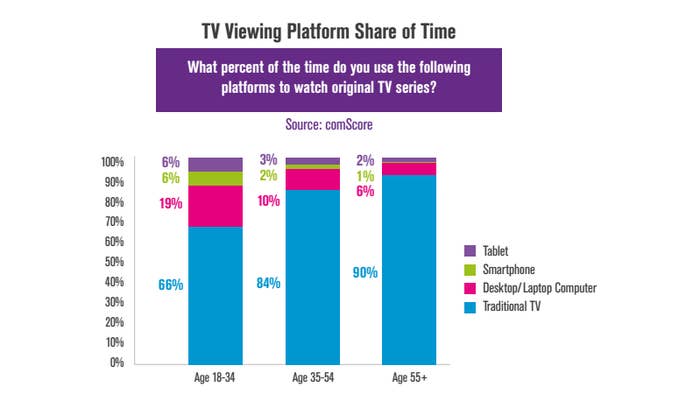

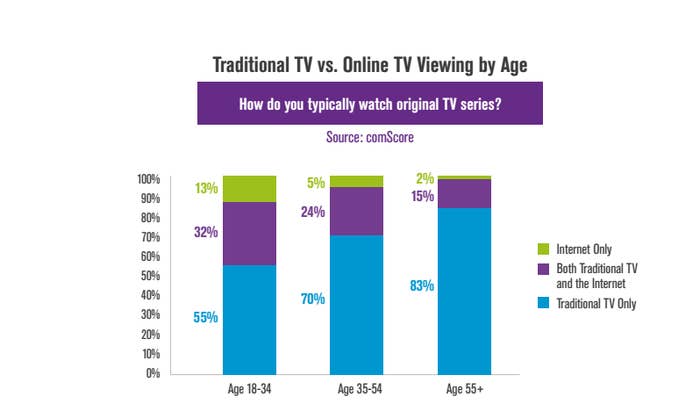

New research out from digital marketing firm ComScore offers the latest evidence that the television is well on its way to becoming the third screen for anyone under the age of 35. According to ComScore's research, about one-third of all television viewing for people between the ages of 18–34 is done on computers, tablets, or smartphones, and nearly half of all viewing in that demographic is done either solely on the internet or a combination of on TV and the internet.

What that means is that it won't be long before those numbers are flipped and viewing on computers and mobile devices overtakes the television for TV watching.

"Younger generations are more likely to watch an original series online, with

45 percent of them watching via the internet, including 13 percent doing so

exclusively," ComScore's research found.

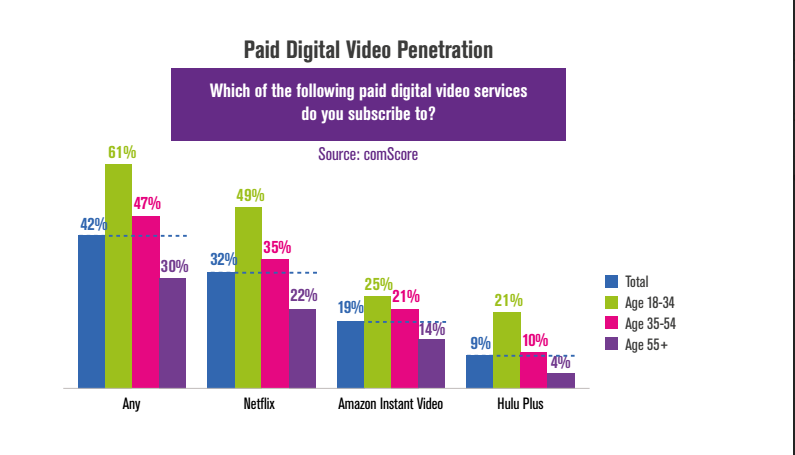

ComScore's research shows that twentysomethings are perfectly willing to pay for a video service that gives them what they want, when they want, across devices, ad-free.

According to ComScore, about 4 in 10 households subscribe to a paid digital video subscription service, with subscriptions among twentysomethings higher than other demographics.

Cable network owners and their distributors (cable, satellite, telecos) currently aren't giving them what they want, so they aren't subscribing to those services.

