“In most sports, young athletes spend years honing skills that they’ll never use when they’re older,” the cartoon video begins, panning over a dejected football player, cheerleader, and lacrosse goalie. “But one sport provides a gateway to a lifetime of enjoyment and expertise: shooting sports.”

That’s from the homepage of the USA High School Clay Target League, the independent, nonprofit provider of what it says is America’s fastest-growing and safest high school sport: target shooting.

This co-ed league, open to students in grades 6 through 12, has grown rapidly in recent years, with 8,600 student athletes participating at last count and more than 12,000 estimated to participate next year, according to founder Jim Sable. With after-school practice at gun clubs, shotguns for equipment, and the promise of new lifelong gun enthusiasts, the league also highlights one of the great hopes of the American firearm industry, which is still straightening itself out after a record-breaking sales frenzy in 2013.

Sporting goods retailer Cabela’s, which is a sponsor for the league, mentioned it in September as a positive for sales, and Sable says the sport has breathed new life into gun clubs in his home state of Minnesota.

The gun business needs more young people to become its favorite kind of customer: people who own and shoot guns not just for self-defense or hunting or constitutional principles but for the downright fun of it. After a decade of massive growth, investors expect companies to keep sales at levels that once seemed like temporary highs, and to do that, gun makers and retailers can’t just rely on hunters buying a new rifle every decade and a box of ammo every year.

