8. Best Buy

If any company seems poised to begin a death spiral, it's Best Buy. For many, its only purpose is to figure out what to buy with free shipping and lower prices on Amazon. But it appears that, for now, the company is turning around: The retailer has dramatically cut costs and recorded its best quarterly earnings in two years. But the last decade has been cruel on single-serving retailers like the now shuttered Circuit City, Borders, and Tower Records. Best Buy is surviving...for now.

7. Office Depot and OfficeMax

Being an office supplier is tough — the two most innovative and successful retailers (Amazon and Wal-Mart) are trying to destroy you, and if you're not Staples, you're stuck being No. 2 and No. 3 in a dying category. So Office Depot and OfficeMax decided to merge in a $1.17 billion deal in February. But the companies, which are both suffering sales and earnings declines, haven't completed the deal yet and still haven't picked a CEO for the merged company.

6. Sharp

The entire Japanese electronics industry has fallen off its collective pedestal, and the country as a whole has lost its reputation for having the most innovative, stylish, and highest-quality electronics (thanks to Apple and Samsung). No company has fallen on harder times than Sharp. The company has lost almost 1 trillion yen in the last two years, and its most successful product — LCD screens — is in the most competitive and commodity-like consumer electronics category. And so the company has sold parts of itself to rival electronics companies and is looking to raise about $1.7 billion through a sale of new stock, further hammering its existing shareholders.

5. Sears

Mark Cohen, the former CEO of Sears Canada, said it himself in June: The retailer is in a "death spiral" and is "damaged," following more than a decade of decline. Eddie Lampert, a hedge fund manager, is in charge of the company, and his management style earned a scathing Businessweek cover story. The company, which lost almost $200 million last quarter, has seen sales declines for more than six years — and even announced earlier this year it would start selling off locations to raise cash.

4. J.C. Penney

Ah, J.C. Penney. In one of the most disastrous "turnarounds" in corporate history, Apple retail chief Ron Johnson, with the support of hedge fund manager and former Penney board member Bill Ackman, managed to alienate customers and spook Wall Street while overseeing a $4 billion decline in sales during a disastrous 17-month tenure. While J.C. Penney's new management has reversed much of Johnson's changes — like bringing back rebates, ditching in-store Wi-Fi, and abandoning Johnson's "shop-in-shops" — the retailer is still hemorrhaging money, looking to raise nearly $1 billion through a stock sale, and has attracted vulture hedge fund investors looking for a discount buy.

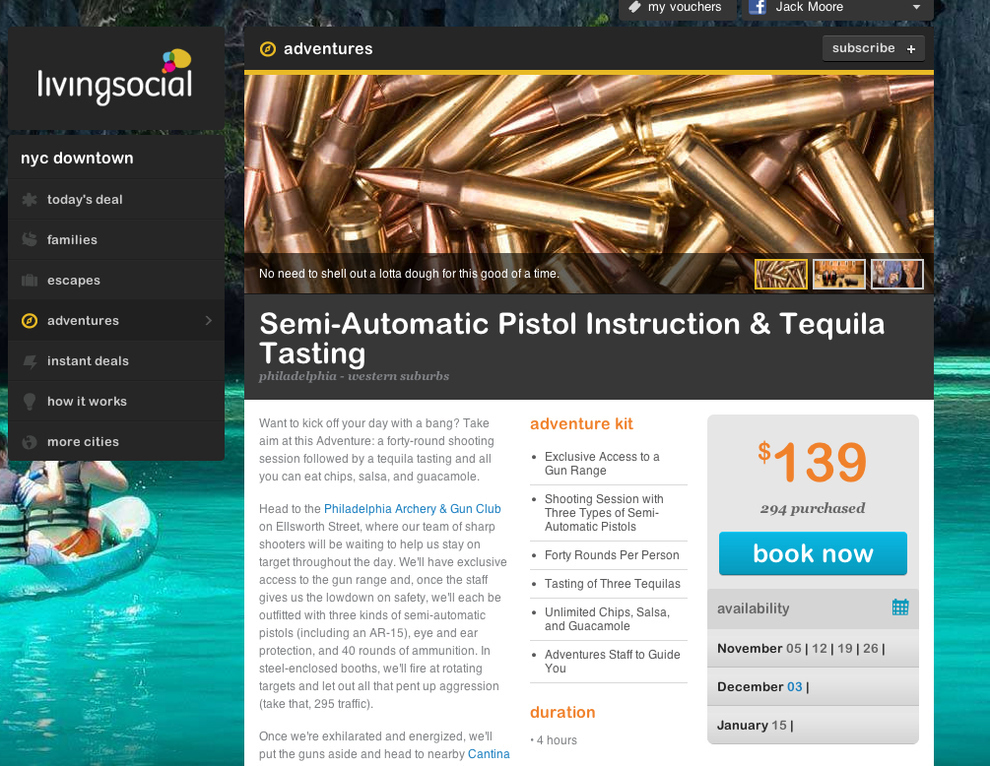

3. LivingSocial

The Groupon clone hasn't been able to shift to doing more straight-up retailing like its main rival and instead appears to be stuck in a classic death spiral, with large-scale layoffs late last year as well as this summer, and a declining product as more and more people view daily deals as something just above spam.

2. Dell

Fifteen years ago, when Steve Jobs came back to rescue Apple, Michael Dell, founder and CEO of the once-mighty PC giant Dell, told investors that if he were in charge of Apple he would "shut it down and give the money back to the shareholders." A decade and a half later, he took his own advice as it relates to his own company.

Amid a declining PC market, and after months of corporate sturm and drang, Dell was able to put his own stockholders out of their misery by getting their approval for a $25 billion buyout to take the company private. Dell said that with the company in private hands, he would be able to focus on investing in data centers and tablets without the pressure of having to please public shareholders every quarter. Not that they were pleased anyway.

1. BlackBerry

After previewing earnings that missed expectations by more than $1 billion, writing off its latest phone as a flop, and announcing it would lay off 4,500 employees, the BlackBerry saga may be coming to an end: The company agreed a week ago to sell itself to Fairfax Financial, a Canadian holding company, for $4.7 billion. In 2008, it was worth more than $80 billion.