Soaring numbers of would-be house-buyers are being forced into renting, thanks to spiralling house prices and falling real wages.

Home ownership in England has fallen to its lowest level in 29 years as younger people are locked out of the housing market.

But more people now own their homes outright than have a mortgage – many of whom are baby-boomers who snapped property up when it was far cheaper.

Campaigners said the latest English Housing Survey demonstrated the stark generational divide in housing. The National Housing Federation warned that people in their thirties are "seeing their chance of home ownership slip through their fingers".

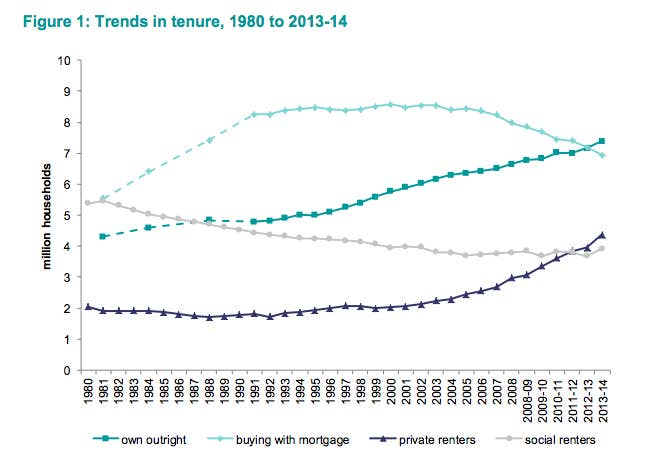

1. This graph shows how warped England's housing market has become, as people increasingly rent rather than own their own homes.

The purple line shows the growing number of households who are renting privately, while the light green line shows the falling number of households who are able to buy with a mortgage.

Some 19% of households were renting privately last year, up from 11% a decade ago. Meanwhile, for the first time since records began, more people now own their homes outright than have a mortgage.

Of the estimated 22.6 million households in England, 63% were owner-occupied last year, the lowest level since 1985.

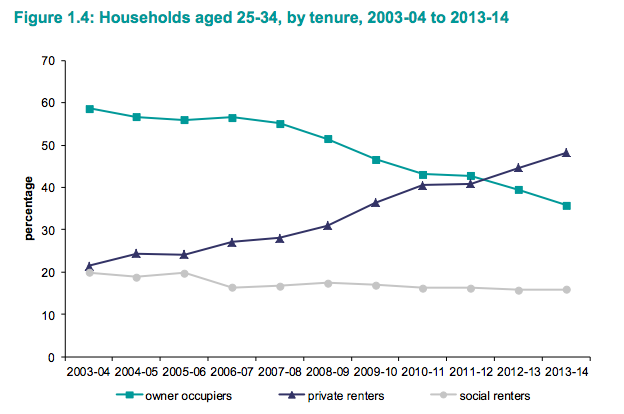

2. Households containing people aged 25–34 are decreasingly likely to own their house.

People aged between 25 and 34 are now far more likely to be renting privately than buy their own home.

Over the past decade, the proportion of private renters aged 25–34 has more than doubled from 21% to 48%. But the proportion who own their homes has dropped from 59% to 36%.

3. London, one of the most expensive cities in the world, has seen a surge in private renters over the last decade.

Soaring house prices in the capital have seen the proportion of private renters more than double from 14% to 30%.

Meanwhile, the proportion buying with a mortgage plummeted from 39% to 27%.

4. But the picture is different outside London, where there are still more people who own their homes than renters.

This graph shows trends in England excluding London. The proportion of private renters has doubled to 18% over the last decade – but that's still much lower than in London.

Owner-occupiers are by far the biggest group, although the proportion buying with a mortgage dropped from 43% in 2003–04 to 31% in 2013–14.

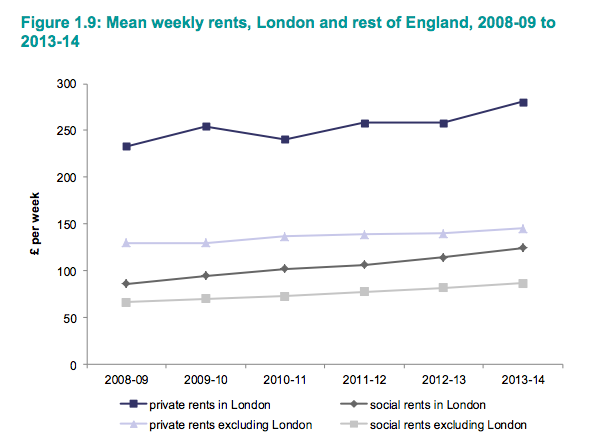

5. Meanwhile, rent bills keep on rising.

This shows how mean weekly rents in both the private and social sectors have increased in London and the rest of England.

The average private rent in London was £281 a week last year, far higher than the £145 outside the capital.

Housing charity Shelter said the figures were "a sign that we are moving closer to becoming a nation of renters".

Its chief executive, Campbell Robb, said: "These figures confirm what millions of people across the country are already feeling: A home of their own has become a distant dream, no matter how hard they work or save."

David Orr from the National Housing Federation added: "People in their thirties are seeing their chance of home ownership slip through their fingers as they struggle to save for the enormous deposits and mortgage payments, no matter how hard they work."