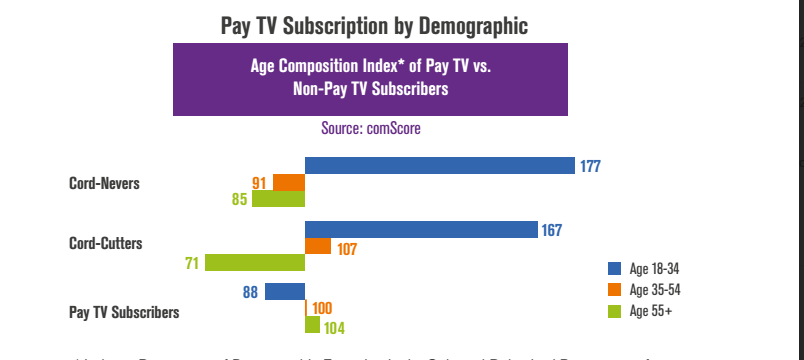

"Cord-nevers are a new phenomenon resulting from a growing number of online video options and the rising costs of pay-TV, which have made subscriptions less justifiable for smaller households," the report said.

ComScore's research aligns well with other data points — such as the continued decline in ratings, the push among networks to get DVR viewing up to seven days after a show airs counted in the ratings, the rise in binge viewing, broadband subscribers overtaking video subscribers at cable companies, and the increasing blackout of networks over high license fee demands — that suggest that consumers are less likely to subscribe to a traditional pay-TV package as more options from Netflix to Apple TV to Xbox emerge.

"About 1 out of 6 Millennials said they did not watch any original TV series

from traditional TV sets within the past 30 days, a significant trend highlighting

the potential for linear TV viewing to erode over time," ComScore's research found.

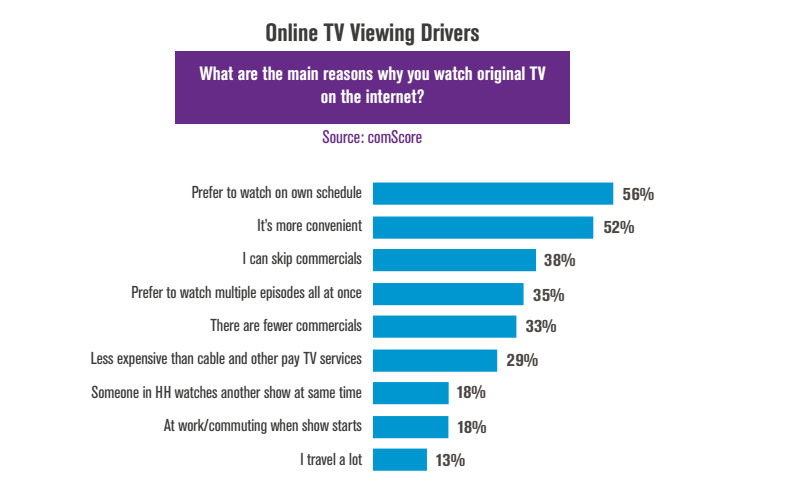

As this chart shows, people are watching TV online and on demand more for convenience than cost.

What this means is that smaller, cheaper, streaming-only TV bundles are not just inevitable, they will eventually become the norm.

For pay-TV distributors and network owners to adapt and evolve, they will eventually have to offer smaller, cheaper streaming-only TV bundles — in many cases as their primary or only type of video subscription. After all, Netflix, Hulu Plus, Amazon Prime, and other such services basically offer network TV shows disaggregated from their networks that allow for on-demand and binge viewing across devices for a low monthly subscription fee.

Put another way: exactly what consumers want.

Younger consumers are perfectly happy to never have their houses wired for video and rely solely on a patchwork of digital distributors to deliver their TV and they are willing to pay for them. Continuing to frame the debate and the business around a simply dichotomy of an "all you can eat" bundle of networks or an "a la carte" channel choice is both disingenuous and alienating — consumers, particularly younger ones, can see that it is an argument built solely to protect the bottom line.

Small wonder then that Dish, Sony, and Verizon are all planning to launch streaming video services between now and the middle of next year. AT&T's impending purchase of DirecTV will allow those companies to experiment with all kinds of streaming offerings to mobile devices, and Comcast's improvements to its set-top box and cloud-based DVR appear to set the stage for it to launch a streaming video service after its Time Warner Cable deal is approved.

Smaller, cheaper, streaming-only TV bundles are not just inevitable, they will eventually become the norm. Who consumers subscribe to for them is a fight only just beginning.

Methodology: ComSore's report is based on answers to an online survey of 1,159 people from Aug. 21 through Aug. 28. The report also didn't measure for web-only, non-TV content. As such, the results for digital viewing generally and of TV shows specifically may be higher than normal.