Snapchat

What it's worth: At least $3 billion, based on a reported offer at that price from Facebook that it rejected.

Why it's worth that much: Snapchat is perhaps the tech world's hottest app — in part because it is popular with teenagers and 20-somethings. That's an audience that's attractive for advertisers, as well as companies like Facebook.

Justification Rating: 3. There is a lot of "potential" ways for Snapchat to make money, but as of right now it still doesn't have any revenue. Further, its founders are in the middle of a lawsuit with one of its alleged cofounders, the company's database was hacked over the holiday break, and it is still shaking off a stigma that management is in over their collective heads. This year is basically a make or break period for Snapchat.

Nest Labs

What it's worth: $2 billion

Why it's worth that much: Nest Labs is defining new smart product categories for home-owners starting with a learning thermostat and a smoke and carbon monoxide detector. Its continued ability to raise large amounts of money speaks to the confidence its investors have in the business.

Justification rating: 4. Nest may be able to change homeowner behavior, unlocking new product categories that didn't exist, and turning them into whole businesses. But, still, producing hardware is a difficult feat — and one slip-up can lead to major problems for the company as a whole.

Spotify

What it's worth: $4 billion.

Why it's worth that much: Spotify is generating a decent amount of revenue, continuing to grow, and has an obvious way of making money with its subscription-based music service. Spotify in November said it had more than 6 million paying subscribers.

Justification rating: 5. Put simply, the more money Spotify makes, the more it has to pay out to the music's rights holders — record labels could always renegotiate the royalty fees Spotify pays them for the right to stream songs, making it hard for the company to earn actual income. That being said, as traditional businesses deteriorate, record labels have been more inclined to work with new services.

Box

What it's worth: $2 billion.

Why it's worth that much: Box was one of the first cloud-based storage providers to explicitly target businesses as its core customer base. As a result, the company has locked up a significant number of the Fortune 500 as clients for its file-sharing and collaboration services.

Justification rating: 6. Box is certainly well on its way to a successful IPO. However, the company has raised an extraordinary amount of money and has a history of burning through that cash rather rapidly in order to expand growth through hiring and marketing. It's going to have to reign that in to justify a successful IPO on par with comparable companies such as Workday.

Evernote

What it's worth: $2 billion, as of its last fundraising round.

Why it's worth that much: The online note service has more than 80 million users, and in June 2012 CEO Phil Libin said the company had 1.4 million paying members (when it had around 34 million users overall). Basically, the company continues to grow at a healthy rate and has an obvious business model.

Justification rating: 7. Evernote is actually making money, but the digital note-taking company hasn't yet found a way to branch out into other services. Sure, it has acquired some companies like Skitch, a lightweight photo markup app, and has moved into physical products like bags and notebooks. But it's not clear if these will pan out to be as successful — on their own and as companions — to Evernote's core business.

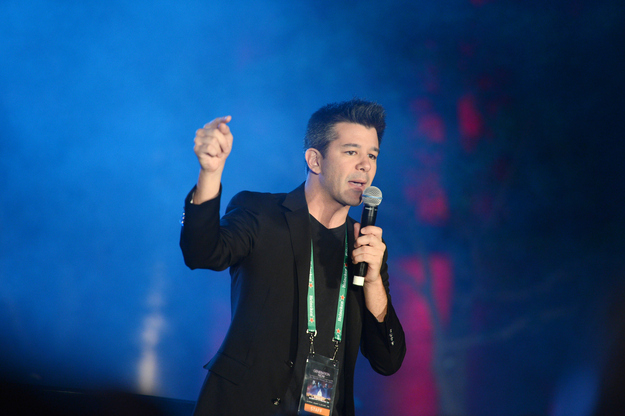

Uber

What it's worth: $3.5 billion.

Why it's worth that much: Based on some internal revenue numbers, Uber is already on track for $1 billion in gross bookings before it takes its personal cut. The company continues to expand to additional cities, and has shown it can continually beat back regulatory issues with local taxi agencies.

Justification rating: 7. Even with its jaw-dropping run-rate for the service, Uber has a penchant for attracting outrage from users. It is being chastised for high pricing during "surge" periods that can reach well into the hundreds of dollars. And while Uber's pricing is based on demand, it still has to balance being pragmatic and keeping its user base happy while fending off a spat of emerging competitors like Lyft.

Airbnb

What it's worth: $2.5 billion, as of its last fundraising round in 2012. (In reality, it is probably worth more today.)

Why it's worth that much: Airbnb, like Uber, serves another obvious supply efficiency problem — matching travelers to a home or apartment owner's empty room, and vice versa. The company has an obvious business model and continues to grow and scale as more rooms are added.

Justification rating: 8. Airbnb is encountering some legal problems in places like New York, and has to invest time, money, and energy in finding ways around those local legal problems.

What it's worth: About $4 billion.

Why it's worth that much: While it might not be as big as Facebook, Pinterest's user base is highly engaged. Pinterest also has obvious commerce applications as a sort of visual shopping experience: things that are probably useful for sitting are logically grouped together without needing a specific keyword like "chair" in the name.

Justification rating: 8. While many in the retail industry see Pinterest as having enormous potential to drive traffic — and more importantly, conversions to sales — to major sites, currently it still has no revenue. Pinterest is also seen as a powerful discovery engine for things outside of products, such as video or photos, which also has powerful commerce applications. Pinterest is also starting to experiment a little bit with services like "promoted pins," though they haven't been rolled out to advertisers yet.

Dropbox

What it's worth: A reported $8 billion.

Why it's worth that much: The company has more than 200 million users and 4 million businesses on its online storage service. Both of those segments are willing to pay for more storage that can synchronize across all devices — like tablets, notebooks and smartphones. The company reportedly approached $200 million in sales for 2013.

Justification rating: 9. While Dropbox was already a popular consumer player running alongside Box, the company recently unveiled a version geared specifically towards businesses — which are typically much more willing to pay for secure online file storage than consumers. With a tiered subscription model and sort of agnostic approach to what files can be stored and accessed, the overall headroom for Dropbox is essentially the entire connected internet.

Xiaomi

What it's worth: A reported $10 billion.

Why it's worth that much: Xiaomi is one of the hottest phone manufacturers in China, often referred to as the country's Apple equivalent. In the opening three minutes of China's "Single's Day," Xiaomi said it sold 110,000 of its new Mi 3 phones.

Justification rating: 9. Xiaomi, at least at face value, appears to be emerging as one of the most popular phone manufacturers in China. If it continues to grow that base, as well as spread internationally, it won't be simply known as an Apple equivalent of China — it will be a separate beast entirely.

Alibaba

What it's worth: In excess of $100 billion.

Why it's worth that much: Just look at how Yahoo's stock has performed in recent months as a result of its Alibaba stake. The company's revenue has already broken the $1 billion mark in a quarter and is still growing at a break-neck pace, as is its overall income.

Justification rating: 10. Alibaba can't really even be called a startup any more at this point. Obvious commerce growth implications: check. Continuing revenue and income growth: check. Heavy mindshare among U.S. stakeholders thanks to Yahoo's investment in the company: check. The Chinese e-commerce giant is well on its way to being one of the most satisfying exits for investors anywhere — especially Yahoo.