In his final Budget before the election, George Osborne announced a new Help to Buy ISA savings account.

Every pound that first-time buyers put towards their deposit will be matched by 25p from the government.

The problem is that people will be limited to saving £200 a month and £12,000 in total – meaning that they would have to save for five years to get the maximum £3,000 top-up. Also, that bonus will only be paid when they actually buy their home.

As a result, housing campaigners dismissed the handout as a "short-term solution" that fails to address the root cause of the housing crisis.

Osborne saved the surprise move until right at the end of his Budget statement on Wednesday.

"The Help to Buy ISA for first-time buyers works like this," he said. "For every £200 you save for your deposit, the Government will top it up with £50 more. It's as simple as this – we'll work hand in hand to help you buy your first home.

"This is a Budget that works for you. A 10% deposit on the average first home costs £15,000, so if you put in up to £12,000, we'll put in up to £3,000 more. A 25% top-up is equivalent to saving for a deposit from your pre-tax income – it's effectively a tax cut for first-time buyers."

The move is forecast to cost taxpayers just over £2 billion over the next parliament.

The Office for Budget Responsibility warned the estimated cost had a "very high uncertainty rating" because it wasn't clear how many people would take up the offer.

Experts warned that the plan would not address the underlying issue – a chronic lack of homes.

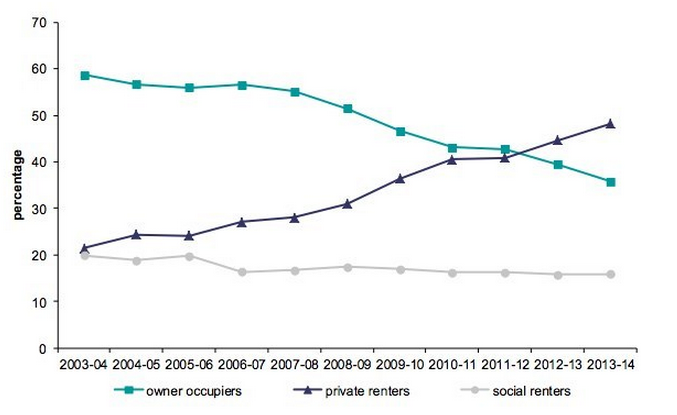

This chart shows how people are increasingly finding it hard to find housing. The purple line shows the growing number of households who are renting privately, while the light-green line shows the falling number able to buy with a mortgage.

Some 19% of households were renting privately last year, up from 11% a decade ago.

People aged between 25 and 34 are the worst off – they're now far more likely to be renting than owning their own home.

The National Housing Federation said the £2.1 billion cost of Osborne's plan could instead be used to help housing associations build 69,000 affordable homes.

Its chief executive, David Orr, added: "This is another short-term initiative for first-time buyers, not a Budget to end the housing crisis.

"We are pleased that the government recognises how difficult it is to get on the housing ladder. But the housing crisis is a long-term problem that calls for a long-term solution and one that affects more than just prospective buyers.

"The Help to Buy ISA will help people scrape together deposits but it fails to address the root cause of unaffordability – the chronic undersupply of homes, which has driven up prices."

Gavin Smart from the Chartered Institute of Housing agreed, saying Britain was "in the grip of a severe housing crisis".

"While the help to buy ISA may help some first-time buyers to overcome barriers to home ownership, it fails to address the fundamental problem – that we are simply not building enough homes," he added.

"Stimulating demand without also addressing the issue of supply runs the risk of further fuelling house price rises."