The Christmas and New Year's holidays give much of corporate America a long vacation before the start of the new year — except corporate lawyers, that is.

Following what has become a late-December tradition, companies dropped some big news as 2015 drew to a close and fewer people were paying attention. Here are some of the best.

🎄 Pre-Christmas 🎄

1. SAC Capital settles class action over insider trading in Wyeth shares.

The hedge fund SAC Capital agreed to settle a lawsuit for $10 million. It was brought by shareholders of the pharmaceutical company Wyeth, who alleged they had lost money because of the fund's trading in those shares. The investors, which included the asset management firm KBC and the Birmingham, Alabama retirement system, claimed they had lost money buying shares in Wyeth when SAC was selling them.

A former SAC employee, Mathew Martoma, was found guilty of insider trading in 2014. The fund itself settled criminal charges and paid $1.8 billion. SAC Capital stopped managing outside investors' money and reformed as Point72 Asset Management, managing the wealth of its founder Steven A. Cohen and his employees. The settlement, which needs judicial approval, was disclosed in court papers on Dec. 23.

2. Investor Bill Gurley leaves the board of Grubhub.

Grubhub (which owns Seamless) announced on Christmas Eve in a regulatory filing that venture capitalist Bill Gurley would be leaving the board. His firm Benchmark first invested in GrubHub in 2010 and holds stakes in other companies like Uber and Yelp that are, or could potentially be, competitors. Gurley is a member of Uber's board of directors. Gurley told the Wall Street Journal that he was stepping down so that he could focus on new investments and younger companies.

3. Green Mountain reveals massive payday for its CEO and disappointing projections for its Kold.

Keurig unveiled the story of its acquisition by the German conglomerate JAB Group in a little-noticed filing the day before Christmas.

The company had received in January a "non-specific suggestion about a combination of" Keurig with a unnamed bidder described as "Party X." The company's stock was trading at almost $128. The company decided not to pursue a deal and one reason they cited was "the anticipated launch of the Keurig Kold" later in the year and "subsequent opportunities to provide products in other high-margin cold beverage categories using the Kold system." The unidentified bidder wouldn't cease pursuing a deal until June.

Keurig then would revise down its revenue projections three times before being agreeing to sell itself. It expects $47 million of revenue in 2016. The projections, which the company assigned a 50% probability to, don't show Kold revenue matching its revenue from hot products until early next decade.

Keurig started talking to JAB in July and also received interest from another potential bidder in November, before announcing the deal with JAB in December, for $92 per share, almost $14 billion.

When JAB first met with Keurig, the pod-and-device maker's stock was trading at $56 per share. By the time JAB and Keurig announced the deal, the stock was down to $51.70, a big decline from $132 at the beginning of 2015.

The drop had worried Coca Cola's Chief Executive Muhtar Kent, the filling said. Kent requested a meeting in June with Keurig CEO Brian Kelley and the company's chairman "to discuss Keurig's strategic direction" and his "concern regarding Keurig's declining stock price."

Kelley will be eligible for a total golden parachute payment of $23.7 million if the acquisition goes through and he loses his job, the filing says.

