We already know that Goldman Sachs had a weak third quarter. Despite posting $1.4 billion in profits, revenue plunged 20% over the year, and its revenue from bonds, foreign exchange, commodities, and derivatives of all three (otherwise known as "FICC") fell 44% from a year ago.

Goldman had the biggest year-over-year drop in total revenue compared to its megabank peers.

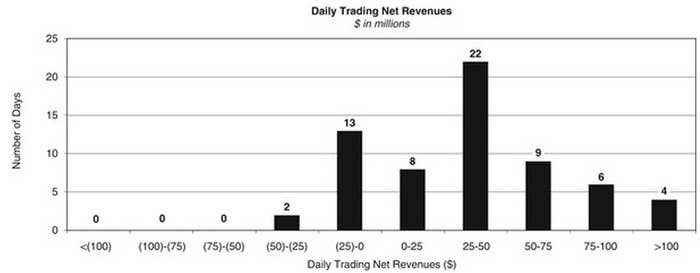

Another filing this morning has another way of describing how bad the quarter was: Goldman's traders lost money on 15 of 64 trading days.

On 13 of those days, the bank's traders lost less than $25 million and on the other two, somewhere between $25 million and $50 million. Last quarter, Goldman lost money trading on just two days, and did the same in the same quarter last year. In all of 2012, the bank only had 14 days of trading losses.

That many trading losses reflect Goldman's poor results in selling and trading bonds, derivatives products, currencies, and commodities, known on Wall Street as "FICC." Last year, FICC revenues of $9.9 billion were 29 percent of Goldman's annual revenues.

That changed last quarter: instead of wiping the floor with its competition like it usually does, the bank's $1.25 billion FICC revenue dropped 44%. Goldman's FICC revenues were less than Citi's, Bank of America's, and JPMorgan's.

Gary Cohn, Goldman's president and chief operating officer, told Bloomberg last month "We don't know precisely why we had a tough quarter, but the results are in, and I can tell you we had a tough quarter in fixed-income."