Executives at business news cable network CNBC are threatening to file a breach of contract lawsuit against a producer who left to become chief executive of StockTwits, which describes itself as a real-time social network for investors and traders, according to two sources close to the situation.

StockTwits two weeks ago hired John Melloy, a seven-year veteran of CNBC who produced the network's Fast Money Halftime Report and Fast Money shows in addition to writing its Behind the Money blog, as its new CEO. And while Melloy told Business Insider that it was his decision to leave CNBC, he is apparently still under contract with the network, meaning that he wasn't an at-will employee free to leave at any time, sources said.

According to both sources, part of the reason why Melloy left CNBC is because executives rebuffed his overtures for a broader role with more involvement on the digital side of the business.

"He wanted to do something more creative and in the news flow," this source said.

That CNBC, a cable network worth several billion dollars, is even considering filing a lawsuit against a relatively unknown producer underscores the rise of social media, particularly Twitter and websites like StockTwits that seek to leverage Twitter's reach, as a medium for breaking news and information. Typically, such legal remedies are reserved for high-ranking executives who are attempting to leave one company to go to a direct competitor, which in this case would more traditionally be defined as another cable news network such as Fox Business, Bloomberg, or perhaps even CNN.

Indeed, if CNBC does move forward with a lawsuit against Melloy, one of the sources said the cause it would most likely pursue would be "exclusivity," meaning that Melloy is only authorized to work for and get paid by CNBC while under contract.

A CNBC representative said the network does not comment on the contract status of employees. Howard Lindzon, the founder of StockTwits who will move into the chairman role to make room for Melloy, declined comment. Melloy, who both sources said was "well-liked and well-respected" inside the CNBC newsroom, did not respond to a request for comment.

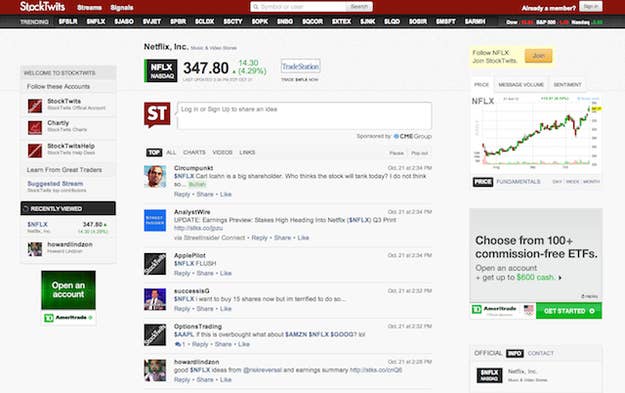

Lindzon founded StockTwits in 2008, and according to its website, it created the $TICKER tag "to enable and organize 'streams' of information around stocks and markets across the web and social media." Put simply, users can search for information about a particular publicly traded company by employing a dollar sign and its stock market ticker symbol (for example, $GE would be used for General Electric). StockTwits claims more than 200,000 users and an audience of more than 40 million for its streams.

While most Wall Street firms still largely ban access to social media networks at the office, Twitter specifically took a big leap forward in April when it was announced that tweets would be incorporated into Bloomberg terminals — thus allowing traders, bankers, and other executives a backdoor way to monitor social media buzz about companies they follow.

At the time of the announcement, Bloomberg executive Brian Rooney told the New York Times that, "We were getting requests from customers who were seeing news they wanted to be aware of on Twitter."

Earlier this year, the U.S. Securities and Exchange Commission had to formalize rules for social media use as everyone from Netflix Chief Executive Reed Hastings to hedge fund billionaire Carl Icahn has taken to the service to disseminate news and information about their companies and investments.

CNBC has recently been pouring resources into expanding its staff and coverage on the digital side. Its website, CNBC.com, scored its second-best month ever in terms of unique visitors in August with 9.3 million.

While its size currently dwarfs StockTwits, one of the sources described the threat of a lawsuit against Melloy as about setting a precedent for the future, particularly as it relates to digital news.

"They're worried about the next person who tries to leave for, say, WSJ.com or CNN.com," this source said. "Melloy is smart, competent, and has a lot of contacts on Wall Street. You wouldn't want to lose him to one of those guys."