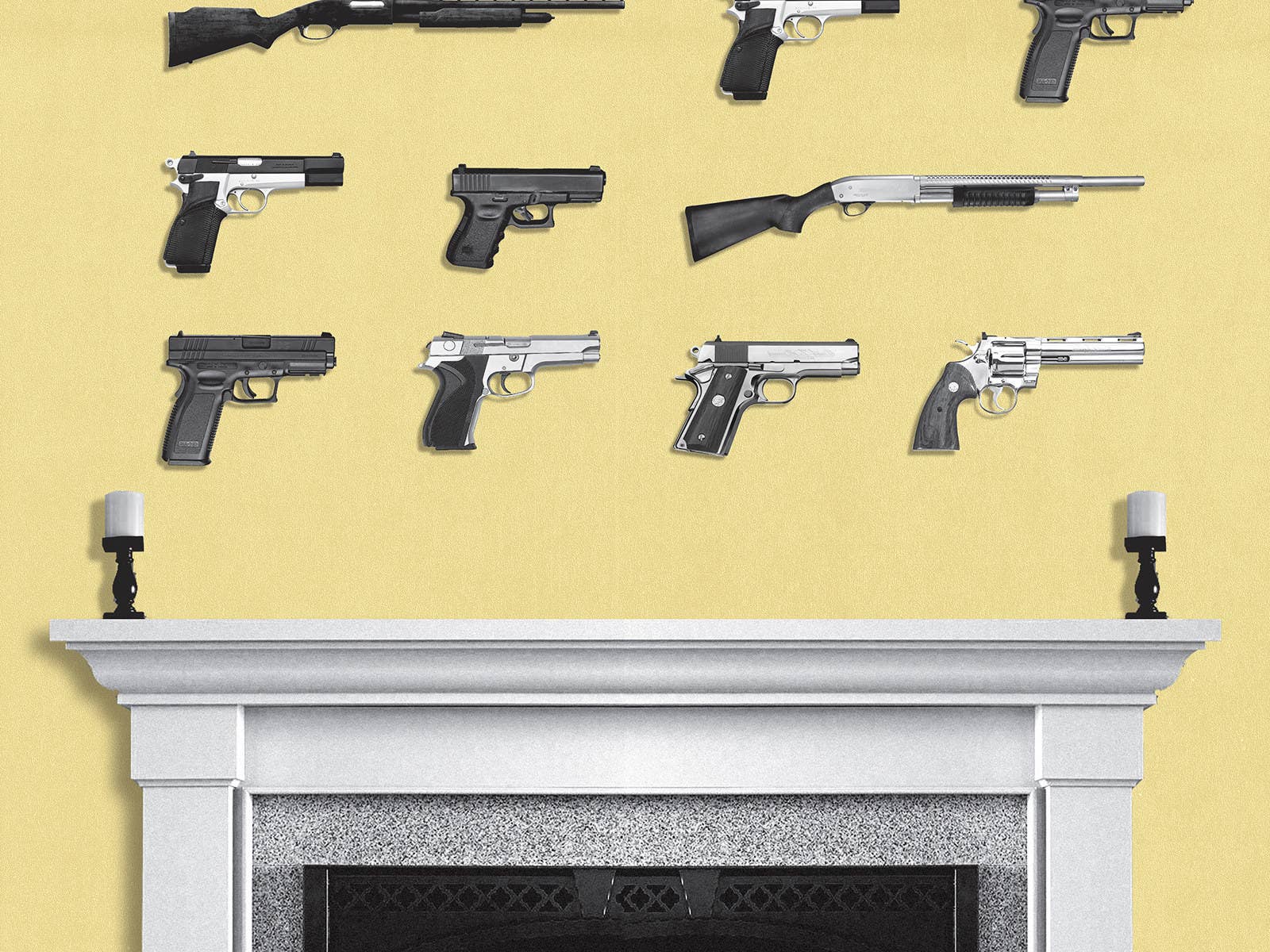

The industry needs people to buy guns the way nerds buy gadgets or fashionistas buy shoes. These are the kind of customers that predictable, long-term growth is built on, even if it’s not the reason sales of guns and ammo have periodically spiked over the past 15 years.

Those spikes have largely been driven by fear — fear for one’s safety, or fear that the government will tighten gun laws. There was a surge in demand after Sept. 11, 2001, “as a direct result of the terrorist acts,” Smith & Wesson wrote in its 2005 annual report. As Americans turned their attention to personal security, the company went from manufacturing about 10,200 handguns a month pre-9/11 to 28,000 a month a few years later.

More surges followed: in the wake of mass shootings; around the 2008 and 2012 presidential elections; and during the economic downturn, helped by looser concealed carry laws. Demand hit an all-time high in 2013 after a gunman slaughtered 26 people, including 20 children, at Sandy Hook Elementary School in Newtown, Connecticut, at the end of 2012 — gun buyers became so convinced that a crackdown was approaching that the industry was hit by “panic buying,” Ed Stack, the CEO of Dick’s Sporting Goods, said on a conference call last year.

Sales have since settled — though at levels double or triple what they were a decade ago — leaving retailers and manufacturers to work their way through an inventory glut. There may be more sales spikes ahead, with a contentious election cycle underway and rising fears of terrorist attacks.

But with pressure from investors to keep sales growing, even from the already-elevated level after the boom decade, the industry is searching for new ideas.

For companies unable to grow sales outside of the periodic bursts of panic buying, results can be dire. Colt Defense, the iconic gunmaker founded by Samuel Colt in the 1800s, blamed its bankruptcy this summer in part on “a commercial sales bubble in 2013 driven by fears of increased future regulation.”

So how to appeal to an entirely new base of customers? Executives have repeatedly brought up one idea in conference calls and in interviews lately: Make guns more fun.

“The first-time gun buyer, especially today, may be purchasing that first firearm for self-defense,” Mike Fifer, the CEO of Sturm Ruger & Co. said on a call with analysts a year ago. “And some of them will never get beyond that. They'll buy the gun with some apprehension and reluctance and they either won't shoot it at all or hope they never use it. And we're not going to win them over as gun buyers.”

But among those first-time purchasers are people who will “accidentally discover that it's really, really a lot of fun,” he said. “And the minute that happens and then they start seeing what guns their friends have, they got the bug and we got a customer for life and new products are going to win them over.”

That dynamic has the industry focused on recreational shooters over hunters, especially after the sales surge in 2013, which Stack said “really brought shooters into the industry.” While there’s overlap between the two groups, the recreational shooter is the one “going to pistol ranges and shooting in leagues or going to gun clubs and shooting skeet, trap, those kinds of things," he said. They’re also more likely to be whizzing through bullets and buying more guns for more purposes.

The industry is embracing “the beauty of the recreational shooter,” Tommy Millner, the CEO of Cabela's, said at a September conference, noting an increase of women and young people in shooting sports. “The hunter shoots one bullet — that's not great for business. The recreational shooter shoots boxes of bullets. And clearly what we see both from our own friends and from our customers is for a new shooter, a gun is like a potato chip: You're not going to have just one.”

