1. Know how your credit score works.

Picture yourself in a big house with an amazing car. It starts with your credit score.

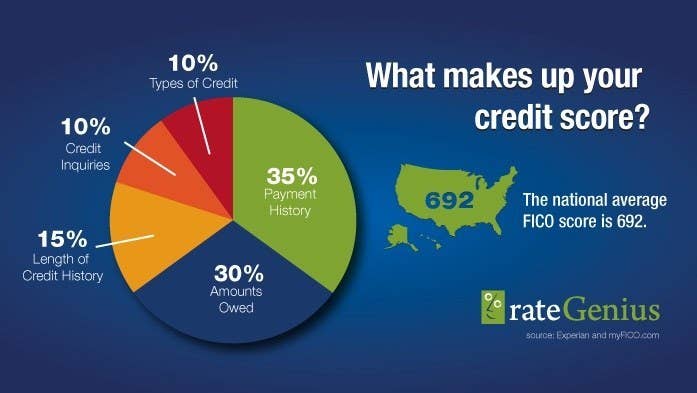

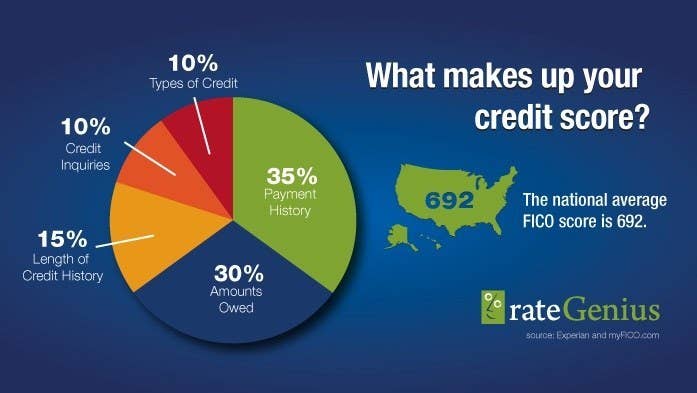

Building and maintaining a good credit score honestly isn't that complicated, once you know how it's calculated. Your credit score is what will allow you to rent an apartment, get a credit card, and of course, save you serious cash when you get a loan for a house. The score goes from 300 to 850, and there are five parts:

1. Payment history (35% of score): How on time you are with payments for your credit card and other loans. Pay on time, your score will go up big.

2. Amounts owed (30% of score): How much you owe versus how much credit you have. So if you have a $1000 limit on your credit card and only owe $50, that's helping your score take off.

3. Length of credit history (15%) of score): How long your accounts have been open, so simply just having a credit card in your wallet will help your score reach new highs.

4. Types of credit in use (10% of score): The types of credit you have in use, like credit cards, and other loans like student loans. So if you've been working to pay off that Sallie Mae loan, you can at least know that's it's helping your score.

5. New credit (10% of score): How many new accounts you have open. Your score takes a temporary hit every time you open a new credit card, but it falls off in a year and your score bounces back.

It breaks down like this: Always pay your credit cards and loans, and don't see your credit card as a ticket to shopping sprees. Responsibility will have your score will go up in no time, and you'll save money when you want that new ride or big house.

While it seems like a great idea to have a bunch credit cards ready to go for a Saturday at American Apparel or the Nike Store, the start to a great credit score begins with using one — and only one — card. Starting with one card and paying it off well will build your score for future credit card applications and loans, and you're just less likely to accidentally miss payments or go beyond your available credit limits.

It can be pretty tempting to sign up for a store credit card when you know you can get that $10 reward with your Victoria's Secret haul or 15% off at Macy's, but you should avoid them if there's any chance you won't remember or be able to pay off your balance every month. Those store cards carry really high interest rates and fees, which can turn that $50 coat into a $200 one in no time.

I know, it's hard to not want your first credit card to be a fancy American Express card or an airline rewards one. Reality is, those cards require high scores, and you have the best chance of getting your first credit card through your bank or with a college credit card like the Discover IT for Students. Being a longtime member at your bank makes your chances of getting a credit card even better, and it'll make the process way easier, which is always welcome.