🎉 Pre-New Year's 🎉

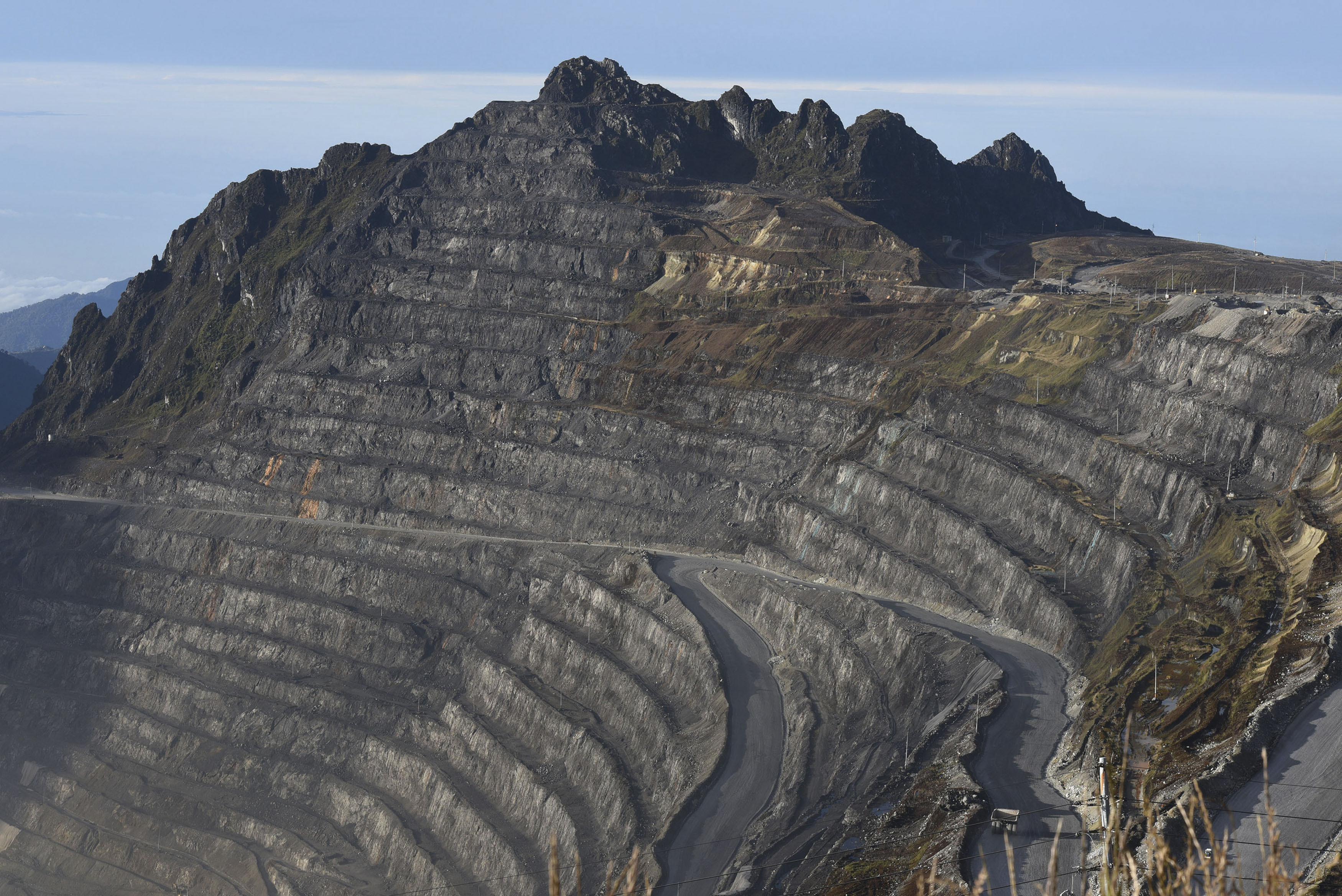

4. Mining giant gives its departing CEO an $80 million retirement gift.

When James R. Moffett, better known as "Jim Bob," agreed to leave his role as executive chairman at the mining giant Freeport-McMoRan, the Phoenix-based company paved an easy exit for him. In a filing the Monday after Christmas, the company detailed that he would receive a combination of severance payments and accumulated stock and benefits valued at almost $80 million.

A portion of Moffett's retirement package comes in stock options he's accumulated. With Freeprot's stock price at $6.79, the options are worth little right now but could gain value if the stock picks up. He also has a $1.5 million consulting deal for 2016, along with use of company aircraft, an office at its headquarters, and administrative staff. Hammered by the crash in commodities prices, the company's stock has fallen 71%, after trading at just over $60 at the end of 2010. His severance pay is just over $16 million and his retirement plan benefit payment will come in at $27. 5 million, the filing says.

