid ounces.)