So you filled out that long form, crossed your fingers, and got rejected. Heartbreaking, right? Well, most credit card companies have "reconsideration lines" which connect you to a real human who can hear your case and accept your application if the circumstance is right. You can find a list of numbers here.

If you're still struggling to get your first credit card, you can get what's called a "secured" card from companies like Capital One or Bank of America. These use an up-front cash deposit as a credit limit.

If you put $300 in a secured card account, you get to use a $300 credit limit, and paying that card on time helps. With enough use, your credit card company can even "graduate" your card to a unsecured credit card after about eight months, which requires no deposit and works like a regular credit card.

If you're really, really struggling, ask your significant other or your parent to add you as an "authorized user" to their credit card account. You get your own copy of their credit card and can spend it the same way, with on-time payments boosting their score and yours. But be responsible — one too many trips to the mall using the card can hurt both of your scores.

Seeing Samuel L. Jackson and Jennifer Garner tell you about credit cards can make you want to get one as soon as the commercial's over. However, applying for too many credit cards can hurt your score because it shows you're desperate for more spending power. Usually, it's good to wait eight months between applications for credit cards, because your score hit from the last application will be gone and you'll have a higher score when it's time to be considered.

Nothing takes up space in our mailbox like those shiny envelopes from credit card companies saying "YOU'VE BEEN PRE-APPROVED!". If you don't need the temptation, you can go to this website and opt-out of those offers. You'll also be saving the lives of many, many trees.

As you use your credit card more and more, you might feel cheated that you didn't get a bigger limit to begin with. Thankfully, you can call your card company and ask for a "credit limit increase", which can give you more power to spend and increase your score. Keep in mind that it's usually best to wait until you've had your card for at least a year to do this.

Most people think of FreeCreditReport.com and its catchy jingles when they want their credit report, but that site often catches people with sneaky, hidden subscription fees. However, you are entitled to three totally free credit reports from all three major credit bureaus (Experian, Equifax, and Transunion) once a year by going to AnnualCreditReport.com.

Credit companies love to see you actually using your card, so paying down your card balance to $0 before your statement comes in can actually hurt your score a little. To boost it every month, pay down your credit card to a small amount like $5, wait until your statement comes in, and then pay off the full amount before the due date. This can boost your score anywhere from 5 to 15 points a month, which can add up quite fast.

Websites like Credit Karma, Quizzle, and Credit Sesame are great because they really do offer you a free credit score without hidden fees. However, the credit score given to you is an estimate of (and not exactly the same as) your actual FICO score, which is the number companies will look at when you want a new card or loan. The FICO score is calculated using more information about you from companies. Still, free scores are calculated in a similar way, and give you a very good estimate of your credit score.

Paying or not paying on time can mean the difference between you paying $10,000 less or $10,000 extra on a house or a car. When it comes to your credit cards and loans, always pay before the due date to make sure your score doesn't suffer. Set an event on your phone, get someone to remind you, stick a Post-It Note on your dog — whatever it takes. Really, just remember to make those payments.

Your credit report follows you throughout your entire adult life, which is why you want to make payments on time. Late payments and delinquency of course are bad for your credit score, but if you have an overdue bill, you can call a company you owe and negotiate to remove it for a full payment.

Not acting on a late payment turns it into a collection, which is the Godzilla of credit problems. If you have a collection, find out the name of the collection agency from your credit report and use templates to write a snail mail letter, stating how you will pay your debt off if your bad marks are removed from your credit report. In most cases, do not call a collection agency, as their shady negotiating tactics can often confuse you into paying your debt without getting it removed from your account.

A small part of your score is determined by the types of credit you have, so just having credit cards in your file won't get you a crazy high score. If you want to get your score up and you don't have any other types of loans, consider something like a small personal loan — paying it off on time will help your score and show companies you're responsible with money.

Of course, we love credit cards because they make us feel powerful, knowing we can buy almost anything we want. But with great power comes great responsibility, and being responsible with a credit card will only save you money later in life. Treat yourself when it's right, make sure you can pay off everything, and you'll have an amazing credit score in no time.