Millner continued: “So you get involved in trap shooting and somebody says, 'Let's go skeet shooting.' Well, you need a different gun to go skeet shooting. And if you're going to go sporting clay shooting, well, you need another gun. And if you're a female handgun target shooter, you may start with a revolver and then your girlfriend has a pistol and you want to shoot that and you like that and you go buy one. So it's been the case with male participants for years, nobody just owns one. And those are really good healthy dynamics for our whole industry, our competitors, ourselves, and our suppliers.”

The size of the commercial firearms, ammunition, and accessories markets in the U.S., in aggregate, was estimated to be $14 billion in 2013, according to an annual report from Remington Outdoor, one of America’s biggest manufacturers of commercial firearms and ammunition. Most manufacturers and retailers that publicly disclose revenue report less than $1 billion a year from guns and ammo, which is less than Lululemon’s yearly sales and a quarter of what Old Navy pulls in domestically.

Vista Outdoor makes most of its $2 billion in annual sales from shooting sports, a segment where ammo — like its Federal Premium brand — is the top-selling item. It has also reported the rise of the recreational shooter.

"A hunter might shoot a box of shells over two years, but a recreational shooter might shoot hundreds of rounds in a single weekend."

“A hunter might shoot a box of shells over two years, but a recreational shooter might shoot hundreds of rounds in a single weekend,” Vista CEO Mark DeYoung told OutdoorLife in February, acknowledging “a big shift” from hunting to recreational ammo sales. “And that consumer is also in the market for consumables — holsters, slings, optics, and other gear — made by the brands in our portfolio.”

Ammo is nearly as lucrative a business as guns. Remington, which owns brands like Bushmaster, Marlin, and Barnes Bullets, brought in 44% of its $939 million in sales last year from ammunition. (The private company, owned by Cerberus Capital Management, was formerly known as Freedom Group.) Ammo was also a more profitable business for the company, with profit margins of 29% compared to 18% for firearms.

Remington’s Bushmaster brand is best known as a leading maker of AR-15-style semiautomatic rifles, which have surged in popularity in the past 20 years by appealing to younger shooters and those less interested in traditional hunting. The guns, known as modern sporting rifles, are often referred to as “military-style assault weapons,” a designation loathed by enthusiasts who argue any militaristic similarity is cosmetic and that they “function like other semi-automatic civilian sporting firearms.”

A big draw of the AR-15-style rifle is how customizable it is, which is a boon for manufacturers and retailers. A New York Times story about the rifles in 2013 quoted a range officer in North Carolina as saying: “You can take the whole gun apart and replace any part you want to without special tools, without knowing a whole lot. ... They are Legos for guys.” In its latest annual filing, Remington said it’s “made acquisitions that enable us to provide components and parts to customize MSRs, allowing us to generate additional sales to existing customers, with component systems and parts often yielding higher margins than complete rifles.”

In August, Walmart, the country’s biggest seller of guns and ammunition, said it would stop selling modern sporting rifles based on lower consumer demand. In September, Cabela’s CEO noted Walmart won’t sell anything “that looks remotely tactical,” which is “a wonderful gift to us as the second largest seller of firearms in the United States.”

Jim Sable told BuzzFeed News he came up with the idea for the high school shooting league in 2001, after watching the average age at his gun club jump to the mid-fifties. He worked with the Minnesota Department of Natural Resources on an informal survey of gun clubs around the state and discovered 10% had gone out of business while another 10% were “hanging on by a thread,” with members even older than at his club.

"Why not go to the schools? That’s where the money is."

“A few people said, we ought to start inviting our children, grandchildren, nieces, and nephews, and I said, 'Well, anything we do will be good, but that all by itself is not going to be good enough because we aren’t going to attract the kinds of numbers that we need,'” said Sable, 77, who established the league as a nonprofit in 2011 and emphasized its focus on safety and sportsmanship.

“I always had a story in the back of my mind that I really enjoyed — back in the 1930s and 1940s, there was a bank robber by the name of Willie Sutton, and he had been arrested numerous times. On the last occasion, the people from the FBI that arrested him said, ‘Willie, why in the world do you keep robbing banks like this?’ And he said, ‘That’s where the money is.’

“And so I thought the same philosophy works here: Why not go to the schools? That’s where the money is.”

It was easier than anyone expected. The league’s website says Sable met with his first athletic director the same day the front page of the local newspaper was dominated by the story of a young man who used the service revolver of his retired police officer grandfather to murder him — then went on a school shooting rampage.

