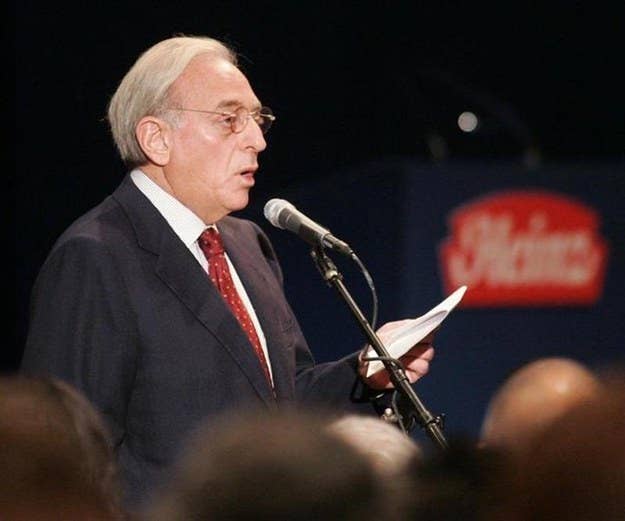

Trian Partners, the enormous hedge fund owned by Nelson Peltz, likes to keep its cards close to the vest. And the hand it's currently trying to conceal is a position in a stock that makes up at least 11% of its $5.8 billion portfolio. The mystery stake first disclosed by Trian itself in its first quarter letter in April, was subsequently not named in the fund's mandatory 13F disclosure for the quarter, the deadline for which was May 15.

So why didn't Trian have to reveal the name of its holding, especially such a large one, while most of its hedge fund industry peers divulged the makeup of their portfolios to the world? Special permission from the Securities and Exchange Commission that has allowed Trian an extension of its disclosure until the fund has completed establishing its entire stake.

That special permission involves a request for confidentiality by the SEC under the Freedom of Information Act to "protect" the investor, which the commission must then deem worthy of meeting one of nine limited FOIA provisions for withholding the information.

According to the SEC's Division of Investment Management, "Section 13(f)(5) of the Securities Exchange Act additionally provides that, in order to grant confidential treatment under section 13(f), the Commission must determine that such action is necessary or appropriate in the public interest and for the protection of investors or to maintain fair and orderly markets."

Representatives for both Trian Partners and the SEC did not return requests for comment.

In the eyes of other, smaller hedge fund managers, the operative word here is "special", especially given the fact that Trian has received such permission four times in the last three years. Other big fish like David Einhorn is are also fans of the disclosure exemption, in Einhorn's case often in an effort to thwart "copycat investors" or ahead of a big presentation at conferences like Ira Sohn and the Value Investing Congress. Warren Buffett has also used the delay tactic and, in some cases, has been granted permission to indefinitely withhold certain investments.

And while it's not unheard of for managers — especially large ones — to request a disclosure delay, approvals of such delays are becoming increasingly difficult to get, according to hedge fund managers and industry attorneys.

"You would have to make a Freedom of Information Act request for confidentiality if the manager feels that it is a confidential piece of business information that would be interrupted by this disclosure," said Dan Viola, a partner with Sadis & Goldberg specializing in hedge fund regulatory issues. "A lot of managers don't use it because generally they're reporting on stale information anyway. [Trian] could have written the request before they started to buy it or it depends on when they wrote it. They probably didn't want to alert the company. One idea is if they disclose that they're purchasing a large position and other people do, the price will go higher and it would impact their buying program."

Three hedge fund managers, two with activism experience, who spoke anonymously to BuzzFeed agreed with this assessment of Trian's potential motives, but questioned the fairness of the SEC's treatment of Trian in allowing the fund to delay its disclosure until well after the first quarter filing deadline.

In essence, the SEC creates the playing field, one of the managers said, adding that smaller industry peers would dislike the perception that Trian got special treatment over others, which would create an unlevel playing field.