George Osborne has unveiled the Treasury's long-awaited 200-page analysis of the potential impact of Britain voting to leave the European Union in June's referendum.

But what's hidden in the detail?

1. George Osborne’s central claim is that the UK would be permanently poorer if it left the EU. But there are multiple scenarios.

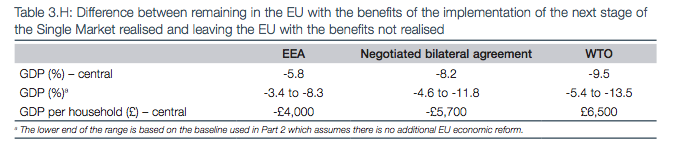

Under all three of the Treasury's scenarios, the UK would be worse off if it left the EU. The analysis sets out three different overviews of the impact of Brexit on the UK economy by 2030, depending on what sort of deal the country is able to secure after it leaves the EU:

• £2,600 worse off per household if the UK is allowed to join the European Economic Area. This currently includes countries such as Norway who aren't in the EU but are allowed to trade with it.

• £4,300 worse off per household in the case of a negotiated bilateral agreement with the remaining EU states. Turkey currently has something resembling this.

• £5,200 worse off per household if the UK just has to cope with being outside the EU – leaving the UK with the same relationship to the organisation as Russia.

These figures are controversial. They are based on GDP per household, which is not a conventional way of looking at household finances.

One further key bit of nuance to what Osborne said is that the analysis does not suggest the UK economy would contract post-Brexit. UK GDP would simply grow faster within the EU, according to the Treasury.

2. This document looks like a forecast and has been reported as a forecast, but it isn't actually a forecast.

It is important to note that the headline figures are not forecasts of the exact state of the economy in 2030. The Treasury analysis estimates the difference between two possible futures, one inside the EU and one outside the EU, whatever the state of the economy in 2030.

The Financial Times explains this difference well: "It is the same as saying, 'We do not know how heavy you will be in 15 years, but if you drink a bottle of cola a day, we are pretty sure you will be fatter than if you keep off the sugar'."

3. The analysis relies on GDP per household, which is an unusual measure.

The Treasury will be happy with headlines stating that "UK households would be £4,300 worse off post-Brexit", because they give the impression that all families would lose that much money if the Leave side wins the vote.

But that's not quite what the document says, and Osborne's spin of this figure has incensed some on the right. Fraser Nelson, editor of The Spectator, for example, accused the chancellor of breathtaking dishonesty.

That's because the figure is not a measure of household income. The number used by the Treasury simply converts GDP into a per-household figure. However, critics will argue that some voters will perceive the analysis as a £4,300 drop in their income because of how the figures have been presented and briefed. In reality, any fall in household income would probably be far lower: GDP per household is much higher than household income.

4. The Treasury reckons it knows where jobs depend on the EU.

5. The government reckons it will lose £36 billion in tax revenue if Britain votes to leave the EU.

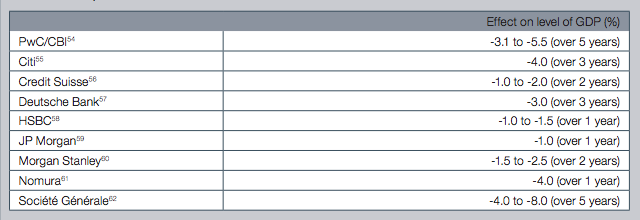

6. The government is very keen to point out that other organisations think Brexit would hit the UK economy.

7. The Treasury's own forecast suggests the government won't reduce immigration.

Despite the government's longstanding commitment to reducing immigration to under 100,000 people a year, the Treasury forecast relies on independent projections that suggest there's little realistic chance of this happening.

The documents say this is due to uncertainty around future migration policies, migrant behaviour, and the type of arrangement the UK may have with the EU. The analysis also states that any drop in immigration could be offset by a fall in emigration or more liberal immigration policies with non-EU countries in order to promote new free trade deals, while deals similar to those that Norway and Switzerland have wouldn't allow a future government to control EU freedom of movement.

As a consequence, all scenarios presented use Office for Budget Responsibility figures published at the last Budget. These have net migration levels at 329,000 per year in 2014 falling to 185,000 per year from 2021 onwards.