When the billionaire activist investor Carl Icahn took an 8.5% in Freeport-McMoRan in August, he said he would discuss "capital expenditures, executive compensation practices and capital structure," with the company's management and board of directors. Icahn then got two of his representatives on the company's board in October.

5. KaloBios files for bankruptcy.

KaloBios, the pharmaceutical company only recently taken over by loathed Wu-Tang patron Martin Shkreli, filed for bankruptcy in Delaware at 11:48 PM on Dec. 29.

After Shrkeli's arrest in December on securities and wire fraud charges, the company's stock was suspended and Shkreli was fired. KaloBios listed in its bankruptcy petition $8.4 million worth of assets and $1.9 million in liabilities. The company had just bought the rights earlier in the month to a treatment for Chagas disease, a parasitic infection native to Latin America.

KaloBios had been well-known for crushing a day trader who bet against the company's stock. The company's shares traded as high as $39.50 before it was delisted by the Nasdaq in December.

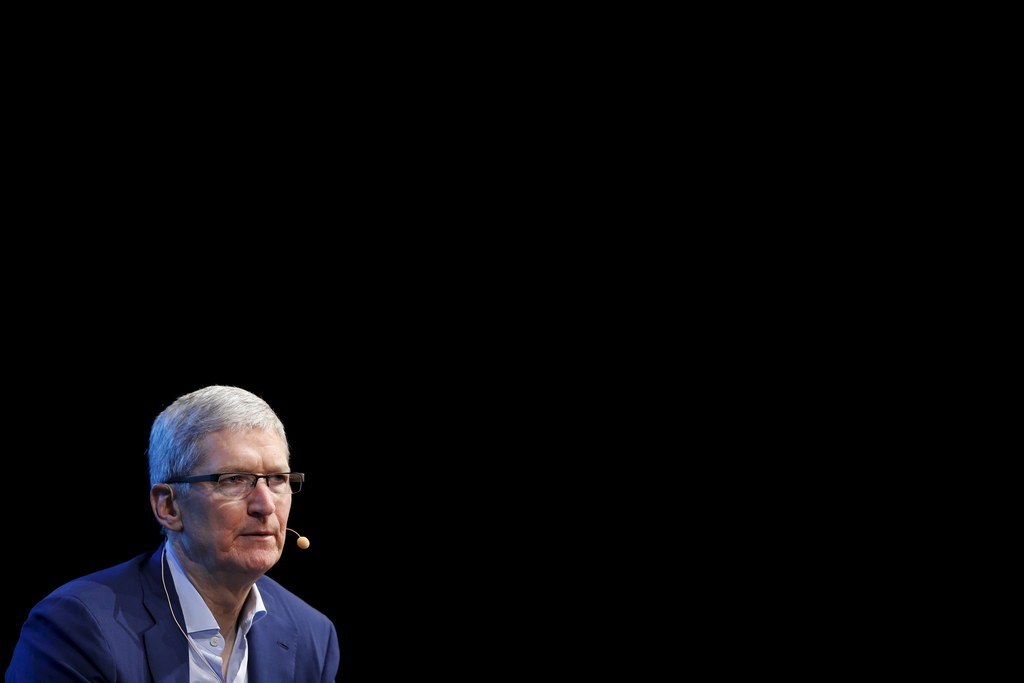

6. Apple settles Italian tax case.

Apple settled a longrunning tax dispute with Italian authorities, La Republicca reported. The €318 million ($347 million) tax bill is a substantial step down from the €880 million Italy alleged Apple didn't pay between 2008 and 2013. Apple has long faced criticism for how it structures its international operations so as to be taxed in low-taxed jurisdictions like Ireland. Tim Cook called criticism of Apple's taxpaying (or lack thereof) "political crap" in an interview with "60 Minutes" in December.