Now, the league, which is accident-free, has expanded to Wisconsin and North Dakota, and 18 other states have expressed interest in starting their own chapters, Sable said. As Bloomberg News reported in July, gun-control advocates haven’t opposed trap shooting as a school sport. Sable said students must obtain a state firearm safety certificate and know they can't bring guns on to school property.

The league may be growing, but hunting and household gun ownership are both on the decline. Last year, a record low of 15.4% of adults lived in households where they or their spouse were hunters, down from a peak of 31.6% in 1977, according to the General Social Survey from NORC, an independent research organization at the University of Chicago. The survey also said just under 35% of adults lived in a household with a firearm in 2014 and 2010, compared with about 50% in 1980.

"Fewer gun owners [are] owning more guns."

“While reliable gun ownership data is difficult to come by, we can safely say that gun ownership is becoming increasingly concentrated,” James Hardiman, an analyst at Wedbush Securities, wrote in an Oct. 12 note recommending Smith & Wesson shares. “Fewer gun owners [are] owning more guns, as guns are primarily marketed to people who already own guns.”

A 2011 survey of more than 10,000 handgun owners found that the average respondent had about seven guns, with 90% responding that they owned more than one, according to the National Shooting Sports Foundation, a trade group. Smith & Wesson CEO James Debney cited the statistic on a 2014 conference call, noting “it just gives you some insight into the collective mentality of people who own firearms.”

That’s not an unusual dynamic — Neiman Marcus recently said that its loyalty program members with “reward status” account for a staggering 40% of its annual revenue, spending 11 times more in a year than other customers. Luxury carmakers like Ferrari have said most of their U.S. sales are to repeat customers.

That collector mentality is reflected in how Sturm Ruger’s business can turn on the bells and whistles of its new pistols, rifles, and revolvers. New product introductions accounted for only 16% of its $542 million in firearm sales last year. In 2013, new products made up 29% of its record $679 million in gun sales, and in 2012, it was 38% of $485 million. Fifer, its CEO, noted last year that gun enthusiasts are “always just looking for an excuse to buy another gun and the best excuse is some cool new features or appearance or special edition.”

Sportsman’s Warehouse, a retail chain that makes almost half of its $660 million in annual sales from hunting and shooting, believes its vast firearm selection will help it steal some business from local mom-and-pop stores, which it estimates command 65% of outdoor activity and sporting goods equipment sales.

“You have a store that you're competing against, some mom-and-pop that has only 25 firearms to choose from, and you walk into that community and you offer 300 different firearms, you're going to get people excited about buying,” CEO John Schaefer said at a September conference. It helps that a lot of industry marketing is centered on the availability of new products, he said.

He continued: “To a lot of our customers, our male customers, buying firearms is akin to females buying shoes. They want to have 20 or 30 firearms. Don't ask me why. They think they're cool. But if you only have 25 to choose from, maybe you buy two. If you have 300 to choose from, over a number of years, you're probably going to end up with 10 or 15 firearms. And we know that because a lot of our customers will talk and they'll brag about having 30 or 40 firearms.”

The National Shooting Sports Foundation estimates the average target shooter recruited at 16 years old spends about $75,000 on the sport in their lifetime. Sable noted that even before college, a sixth-grader in the program might start out with a youth model shotgun, hit a growth spurt, and get another gun, then buy yet another gun before graduation.

"They want to have 20 or 30 firearms. Don't ask me why. They think they're cool."

Hunting and shootings sports advocates have been brainstorming ways to appeal to young people in recent years. The Hunting Heritage Trust and the National Shooting Sports Foundation commissioned a survey of 8- to 17-year-olds in 2012 that centered on the influence of peers in youth attitudes toward hunting and shooting. A subsequent report on the NSSF’s website concluded: “The more familiar youth are with individuals their own age who participate in hunting and shooting, the more likely they will be to support and actively participate in these activities.”

That’s in line with what Fifer, the Sturm Ruger CEO, told Shooting Sports Retailer last year — that every shooter needs to introduce 12 new people to shooting each year.

The NSSF report, which found respondents to be more enthusiastic about target shooting than hunting, recommended making a youth ambassador program to help build social acceptance of both sports. A big part of that job is helping their friends discover the fun of shooting.

“Youth ambassadors and others should focus on getting newcomers to take a first step into target shooting through any means, whether a BB or pellet gun, paintball gun, or archery bow,” the report said. “The point should be to get newcomers started shooting something, with the natural next step being a move toward actual firearms.”