One implication of this methodological choice is that the government doesn't seem to expect the prime minister's emergency brake deal, which will allow the UK to temporarily restrict the in-work benefits of newly arrived migrants, to have much of an impact on immigration levels.

However, another possible explanation is that the government may not want to explicitly point out the economic benefits of high net migration levels – and how Osborne is reliant on high immigration to achieve his economic growth targets.

8. There's a diagram showing how the EU is already splintering.

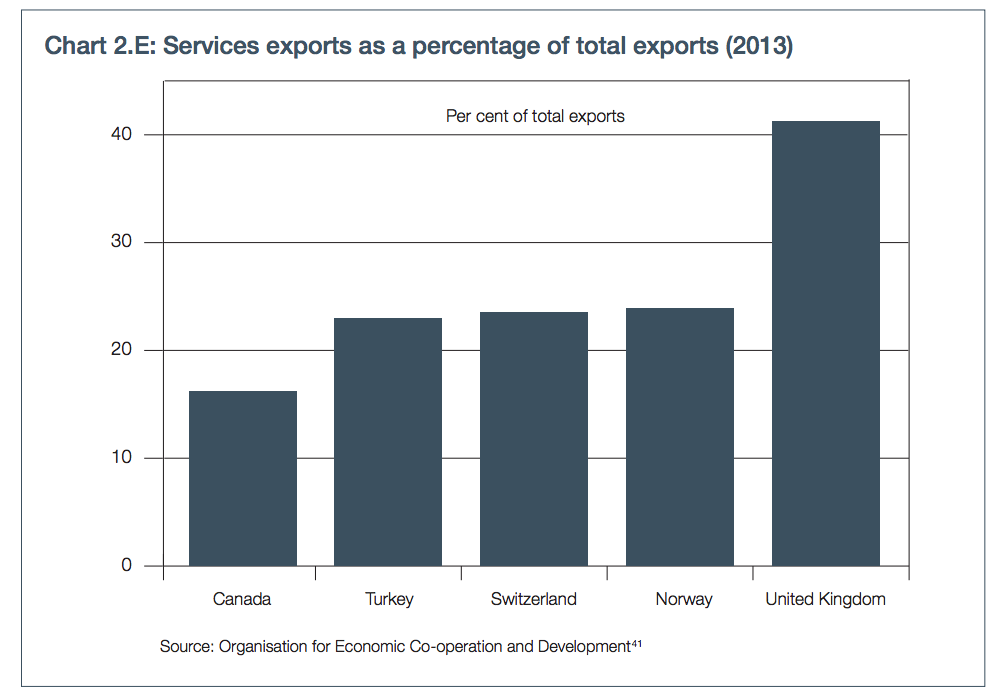

9. The service industry is much more important in the UK than in other major countries that trade with the EU but exist outside the EU.

10. The Treasury argues that the EU could actually have a more positive effect on the UK economy if it is reformed to make it more pro-market.

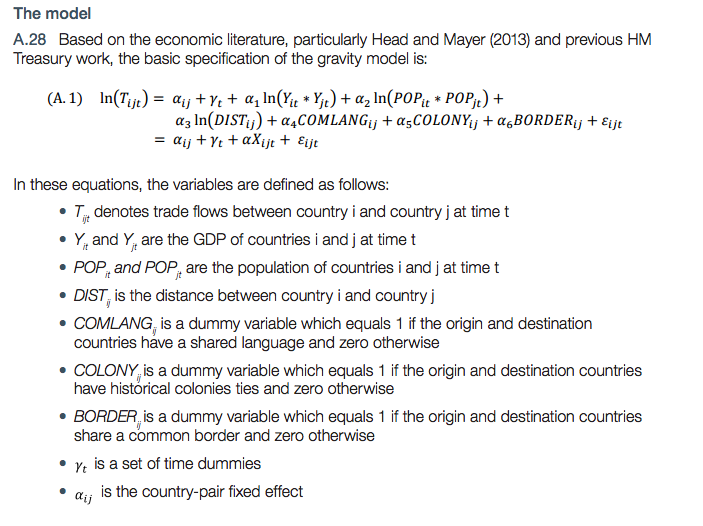

11. The Treasury analysis uses a very complicated formula.