We asked the BuzzFeed Community what little tricks they use to save money. Here are some of the best responses about spending and saving actual cash money:

1. Save bills that have a specific number on them.

"My mom always keeps bills that have a 7 in their note number. So for example, is she has a $20 bill that has 'G7' on it, she will not spend it. Note numbers go up to the number 12 I believe, with letters going up to L."

—Dee Rubio, Facebook

2. Or pick a random bill and then save all of them that you get for a month.

3. Get a digital coin bank that'll show you exactly how much you're saving.

"Also buying a cheap coin bank with a digital counter. I'm less likely to grab change for an impulse snack the higher I see the number go. Around Christmas, you can find a small one for about $5."

—Claire Harden, Facebook

This one is available here.

4. Or get one that's so cute you'll want to give it all your coins.

5. Put increasing (or decreasing) amounts of money in a piggy bank every week.

"Get a piggy bank and put it on a high shelf that you can reach. Start with $1, next week put $2, then $3… Write it on your calendar. After a year you will have $1,405!"

This also works the other way around if you start by putting $52 the first week, $51 the second week, and so on. That way the savings will be easier on your budget towards the holidays.

6. Open up separate accounts for bills and spending.

7. Or have two checking accounts: one where you know the pin number and one where you don't.

"I have two checking accounts: one that I use, and a second that I don't use. I don't remember the PIN number and my ATM card isn't activated, so I can't even use it or transfer money from that account, only into it."

8. When possible, use cash over credit cards.

"My husband and I discovered that we spend less when it's in cash. We pay the bills, then take whatever's left over for two weeks out of the bank, and we don't touch our debit cards until it's time to pay bills again. When you see your money, you wanna hoard it."

9. Pull out the exact amount you want to spend for the week in cash.

10. Just hide your credit cards.

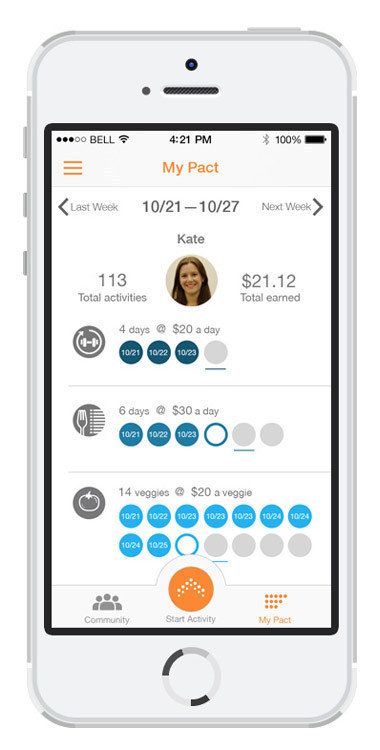

11. Get paid to work out with the Pact app.

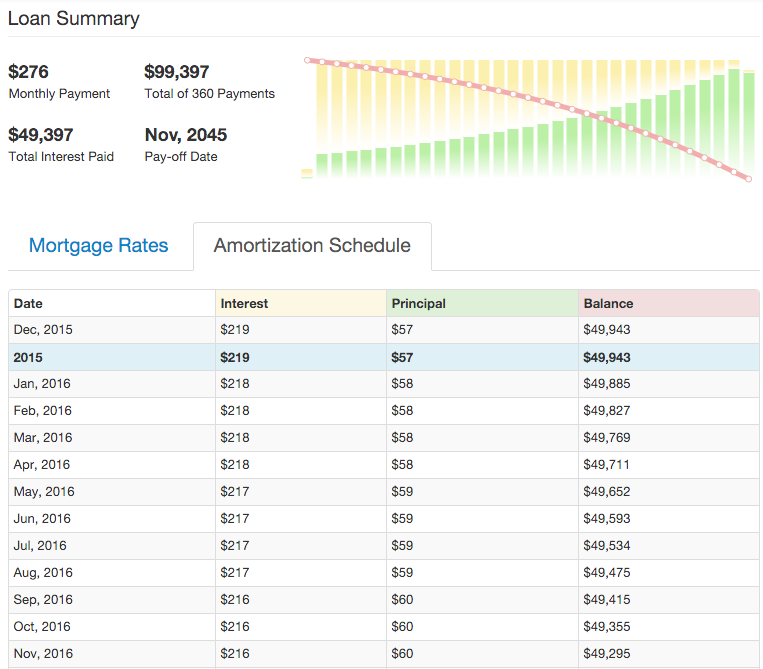

12. Get an amortization schedule for loans.

13. Before making an expensive lifestyle change, test-drive your expected budget.

"When you decide you need to save money for an apartment or a new car or whatever it may be, save the amount of extra money you will need to pay for it every month to see how it feels. So if I was getting an apt for $550/mo I would save $550 every month (less the amount of my current rent). This way I can see how the costs will affect my money and I can actually save for a deposit in the process."

14. Be careful where you go.

Answers have been edited for length and clarity.