In a sense, new parents Shawn and Laura Lechette got $1,500 for nothing. In another, it was for asking.

The couple — whose employers, like most, don't provide paid family leave — raised the sum from friends and family, who donated via GoFundMe, the country's largest crowdfunding site for personal expenses. A search for "maternity leave" on the site yielded more than 1,200 results.

Just 12% of Americans, excluding those who work for the government, have access to paid time to spend with their newborns. Some of that 88% are now turning to crowd-funding to pay for the benefit.

"We definitely looked into other sources of funds for maternity leave, but none were available to us," said Mr. Lechette, 31, who works in retail.

While many associate modern crowdfunding with creative and entrepreneurial projects on sites like Kickstarter, personal finance campaigns (where donors don't receive rewards or payback) are also becoming more common, according to Ethan Mollick, an assistant professor at the Wharton Business School who studies the subject.

"Raising money from friends and family is the least financially expensive in a lot of ways, because they don't have the same incentives to make money from you that an investor would," Wollick said of the strategy. "Whether it's 'friends and family' versus venture capital funding or versus a payday loan, going to your own community is a better bet."

Personal crowd-funders may ask for help covering the cost of child care during an emergency, transportation to see a medical specialist, or to replace property lost during a disaster insurance won't cover. Sites like GoFundMe, GiveForward, YouCaring, and “Generosity” (formerly IndieGogo Life) offer platforms for these campaigns, charging modest percentages for facilitating.

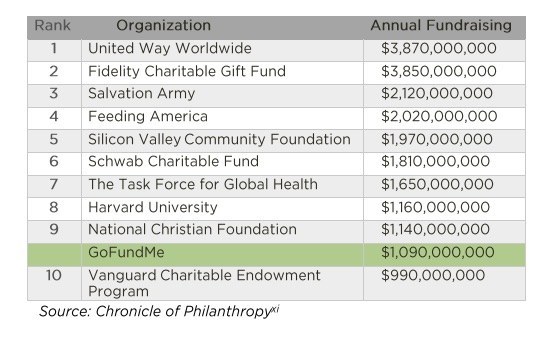

Total giving through crowd-funding (for all types) is expected to grow at 25% annually, according to Blackbaud Inc., a technology provider for the sites. Donations on GoFundMe alone — which exclusively funds personal campaigns (such as medical, emergency, and educational causes) — totaled more than $1 billion in 2015, rivaling America’s top charities.

Seeing a fast-growing model, Accel Partners and Technology Crossover Ventures purchased a majority stake in GoFundMe last summer, valuing the platform at about $600 million, the Wall Street Journal reported.

Funds raised by top charities and GoFundMe in 2015:

As predatory lenders rise — whether targeting students looking to pay for college or the 68 million "un-banked" Americans who rely on payday loans and pre-paid debit cards like RushCard — consumers like the Lechettes have found crowd-funding sites safer and cheaper ways to weather crises.

Most platforms charge a one-time facilitation fee (they average 5% to 8%, according to their sites), which are cheap and painless compared with the compounding nature of credit card debt and the high interest rates on payday loans (above 500% in states with no caps).

"Think of it as a loan you never have to pay back," said Dan Saper, CEO of YouCaring, another crowd-funding site dedicated to personal finance campaigns.

How they got here

Laura Lechette, 30, is a full-time veterinary technician. She and Shawn live in Delaware County, Pennsylvania, with their other two children. When Laura became pregnant in June 2015, they were doing well financially. But an unforeseen need for car and home repairs (totaling about $2,000) caused the pair to fall behind on their bills. With their credit rating pummeled, they couldn't get another type of loan and maxed out their credit cards.

Laura's job also abruptly changed her time-off policy: Instead of a week or two of time available at the beginning of the year (which she planned to use for maternity leave), employees would start to accrue vacation and sick days on January 1st. Under the new system, Laura accrued only eight hours by her due date. The Lechettes's daughter, Arwen, was born Wednesday.

The Lechettes's story is typical for parents in the United States, which still does not federally mandate paid leave (one of the only industrialized nations that doesn't) and a threadbare safety net when it comes to other welfare programs, like food stamps and subsidized housing.

But with money raised via crowd-funding, Laura and Shawn can cover some expenses, like rent, while putting earnings towards new needs like baby wipes and formula. Laura will still have return to work shortly after giving birth, like most American mothers, to keep bringing in wages.

No savings

A recent financial survey found that most Americans don't have as much as $1,000 of emergency savings, and would turn to a credit card or other sources to pay for in-a-bind expenses. Nearly one-third of members on YouCaring.com make less than $50,000 a year.

Josh Chapman, CEO of GiveForward, said that as more people have participated in campaigns (whether giving or raising funds), the stigma and taboo around asking has lessened, while awareness has increased. Both factors have led to a rise in site use, he said.

"At the highest level, people aren’t taking out a loan when they’re coming to GiveForward," he added. "They’re taking donations that are not going to be returned."

Chapman likened the system to the earliest forms of insurance, where a community pools resources to reduce risk — the expectation is that if a community member donates to a campaign, the campaign founder will likely donate to that friend in the future when he or she is in need.

Major insurance provider Nationwide, seeing a trend of increased personal crowd-funding, even partnered with platform GiveForward recently, investing an undisclosed amount in the site.

While there are some instances of fraud in the space, Wharton's Mollick says those occasions are rare. Since most givers to campaigns are friends and family, there's social oversight built into the system.

"When people feel accountable to other folks, the risk decreases," he said. "It’s easier to pull a fraud on strangers than it is on people you know and have a long-term relationship with."

"We went to crowd-funding because it wouldn't hurt our credit further or put us in an even worse spot if it wound up not working out," said Shawn, who called the experience "humbling." Floored by the generosity of their community, the experience also left the couple disappointed in the absence of paid leave that contributed to their circumstances. "It makes you upset the USA hasn't caught on," he said.