After failing to sell the company, BlackBerry once again reported a huge loss today that included a $1.6 billion reduction due to unsold smartphones.

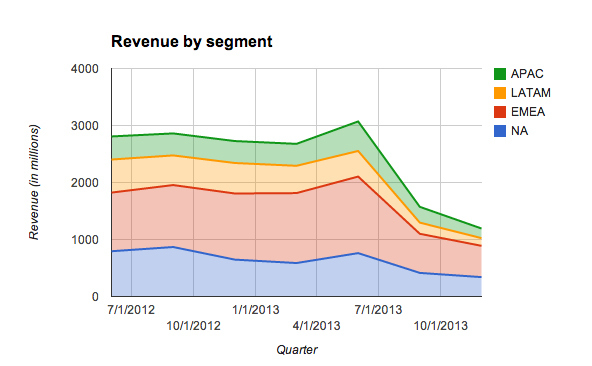

The company reported revenue of about $1.2 billion, compared to $2.7 billion in the same quarter a year earlier. Since the launch of BlackBerry 10 and the company's BB10 smartphones, it has basically seen its business evaporate — including a $1 billion write-down earlier this year on BlackBerry 10 smartphones.

More importantly, some of BlackBerry's biggest businesses have seen a massive drop-off, including revenue from Europe, Middle East and Africa (shortened to EMEA in industry parlance).

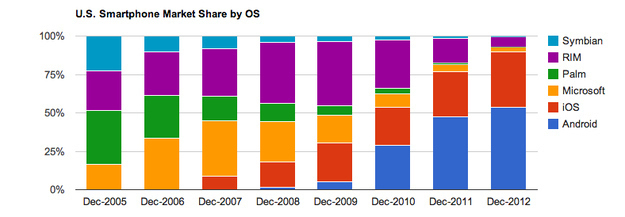

The culprit is pretty obvious — BlackBerry's smartphone empire was basically destroyed by the entry of the iPhone and smartphones powered by Google's Android operating system. Basically, employees began demanding that their companies allow them to use their iPhones at work in lieu of company-issued phones — typically BlackBerries.

As a result, the company had to re-create its entire smartphone empire, which it hoped to do with the touchscreen-equipped BlackBerry Z10 under new CEO Thorsten Heins. That didn't work, and BlackBerry ended up firing Heins and trying to sell the company — which also didn't work.

The company now says it plans to work with Foxconn to produce lower-cost smartphones under the leadership of new CEO John Chen. With $1 billion in the bank, the company is essentially now trying to find some kind of niche in the smartphone ecosystem, which has essentially been taken over by the iPhone and Android devices.

And, as a result, the stock price has basically plummeted, even in the past year.

But, given that shareholders are used to bad news from BlackBerry, the announcement that the company was going to work with Foxconn and try a few new things sent shares up more than 15 percent in trading today.